Answered step by step

Verified Expert Solution

Question

1 Approved Answer

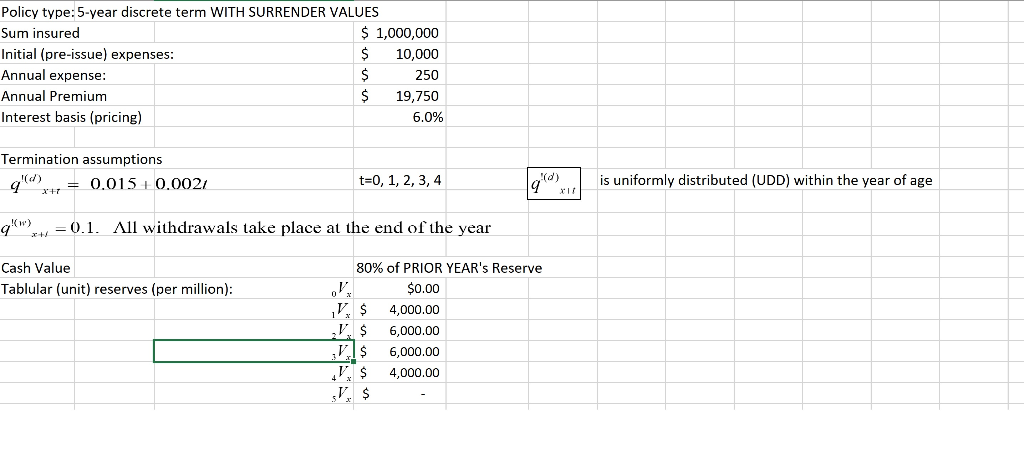

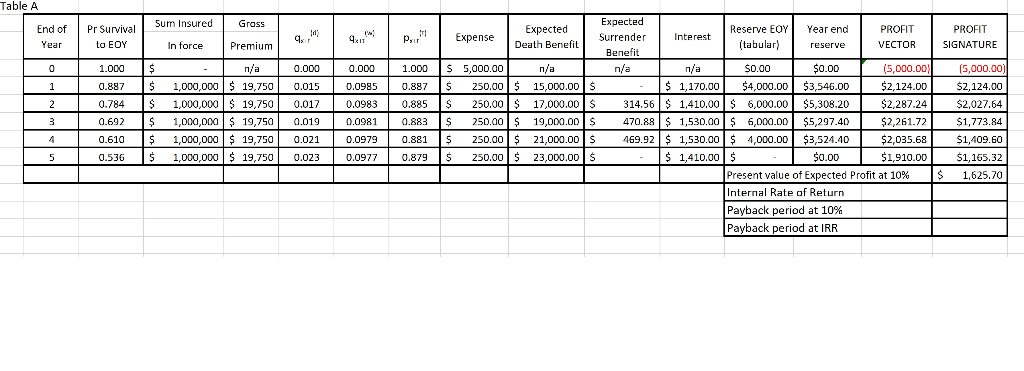

Calculate the internal rate of return Calculate the discounted payback period at 10% Calculate the discounted payback period at the IRR rate Policy type: 5-year

Calculate the internal rate of return

Calculate the internal rate of return

Calculate the discounted payback period at 10%

Calculate the discounted payback period at the IRR rate

Policy type: 5-year discrete term WITH SURRENDER VALUES Sum insured Initial (pre-issue) expenses Annual expense Annual Premium Interest basis (pricing) $ 1,000,000 $ 10,000 250 $ 19,750 6.0% Termination assumptions ()is uniformly distributed (UDD) within the year of age t-0, 1, 2, 3,4 q0.1. All withdrawals take place at the end of the year Cash Value 80% of PRIOR YEAR's Reserve Tablular (unit) reserves (per million) $0.00 V$ 4,000.00 $6,000.00 6,000.00 V 4,000.00 Table A Expected Surrender Benefit Sum Insured Grass Reserve EOY End ofPr Survival Expected Year end PROFIT PROFIT Expense Death Benefit Interest (tabular) rereVECTOR SIGNATURE Year to EOY 1.000 0.887 1,000,000 19,750 0.784 1,000,000 $ 19,750 0.0170.0983 0.885 S 250,00 17,000.00 314.56 1,410.00 $ 6,000.00 $5,308.20 0.692 $ 1,000,000| $ 19,750| 0.019 | 0.0981 | 0.883 $ 250.00 $ 19,000.00|$ 470.88| $ 1,530.001$ 6,000.00| $5,297.40 0.610 1,000,000$ 19,7500.0210.0979 0.881 0.536 $1,000,000$ 19,7500.023.09770.879$ 250.00$ 23,000.00 S Premium In force 5,000.00) 2,124.00$2,124.00 $2,287.2427.64 $1,773.8.4 250.00$ 21,000.00 469.92 1,530.00,000.00$3,524.40 $2,035.68$1,409.60 1,910.00 $1,165.32 1,625.70 0.00 0.00 5,000.00 0.000 0.000 1.000 S 5,000.00 15,000.00 S 5 $4,000.00 $3,546.00 0.015 0.887 250.00 0.0985 1,170.0 $2,261.72 $ 1,410.00 0.00 $ Present value of Expected Profit at 10% Internal Rate of Return Payback period at 10% Payback period at IRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started