Answered step by step

Verified Expert Solution

Question

1 Approved Answer

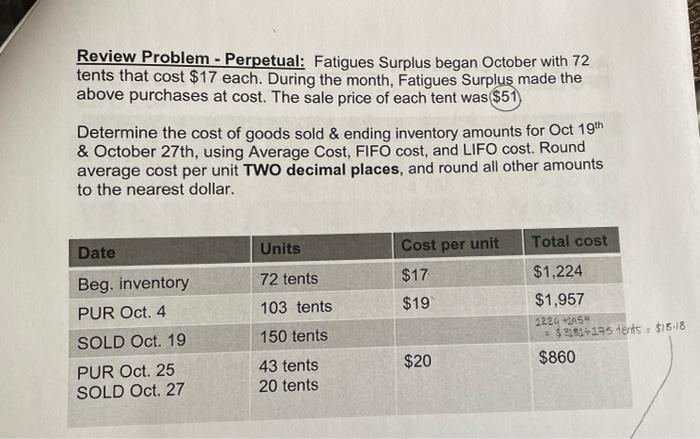

Calculate the gross margin under the FIFO and LIFO methods. Review Problem - Perpetual: Fatigues Surplus began October with 72 tents that cost $17 each.

Calculate the gross margin under the FIFO and LIFO methods.

