Answered step by step

Verified Expert Solution

Question

1 Approved Answer

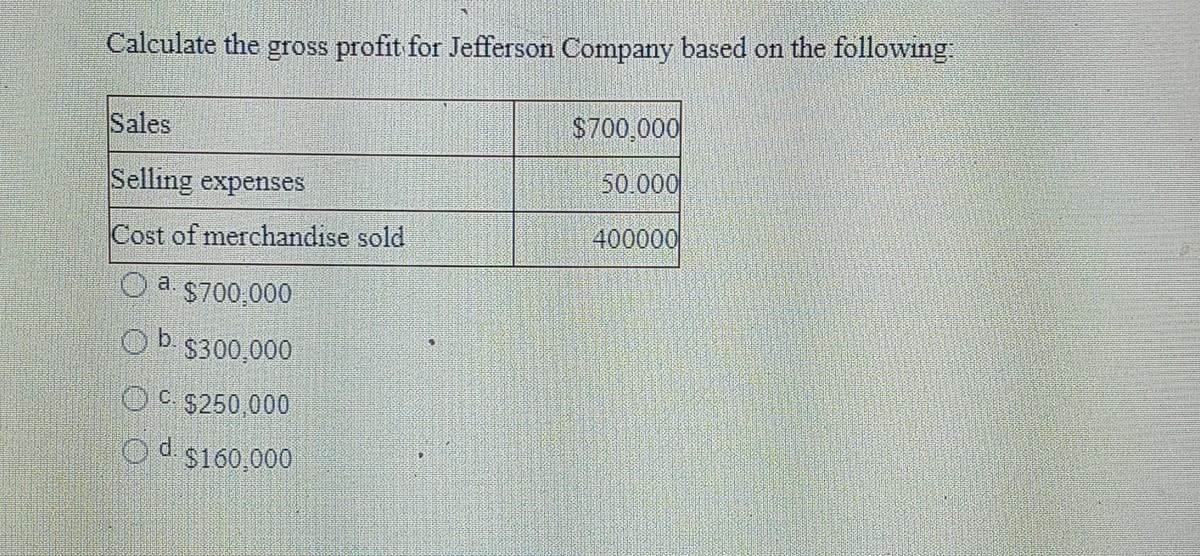

Calculate the gross profit for Jefferson Company based on the following: Sales $700,000 Selling expenses 50.000 Cost of merchandise sold 400000 a. $700,000 O b.$300,000

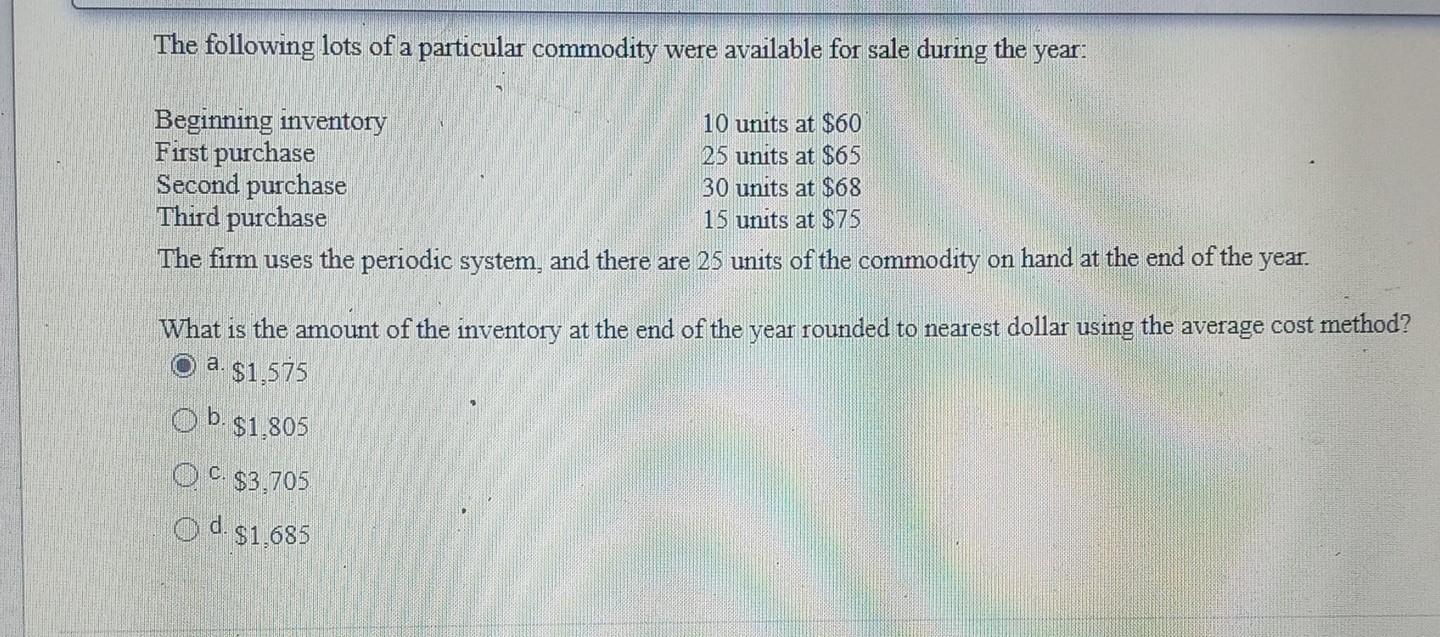

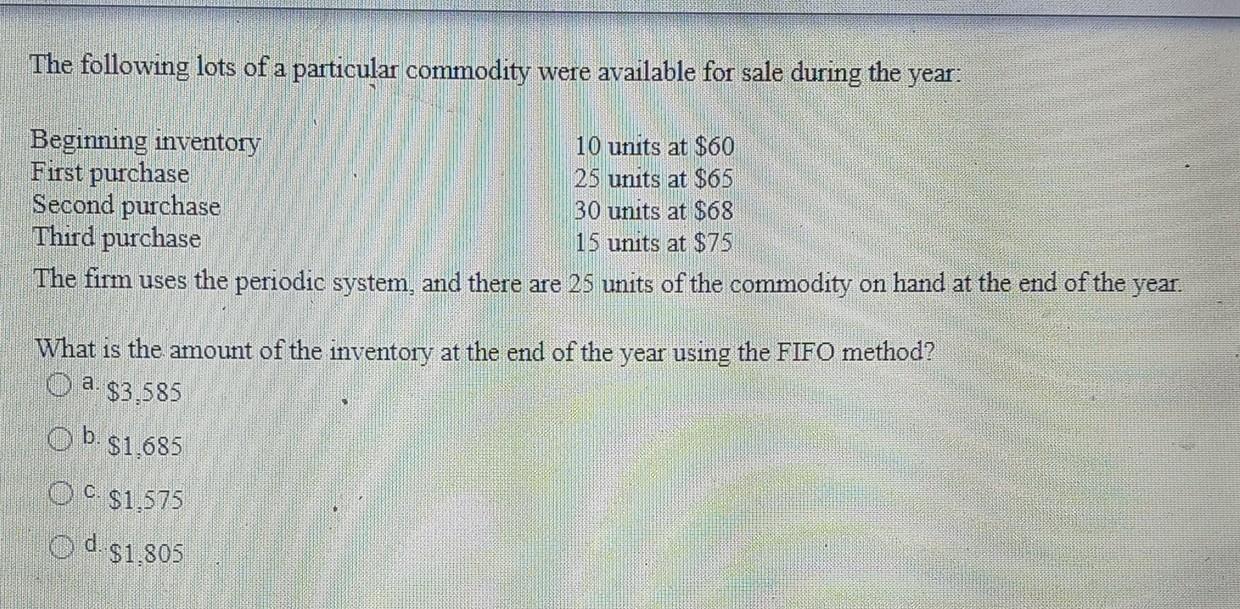

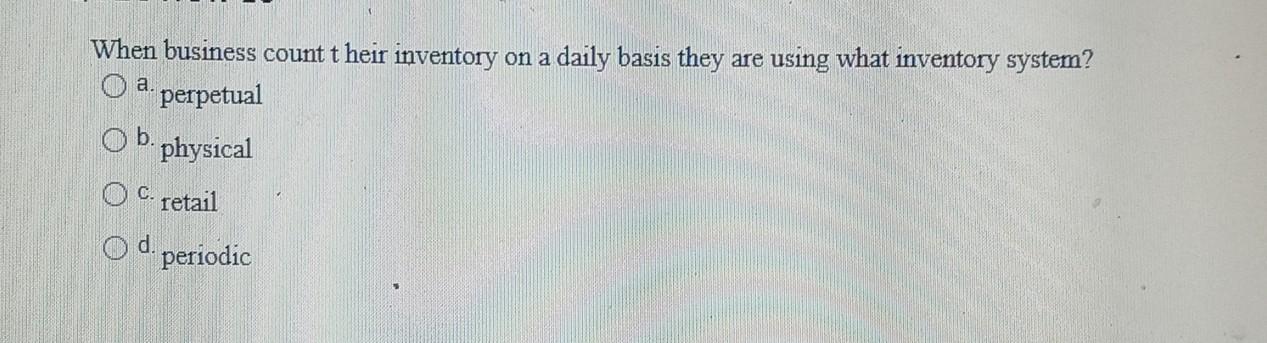

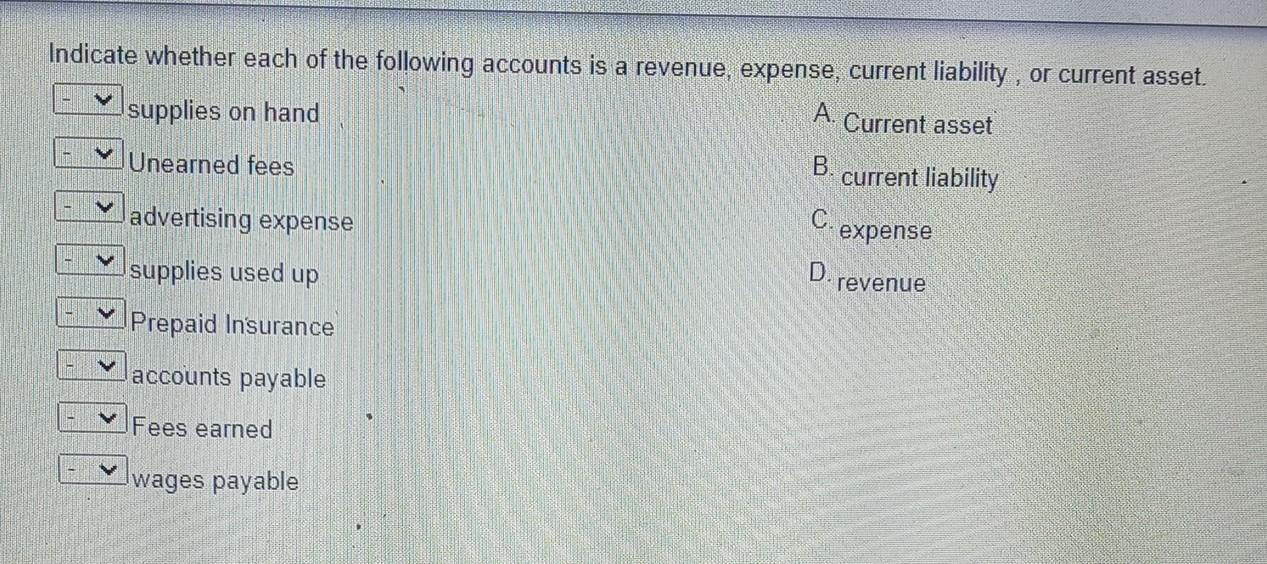

Calculate the gross profit for Jefferson Company based on the following: Sales $700,000 Selling expenses 50.000 Cost of merchandise sold 400000 a. $700,000 O b.$300,000 O C. $250,000 O d. $160,000 The following lots of a particular commodity were available for sale during the year: Beginning inventory 10 units at $60 First purchase 25 units at $65 Second purchase 30 units at $68 Third purchase 15 units at $75 The firm uses the periodic system, and there are 25 units of the commodity on hand at the end of the year. What is the amount of the inventory at the end of the year rounded to nearest dollar using the average cost method? a. $1,575 O a. O b. $1,805 O C. $3,705 O d. $1,685 The following lots of a particular commodity were available for sale during the year: Beginning inventory 10 units at $60 First purchase 25 units at $65 Second purchase 30 units at $68 Third purchase 15 units at $75 The firm uses the periodic system, and there are 25 units of the commodity on hand at the end of the year. What is the amount of the inventory at the end of the year using the FIFO method? O a. $3,585 O b. $1,685 O C. $1.575 O d. $1,805 When business count their inventory on a daily basis they are using what inventory system? O a. perpetual Ob. physical O C. retail O d. periodic Indicate whether each of the following accounts is a revenue, expense, current liability, or current asset. supplies on hand A. Current asset Unearned fees . current liability advertising expense C expense D supplies used up Prepaid Insurance V V revenue accounts payable Fees earned wages payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started