Answered step by step

Verified Expert Solution

Question

1 Approved Answer

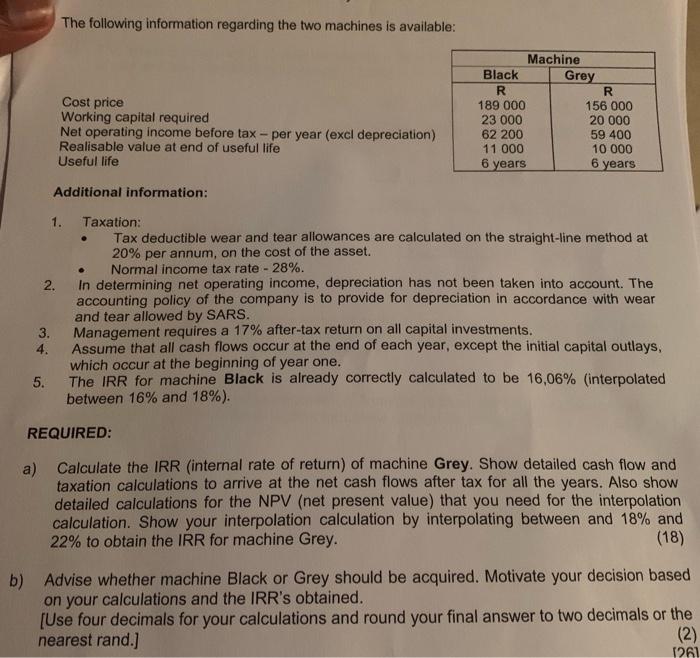

The following information regarding the two machines is available: Machine Black Grey R. Cost price Working capital required Net operating income before tax -

The following information regarding the two machines is available: Machine Black Grey R. Cost price Working capital required Net operating income before tax - per year (excl depreciation) Realisable value at end of useful life 189 000 156 000 20 000 59 400 10 000 6 years 23 000 62 200 11 000 Useful life 6 years Additional information: Taxation: Tax deductible wear and tear allowances are calculated on the straight-line method at 20% per annum, on the cost of the asset. Normal income tax rate -28%. 1. In determining net operating income, depreciation has not been taken into account. The accounting policy of the company is to provide for depreciation in accordance with wear and tear allowed by SARS. 2. Management requires a 17% after-tax return on all capital investments. Assume that all cash flows occur at the end of each year, except the initial capital outlays, 3. 4. which occur at the beginning of year one. The IRR for machine Black is already correctly calculated to be 16,06% (interpolated 5. between 16% and 18%). REQUIRED: a) Calculate the IRR (internal rate of return) of machine Grey. Show detailed cash flow and taxation calculations to arrive at the net cash flows after tax for all the years. Also show detailed calculations for the NPV (net present value) that you need for the interpolation calculation. Show your interpolation calculation by interpolating between and 18% and 22% to obtain the IRR for machine Grey. (18) b) Advise whether machine Black or Grey should be acquired. Motivate your decision based on your calculations and the IRR's obtained. [Use four decimals for your calculations and round your final answer to two decimals or the nearest rand.] (2) 1261

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANALYSIS OF CASH FLOW OF MACHINEGREY Initial Cash Flow Cost Price 156000 Working capital 20000 Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started