Question: Calculate the Long-Term Debt Coverage Ratio based on the information below , please show work Assets Liabilities Cash $ 500 $ 350 $ 1,200 $

Calculate the Long-Term Debt Coverage Ratio based on the information below , please show work

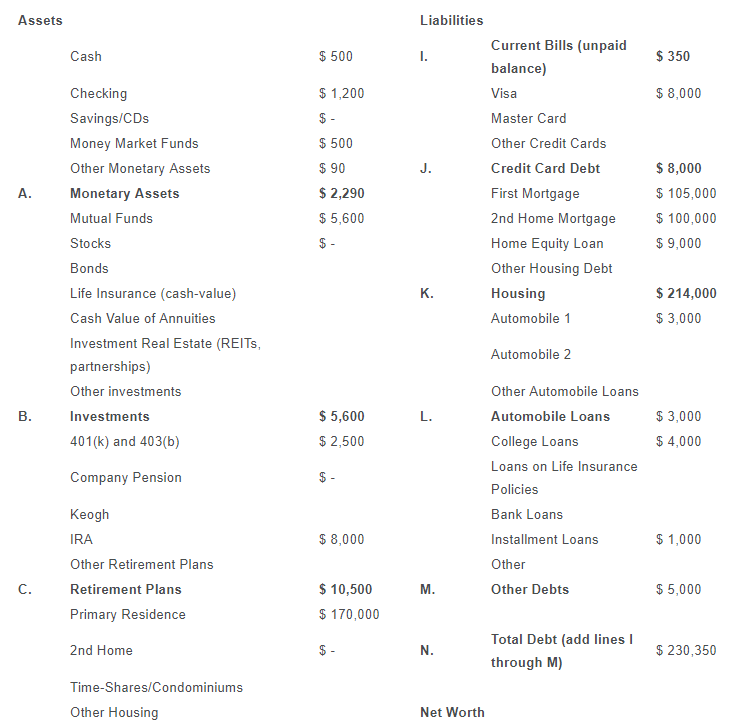

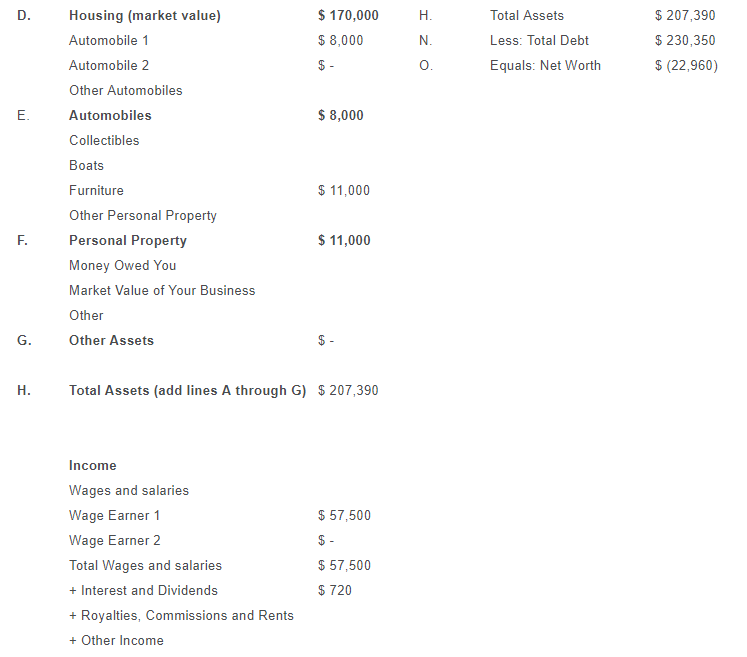

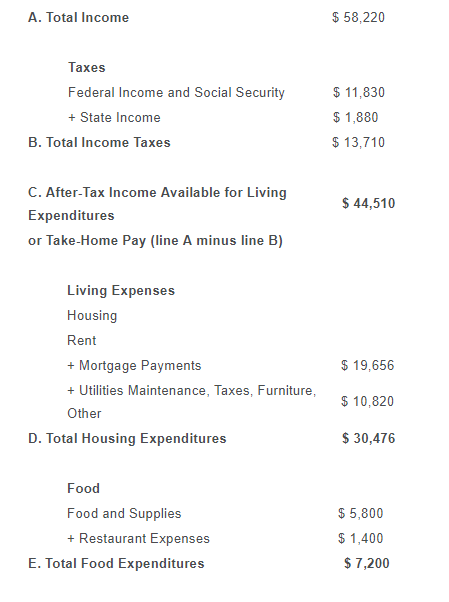

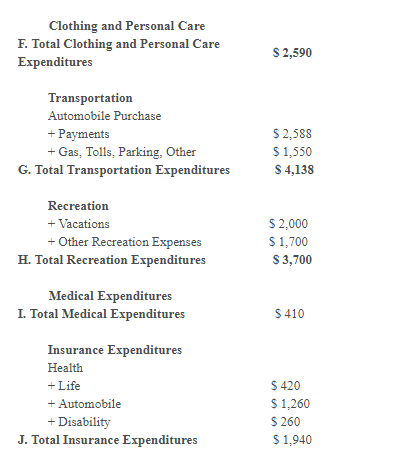

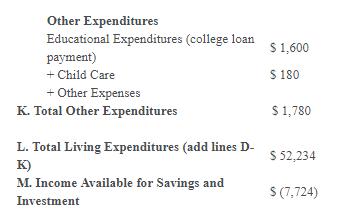

Assets Liabilities Cash $ 500 $ 350 $ 1,200 $ 8,000 $- Checking Savings/CDs Money Market Funds Other Monetary Assets Monetary Assets Mutual Funds Stocks $ 8,000 $ 500 $ 90 $ 2,290 $ 5,600 Current Bills (unpaid balance) Visa Master Card Other Credit Cards Credit Card Debt First Mortgage 2nd Home Mortgage Home Equity Loan Other Housing Debt Housing Automobile 1 $ 105,000 $ 100,000 $ 9,000 $ 214,000 $3,000 Bonds Life Insurance (cash-value) Cash Value of Annuities Investment Real Estate (REITS, partnerships) Other investments Automobile 2 B. L. Investments 401(k) and 403(b) $ 5,600 $ 2,500 Other Automobile Loans Automobile Loans College Loans Loans on Life Insurance Policies $ 3,000 $ 4,000 Company Pension Bank Loans Keogh IRA $ 8,000 Installment Loans $1,000 Other Other Retirement Plans Retirement Plans Primary Residence M. Other Debts $ 5,000 $ 10,500 $ 170,000 2nd Home Total Debt (add lines through M) $ 230.350 Time-Shares/Condominiums Other Housing Net Worth D. $ 170,000 $ 8,000 Izo Total Assets Less: Total Debt Equals: Net Worth $ 207,390 $ 230,350 $ (22,960) $- Housing (market value) Automobile 1 Automobile 2 Other Automobiles Automobiles Collectibles $ 8,000 Boats $ 11,000 F. $ 11,000 Furniture Other Personal Property Personal Property Money Owed You Market Value of Your Business Other Other Assets G. H. Total Assets (add lines A through G) $207,390 Income Wages and salaries Wage Earner 1 $ 57,500 $ - $ 57,500 Wage Earner 2 Total Wages and salaries + Interest and Dividends + Royalties, Commissions and Rents + Other Income $ 720 A. Total Income $ 58,220 