Answered step by step

Verified Expert Solution

Question

1 Approved Answer

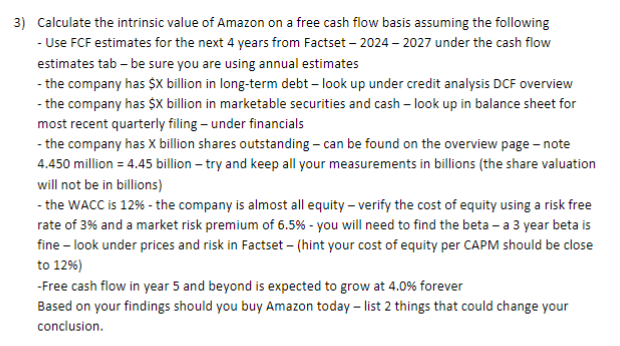

Calculate the intrinsic value of Amazon on a free cash flow basis assuming the following Use FCF estimates for the next 4 years from Factset

Calculate the intrinsic value of Amazon on a free cash flow basis assuming the following

Use FCF estimates for the next years from Factset under the cash flow

estimates tab be sure you are using annual estimates

the company has $ billion in longterm debt look up under credit analysis DCF overview

the company has $ billion in marketable securities and cash look up in balance sheet for

most recent quarterly filing under financials

the company has billion shares outstanding can be found on the overview page note

million billion try and keep all your measurements in billions the share valuation

will not be in billions

the WACC is the company is almost all equity verify the cost of equity using a risk free

rate of and a market risk premium of you will need to find the beta a year beta is

fine look under prices and risk in Factset hint your cost of equity per CAPM should be close

to

Free cash flow in year and beyond is expected to grow at forever

Based on your findings should you buy Amazon today list things that could change your

conclusion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started