Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the implied return for the AMAZON stock. Calculate alpha the risk adjusted excess return. Use graphs or plots if needed. Real time current stock

Calculate the implied return for the AMAZON stock. Calculate alpha the risk adjusted excess return. Use graphs or plots if needed.

Real time current stock : 3,223.91 USD May 11, 9:56 PM

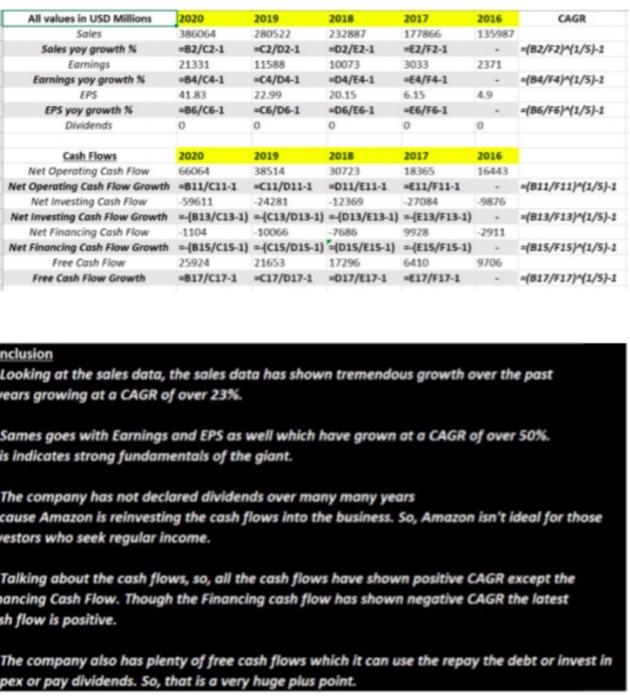

use real time stock data from amazon 2021

All values in USD Millions Sales Sales yoy growth Earnings Earnings yoy growth EPS EPS yoy growth Dividends 2020 386064 -82/02-1 21331 -84/04-1 41.83 -B6/C6-1 0 2019 280522 -C2/02-1 11588 C4/04-1 22.99 -C6/06-1 0 2018 232887 02/E2-1 10073 04/04-1 20.15 -06/E6-1 0 2017 177866 E2/52-1 3033 4/64-1 6.15 -E6/F6-1 0 2016 CAGR 135987 (82/F2741/5)-1 2371 (84/44771/5)-2 49 (86/F67(1/5)-1 -(811/F117(1/5) Cash Flows 2020 2019 2018 2017 2016 Net Operating Cash Flow 66064 38514 30723 18365 16443 Net Operating Cash Flow Growth-611/011-111/011-1 011/E11-1 E11/F11-1 Net Investing Cash Flow -59611 -24281 -12369 27084 -9876 Net Investing Cash Flow Growth -(813/C13-1) - C13/013-1) -- (013/E13-1) --E13/F13-1) Net Financing Cash Flow 1104 -10066 -7686 9928 2911 Net Financing Cash Flow Growth =-(815/C15-1) =1C15/015-1) 015/E15-1) = {E15/515-1) Free Cash Flow 2592421653 17296 6410 Free Cash Flow Growth -817/017-1C17/017-2017/E17-117/F17-1 (813/513)(1/5) =815/F2SY41/5) (817/F17/11/5H1 9706 inclusion Looking at the sales data, the sales data has shown tremendous growth over the past wears growing at a CAGR of over 23% Sames goes with Earnings and EPS as well which have grown at a CAGR of over 50% is indicates strong fundamentals of the giant. The company has not declared dividends over many many years cause Amazon is reinvesting the cash flows into the business. So, Amazon isn't ideal for those estors who seek regular income. Talking about the cash flows, so, all the cash flows have shown positive CAGR except the ancing Cash Flow. Though the Financing cash flow has shown negative CAGR the latest sh flow is positive. The company also has plenty of free cash flows which it can use the repay the debt or invest in pex or pay dividends. So, that is a very huge plus point. All values in USD Millions Sales Sales yoy growth Earnings Earnings yoy growth EPS EPS yoy growth Dividends 2020 386064 -82/02-1 21331 -84/04-1 41.83 -B6/C6-1 0 2019 280522 -C2/02-1 11588 C4/04-1 22.99 -C6/06-1 0 2018 232887 02/E2-1 10073 04/04-1 20.15 -06/E6-1 0 2017 177866 E2/52-1 3033 4/64-1 6.15 -E6/F6-1 0 2016 CAGR 135987 (82/F2741/5)-1 2371 (84/44771/5)-2 49 (86/F67(1/5)-1 -(811/F117(1/5) Cash Flows 2020 2019 2018 2017 2016 Net Operating Cash Flow 66064 38514 30723 18365 16443 Net Operating Cash Flow Growth-611/011-111/011-1 011/E11-1 E11/F11-1 Net Investing Cash Flow -59611 -24281 -12369 27084 -9876 Net Investing Cash Flow Growth -(813/C13-1) - C13/013-1) -- (013/E13-1) --E13/F13-1) Net Financing Cash Flow 1104 -10066 -7686 9928 2911 Net Financing Cash Flow Growth =-(815/C15-1) =1C15/015-1) 015/E15-1) = {E15/515-1) Free Cash Flow 2592421653 17296 6410 Free Cash Flow Growth -817/017-1C17/017-2017/E17-117/F17-1 (813/513)(1/5) =815/F2SY41/5) (817/F17/11/5H1 9706 inclusion Looking at the sales data, the sales data has shown tremendous growth over the past wears growing at a CAGR of over 23% Sames goes with Earnings and EPS as well which have grown at a CAGR of over 50% is indicates strong fundamentals of the giant. The company has not declared dividends over many many years cause Amazon is reinvesting the cash flows into the business. So, Amazon isn't ideal for those estors who seek regular income. Talking about the cash flows, so, all the cash flows have shown positive CAGR except the ancing Cash Flow. Though the Financing cash flow has shown negative CAGR the latest sh flow is positive. The company also has plenty of free cash flows which it can use the repay the debt or invest in pex or pay dividends. So, that is a very huge plus point Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started