Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the intrinsic value of Toyota in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently.

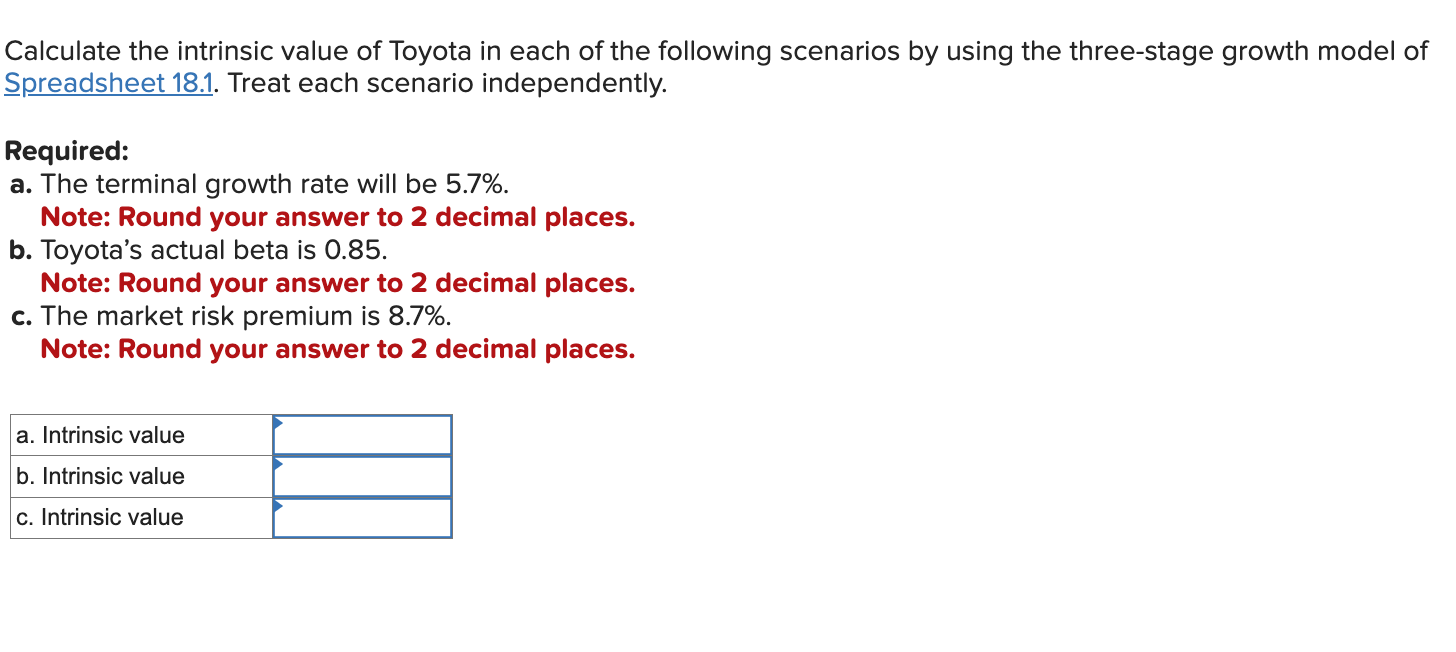

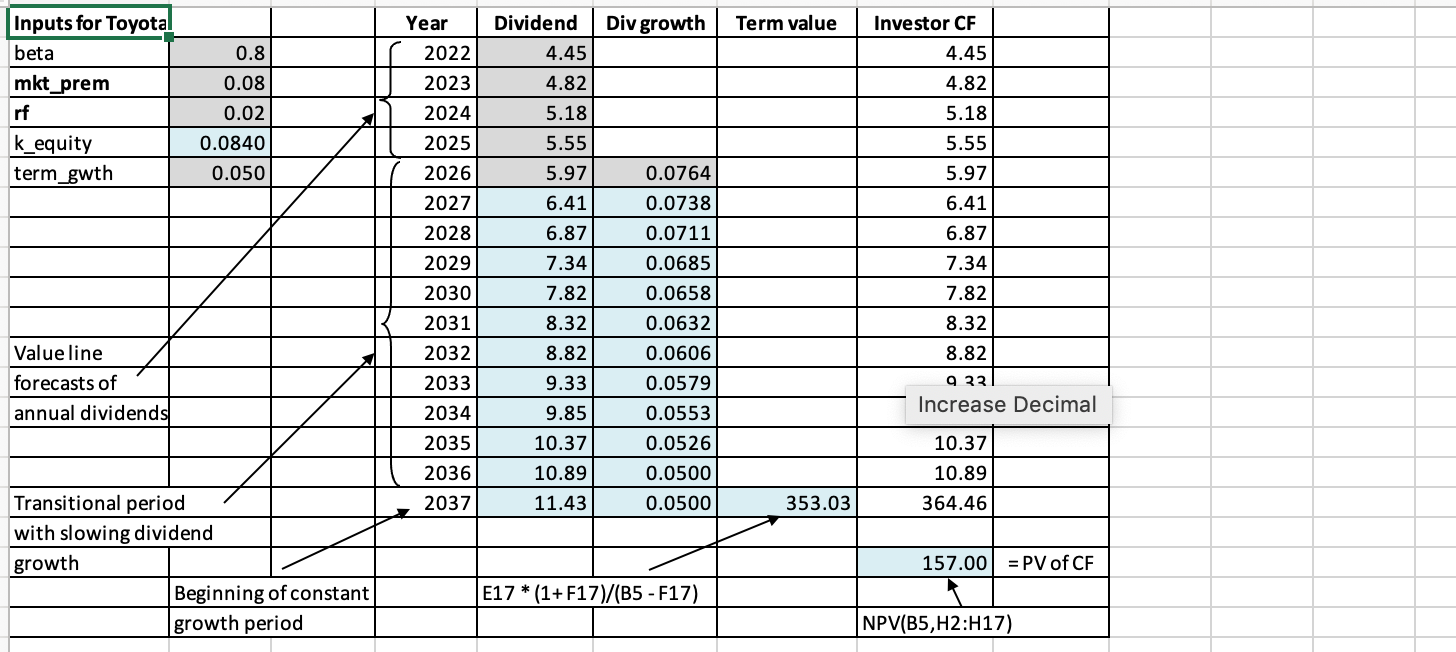

Calculate the intrinsic value of Toyota in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. Required: a. The terminal growth rate will be 5.7%. Note: Round your answer to 2 decimal places. b. Toyota's actual beta is 0.85 . Note: Round your answer to 2 decimal places. c. The market risk premium is 8.7%. Note: Round your answer to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Inputs for Toyota & & Year & Dividend & Div growth & Term value & Investor CF & \\ \hline beta & 0.8 & 2022 & 4.45 & & & 4.45 & \\ \hline mkt_prem & 0.08 & 2023 & 4.82 & & & 4.82 & \\ \hline rf & 0.02 & 2024 & 5.18 & & & 5.18 & \\ \hline k_equity & 0.0840 & 2025 & 5.55 & & & 5.55 & \\ \hline \multirow[t]{6}{*}{ term_gwth } & 0.050 & 2026 & 5.97 & 0.0764 & & 5.97 & \\ \hline & & 2027 & 6.41 & 0.0738 & & 6.41 & \\ \hline & & 2028 & 6.87 & 0.0711 & & 6.87 & \\ \hline & & 2029 & 7.34 & 0.0685 & & 7.34 & \\ \hline & & 2030 & 7.82 & 0.0658 & & 7.82 & \\ \hline & & 2031 & 8.32 & 0.0632 & & 8.32 & \\ \hline Value line & & 2032 & 8.82 & 0.0606 & & 8.82 & \\ \hline forecasts of & & 2033 & 9.33 & 0.0579 & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Increase Decimal }} \\ \hline \multirow[t]{3}{*}{ annual dividends } & & 2034 & 9.85 & 0.0553 & & & \\ \hline & & 2035 & 10.37 & 0.0526 & & 10.37 & \\ \hline & & 2036 & 10.89 & 0.0500 & & 10.89 & \\ \hline Transitional period & & 2037 & 11.43 & 0.0500 & 353.03 & 364.46 & \\ \hline \multicolumn{8}{|c|}{ with slowing dividend } \\ \hline \multirow[t]{3}{*}{ growth } & & & & 7 & & 157.00 & =PV of CF \\ \hline & Beginning of constant & & \multicolumn{2}{|c|}{E17(1+F17)/(B5F17)} & & 1 & \\ \hline & growth period & & & & & \multicolumn{2}{|l|}{NPV(B5,H2:H17)} \\ \hline \end{tabular}

