Answered step by step

Verified Expert Solution

Question

1 Approved Answer

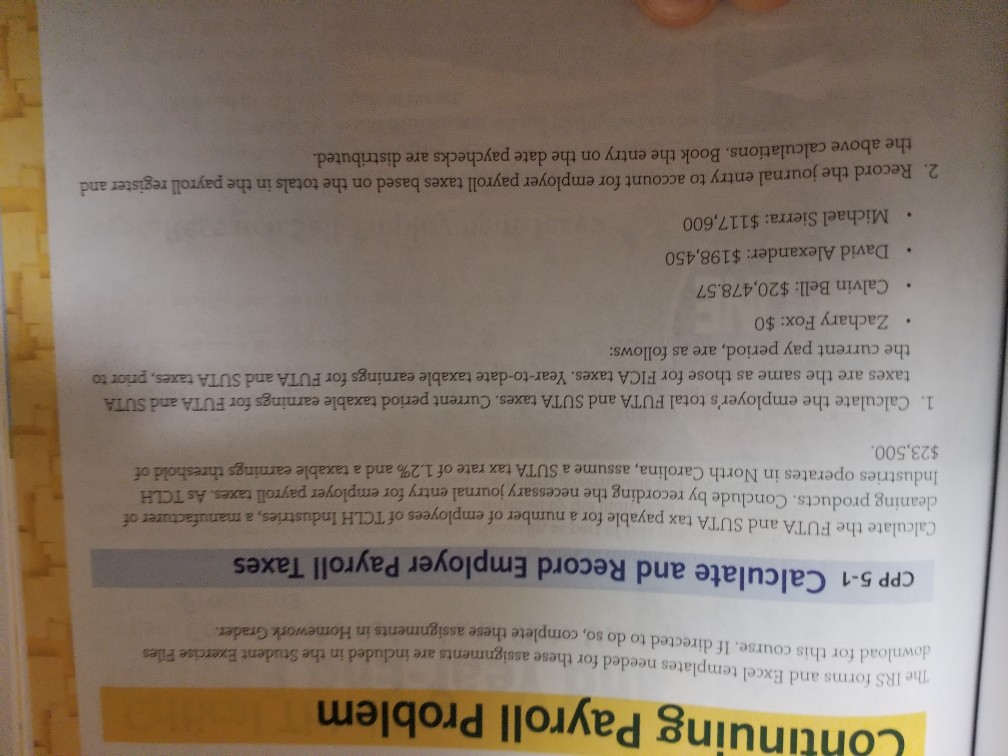

calculate the FUTA and SUTA tax payable for a number of employees of TCLH Industries, a manufacturer of cleaning products. Conclude by recording the necessary

calculate the FUTA and SUTA tax payable for a number of employees of TCLH Industries, a

manufacturer of cleaning products. Conclude by recording the necessary journal entry for employer payroll taxes. As TCLH Industries operates in North Carolina, assume a SUTA TAX RATE OF 1.2% AND A TAXABLE EARNINGS THRESHOLD of 23,500

