Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the gain/loss and ATCF from the following asset dispositions. 1. Rock Chalk Inc. purchased a piece of 3-year property on 10/15/2017 for $80,000.

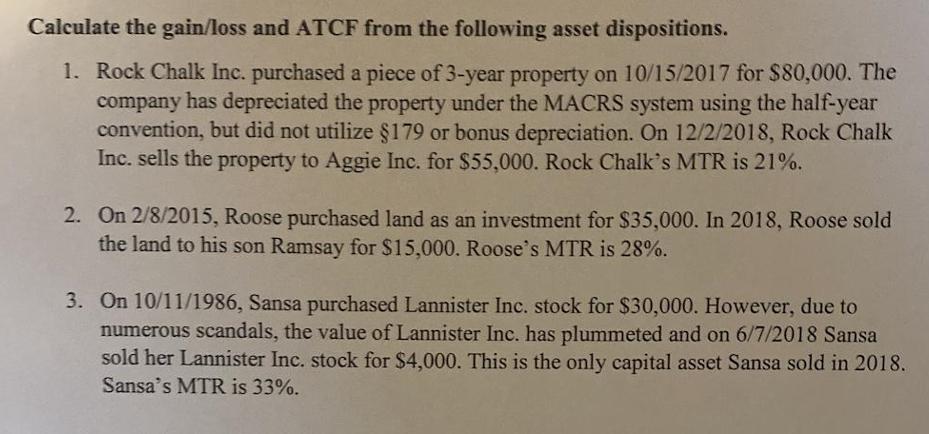

Calculate the gain/loss and ATCF from the following asset dispositions. 1. Rock Chalk Inc. purchased a piece of 3-year property on 10/15/2017 for $80,000. The company has depreciated the property under the MACRS system using the half-year convention, but did not utilize 179 or bonus depreciation. On 12/2/2018, Rock Chalk Inc. sells the property to Aggie Inc. for $55,000. Rock Chalk's MTR is 21%. 2. On 2/8/2015, Roose purchased land as an investment for $35,000. In 2018, Roose sold the land to his son Ramsay for $15,000. Roose's MTR is 28%. 3. On 10/11/1986, Sansa purchased Lannister Inc. stock for $30,000. However, due to numerous scandals, the value of Lannister Inc. has plummeted and on 6/7/2018 Sansa sold her Lannister Inc. stock for $4,000. This is the only capital asset Sansa sold in 2018. Sansa's MTR is 33%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the gainloss and aftertax cash flow ATCF for each of the asset dispositions 1 Rock Ch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started