Calculate the intrinsic value of Toyota in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. Required: a. The terminal growth rate will be 5.7%. Note: Round your answer to 2 decimal places. b. Toyota's actual beta is 0.85 . Note: Round your answer to 2 decimal places. c. The market risk premium is 8.7%. Note: Round your answer to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Inputs for Toyota & & Year & Dividend & Div growth & Term value & Investor CF & \\ \hline beta & 0.8 & 2022 & 4.45 & & & 4.45 & \\ \hline mkt_prem & 0.08 & 2023 & 4.82 & & & 4.82 & \\ \hline rf & 0.02 & 2024 & 5.18 & & & 5.18 & \\ \hline k_equity & 0.0840 & 2025 & 5.55 & & & 5.55 & \\ \hline \multirow[t]{6}{*}{ term_gwth } & 0.050 & 2026 & 5.97 & 0.0764 & & 5.97 & \\ \hline & & 2027 & 6.41 & 0.0738 & & 6.41 & \\ \hline & & 2028 & 6.87 & 0.0711 & & 6.87 & \\ \hline & & 2029 & 7.34 & 0.0685 & & 7.34 & \\ \hline & & 2030 & 7.82 & 0.0658 & & 7.82 & \\ \hline & & 2031 & 8.32 & 0.0632 & & 8.32 & \\ \hline Value line & & 2032 & 8.82 & 0.0606 & & 8.82 & \\ \hline forecasts of & & 2033 & 9.33 & 0.0579 & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Increase Decimal }} \\ \hline \multirow[t]{3}{*}{ annual dividends } & & 2034 & 9.85 & 0.0553 & & & \\ \hline & & 2035 & 10.37 & 0.0526 & & 10.37 & \\ \hline & & 2036 & 10.89 & 0.0500 & & 10.89 & \\ \hline Transitional period & & 2037 & 11.43 & 0.0500 & 353.03 & 364.46 & \\ \hline \multicolumn{8}{|c|}{ with slowing dividend } \\ \hline \multirow[t]{3}{*}{ growth } & & & & 7 & & 157.00 & =PV of CF \\ \hline & Beginning of constant & & \multicolumn{2}{|c|}{E17(1+F17)/(B5F17)} & & 1 & \\ \hline & growth period & & & & & \multicolumn{2}{|l|}{NPV(B5,H2:H17)} \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started