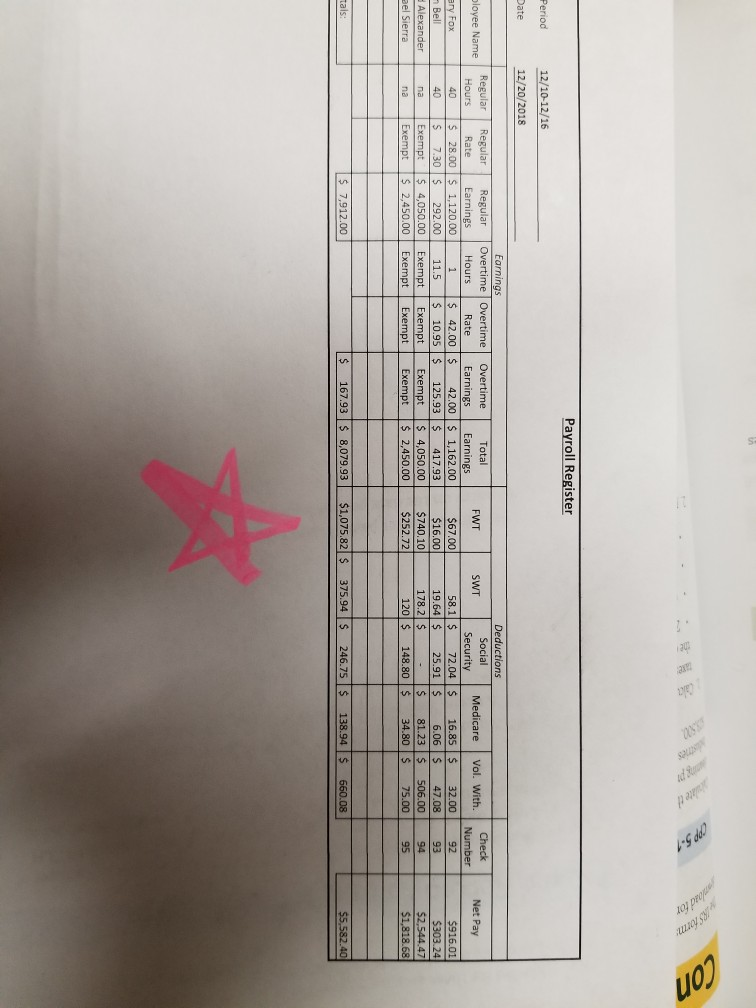

Payroll Register Period 12/10-12/16 Date 12/20/2018 Earnings Deductions Social Security Regular RegularRegularOvertime Overtime Overtime Total loyee Name Medicare Vol. With.Check FWT SWT Rate Earnings Rate Earnings Earnings 42.00$ 1,162.00 40 40 S 7.30|$ 292.00| 11.5 |$ 10.95|$ 125.93|$ 417.93 na Exempt $ 4,050.00 Exempt na Exempt S 2,450.001 Exempt Exempt Exempt | $ 2,450.00 28.00 $67.00 $16.00 58.1 $ 72.04$ 16.85 32.00 92 1 ry 1 $ 42.00 916.01 19.64 25.91 6.06 $ 47.0893 1 Exempt Exempt 4,050.00 $740.1 178.2 $ $ 81.23 506.00 94 $2,544.47 1 120 $ 148.80 $34.80 $ 75.00 95 el S $252.72 tals $7,912.00 $167.93 8,079.93 $1,075.82$ 375.94 246.75$ 138.94 660.08 $5,582.40 Lohtinuing Payroll Problem The IRS forms and Excel templates needed for these assignments are included in the Student Exercise Files download for this course. If directed to do so, complete these assignments in Homework Grader CPP 5-1 Calculate and Record Employer Payroll Taxes Calculate the FUTA and SUTA tax payable for a number of employees of T cleaning products. Conclude by recording the necessary journal entry for emp Industries operates in North Carolina, assume a SUTA tax rate of 1.2% and a taxable earnings threshold of CLH Industries, a manufacturer of oyer payroll taxes. As TCLH $23,500 1. Calculate the employer's total FUTA and SUTA taxes. Current period taxable earnings for FUTA and SUTA taxes are the same as those for FICA taxes. Year-to-date taxable earnings for FUTA and SUTA taxes, prior to the current pay period, are as follows: . Zachary Fox: $0 Calvin Bell: $20,478.57 David Alexander: $198,450 Michael Sierra: $117,600 . Record the journal entry to account for employer payroll taxes based on the totals in the the above calculations. Book the entry on the date paychecks are distributed. payroll register and 2. Payroll Register Period 12/10-12/16 Date 12/20/2018 Earnings Deductions Social Security Regular RegularRegularOvertime Overtime Overtime Total loyee Name Medicare Vol. With.Check FWT SWT Rate Earnings Rate Earnings Earnings 42.00$ 1,162.00 40 40 S 7.30|$ 292.00| 11.5 |$ 10.95|$ 125.93|$ 417.93 na Exempt $ 4,050.00 Exempt na Exempt S 2,450.001 Exempt Exempt Exempt | $ 2,450.00 28.00 $67.00 $16.00 58.1 $ 72.04$ 16.85 32.00 92 1 ry 1 $ 42.00 916.01 19.64 25.91 6.06 $ 47.0893 1 Exempt Exempt 4,050.00 $740.1 178.2 $ $ 81.23 506.00 94 $2,544.47 1 120 $ 148.80 $34.80 $ 75.00 95 el S $252.72 tals $7,912.00 $167.93 8,079.93 $1,075.82$ 375.94 246.75$ 138.94 660.08 $5,582.40 Lohtinuing Payroll Problem The IRS forms and Excel templates needed for these assignments are included in the Student Exercise Files download for this course. If directed to do so, complete these assignments in Homework Grader CPP 5-1 Calculate and Record Employer Payroll Taxes Calculate the FUTA and SUTA tax payable for a number of employees of T cleaning products. Conclude by recording the necessary journal entry for emp Industries operates in North Carolina, assume a SUTA tax rate of 1.2% and a taxable earnings threshold of CLH Industries, a manufacturer of oyer payroll taxes. As TCLH $23,500 1. Calculate the employer's total FUTA and SUTA taxes. Current period taxable earnings for FUTA and SUTA taxes are the same as those for FICA taxes. Year-to-date taxable earnings for FUTA and SUTA taxes, prior to the current pay period, are as follows: . Zachary Fox: $0 Calvin Bell: $20,478.57 David Alexander: $198,450 Michael Sierra: $117,600 . Record the journal entry to account for employer payroll taxes based on the totals in the the above calculations. Book the entry on the date paychecks are distributed. payroll register and 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started