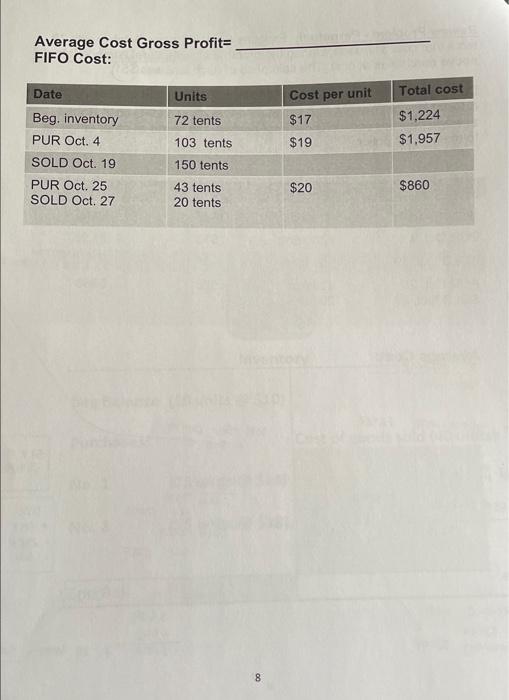

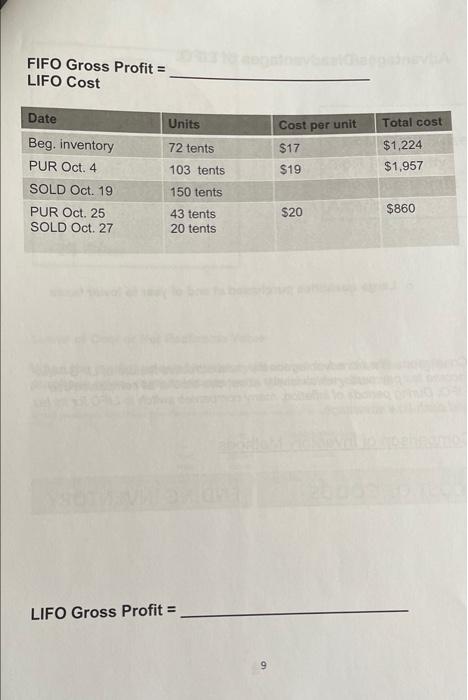

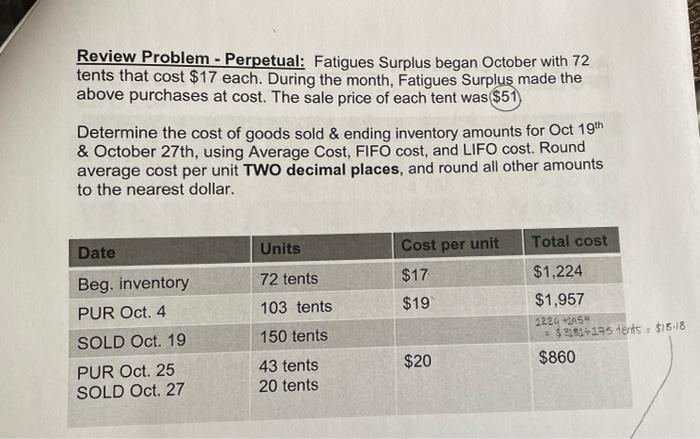

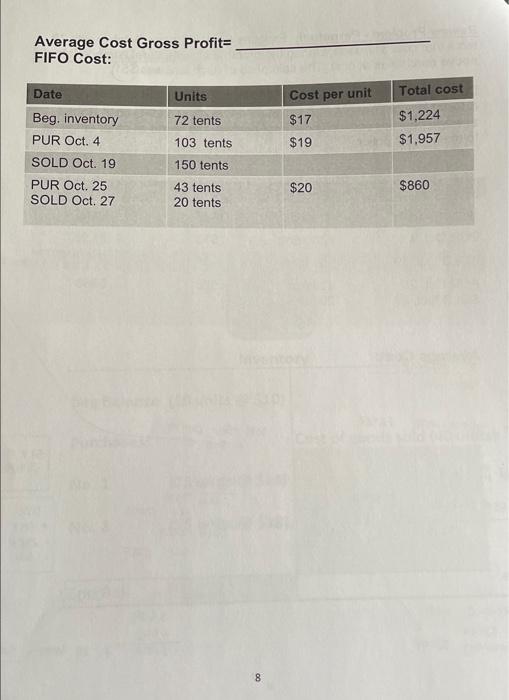

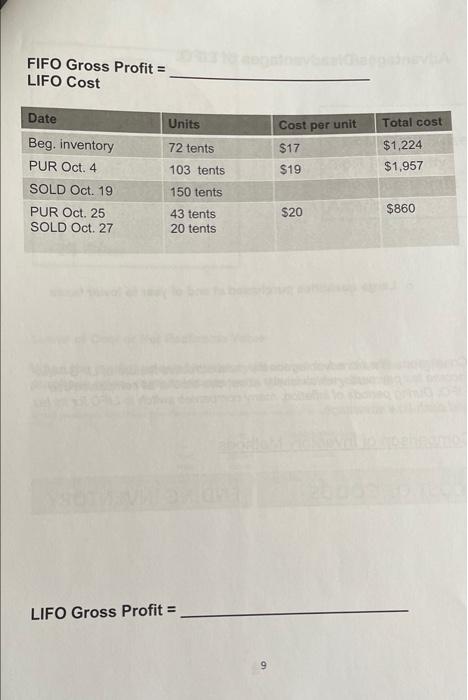

Review Problem - Perpetual: Fatigues Surplus began October with 72 tents that cost $17 each. During the month, Fatigues Surplus made the above purchases at cost. The sale price of each tent was $51) Determine the cost of goods sold & ending inventory amounts for Oct 19th & October 27th, using Average Cost, FIFO cost, and LIFO cost. Round average cost per unit TWO decimal places, and round all other amounts to the nearest dollar. Date Units Total cost Cost per unit $17 72 tents Beg. inventory PUR Oct. 4 SOLD Oct. 19 $19 103 tents $1,224 $1,957 2224 05 = $2.614135 tents. $15.18 $860 150 tents $20 PUR Oct. 25 SOLD Oct. 27 43 tents 20 tents Average Cost Gross Profit= FIFO Cost: Date Total cost Units 72 tents Cost per unit $17 $19 $1,224 $1.957 103 tents Beg. inventory PUR Oct. 4 SOLD Oct. 19 PUR Oct. 25 SOLD Oct. 27 150 tents $20 $860 43 tents 20 tents 8 FIFO Gross Profit = LIFO Cost Units Cost per unit Total cost 72 tents Date Beg. inventory PUR Oct. 4 SOLD Oct. 19 PUR Oct. 25 SOLD Oct. 27 $17 $19 $1,224 $1,957 103 tents 150 tents $20 $860 43 tents 20 tents LIFO Gross Profit =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started