Taxes Federal Income and Social Security + State Income B. Total Income Taxes $ 11,830 $ 1,880 $ 13,710 $ 44,510 C. After-Tax Income Available for Living Expenditures or Take-Home Pay (line A minus line B) Living Expenses Housing Rent + Mortgage Payments + Utilities Maintenance, Taxes, Furniture, Other D. Total Housing Expenditures $ 19,656 $ 10,820 $ 30,476 $ 5,800 Food Food and Supplies + Restaurant Expenses E. Total Food Expenditures $ 1,400 $ 7,200 Clothing and Personal Care F. Total Clothing and Personal Care Expenditures S 2,590 Transportation Automobile Purchase + Payments + Gas, Tolls, Parking, Other G. Total Transportation Expenditures $ 2.588 $ 1,550 S 4,138 Recreation + Vacations + Other Recreation Expenses H. Total Recreation Expenditures $ 2,000 $ 1,700 $ 3,700 Medical Expenditures I. Total Medical Expenditures $ 410 Insurance Expenditures Health + Life + Automobile + Disability J. Total Insurance Expenditures $ 420 $ 1,260 $ 260 $ 1,940 Other Expenditures Educational Expenditures (college loans $ 1.600 payment) + Child Care $ 180 + Other Expenses K. Total Other Expenditures $ 1,780 $ 52,234 L. Total Living Expenditures (add lines D- K) M. Income Available for Savings and Investment $(7,724) Assets Liabilities Cash $ 500 $ 350 $ 1,200 $ 8,000 $- Checking Savings/CDs Money Market Funds Other Monetary Assets Monetary Assets Mutual Funds Stocks $ 8,000 $ 500 $ 90 $ 2,290 $ 5,600 Current Bills (unpaid balance) Visa Master Card Other Credit Cards Credit Card Debt First Mortgage 2nd Home Mortgage Home Equity Loan Other Housing Debt Housing Automobile 1 $ 105,000 $ 100,000 $ 9,000 $ 214,000 $3,000 Bonds Life Insurance (cash-value) Cash Value of Annuities Investment Real Estate (REITS, partnerships) Other investments Automobile 2 B. L. Investments 401(k) and 403(b) $ 5,600 $ 2,500 Other Automobile Loans Automobile Loans College Loans Loans on Life Insurance Policies $ 3,000 $ 4,000 Company Pension Bank Loans Keogh IRA $ 8,000 Installment Loans $1,000 Other Other Retirement Plans Retirement Plans Primary Residence M. Other Debts $ 5,000 $ 10,500 $ 170,000 2nd Home Total Debt (add lines through M) $ 230.350 Time-Shares/Condominiums Other Housing Net Worth D. $ 170,000 $ 8,000 Izo Total Assets Less: Total Debt Equals: Net Worth $ 207,390 $ 230,350 $ (22,960) $- Housing (market value) Automobile 1 Automobile 2 Other Automobiles Automobiles Collectibles $ 8,000 Boats $ 11,000 F. $ 11,000 Furniture Other Personal Property Personal Property Money Owed You Market Value of Your Business Other Other Assets G. H. Total Assets (add lines A through G) $207,390 Income Wages and salaries Wage Earner 1 $ 57,500 $ - $ 57,500 Wage Earner 2 Total Wages and salaries + Interest and Dividends + Royalties, Commissions and Rents + Other Income $ 720 A. Total Income $ 58,220 Taxes Federal Income and Social Security + State Income B. Total Income Taxes $ 11,830 $ 1,880 $ 13,710 $ 44,510 C. After-Tax Income Available for Living Expenditures or Take-Home Pay (line A minus line B) Living Expenses Housing Rent + Mortgage Payments + Utilities Maintenance, Taxes, Furniture, Other D. Total Housing Expenditures $ 19,656 $ 10,820 $ 30,476 $ 5,800 Food Food and Supplies + Restaurant Expenses E. Total Food Expenditures $ 1,400 $ 7,200 Clothing and Personal Care F. Total Clothing and Personal Care Expenditures S 2,590 Transportation Automobile Purchase + Payments + Gas, Tolls, Parking, Other G. Total Transportation Expenditures $ 2.588 $ 1,550 S 4,138 Recreation + Vacations + Other Recreation Expenses H. Total Recreation Expenditures $ 2,000 $ 1,700 $ 3,700 Medical Expenditures I. Total Medical Expenditures $ 410 Insurance Expenditures Health + Life + Automobile + Disability J. Total Insurance Expenditures $ 420 $ 1,260 $ 260 $ 1,940 Other Expenditures Educational Expenditures (college loans $ 1.600 payment) + Child Care $ 180 + Other Expenses K. Total Other Expenditures $ 1,780 $ 52,234 L. Total Living Expenditures (add lines D- K) M. Income Available for Savings and Investment $(7,724)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts