PLEASE HELP ME!! I can't figure out these answers

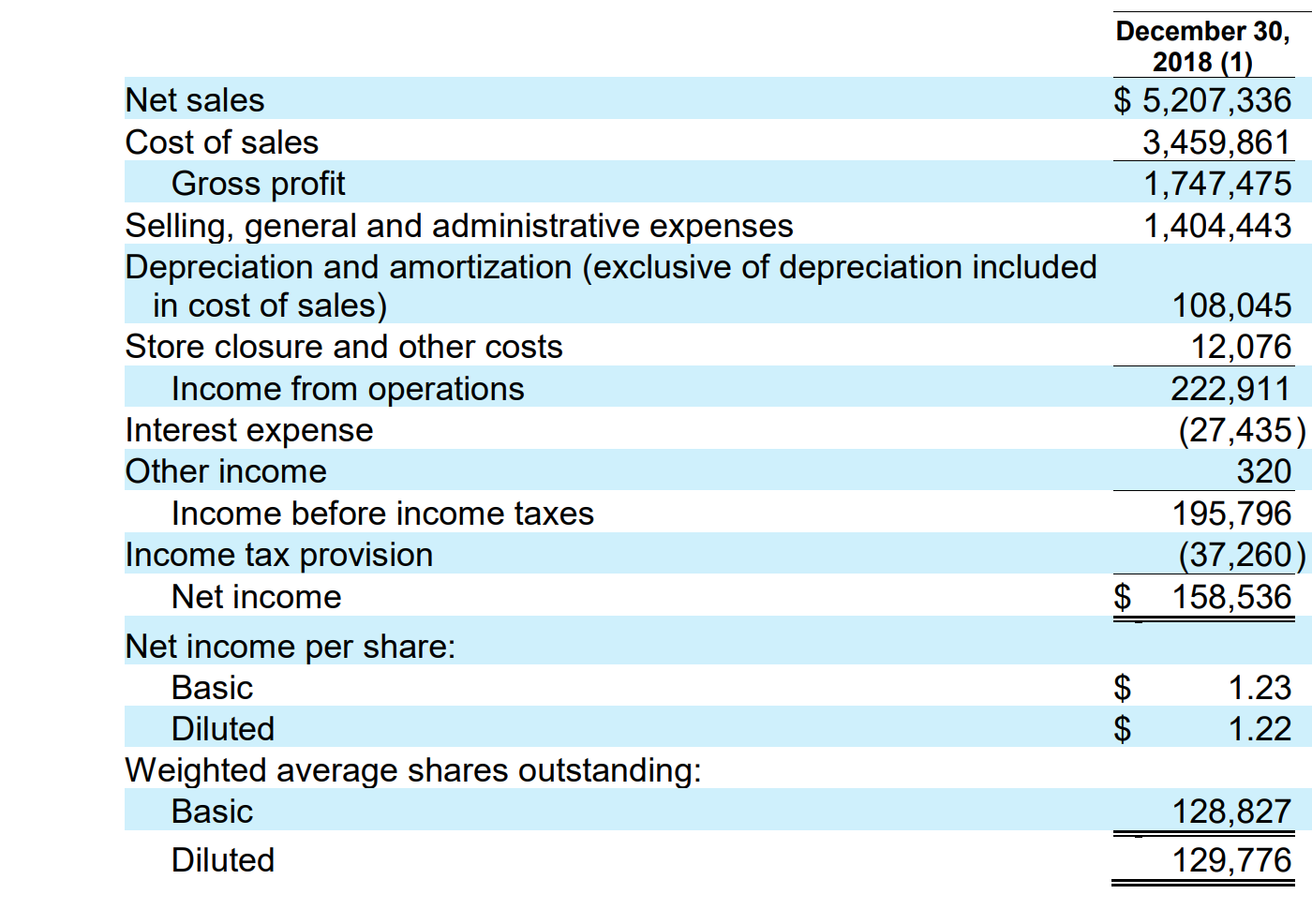

Prepare a horizontal analysis of the Income Statement for the most current year. (See page 18-11 for the proper format).

Note you MUST USE EXCEL to create the horizontal analysis. An excel file MUST BE TURNED IN with the project to earn points for this question.

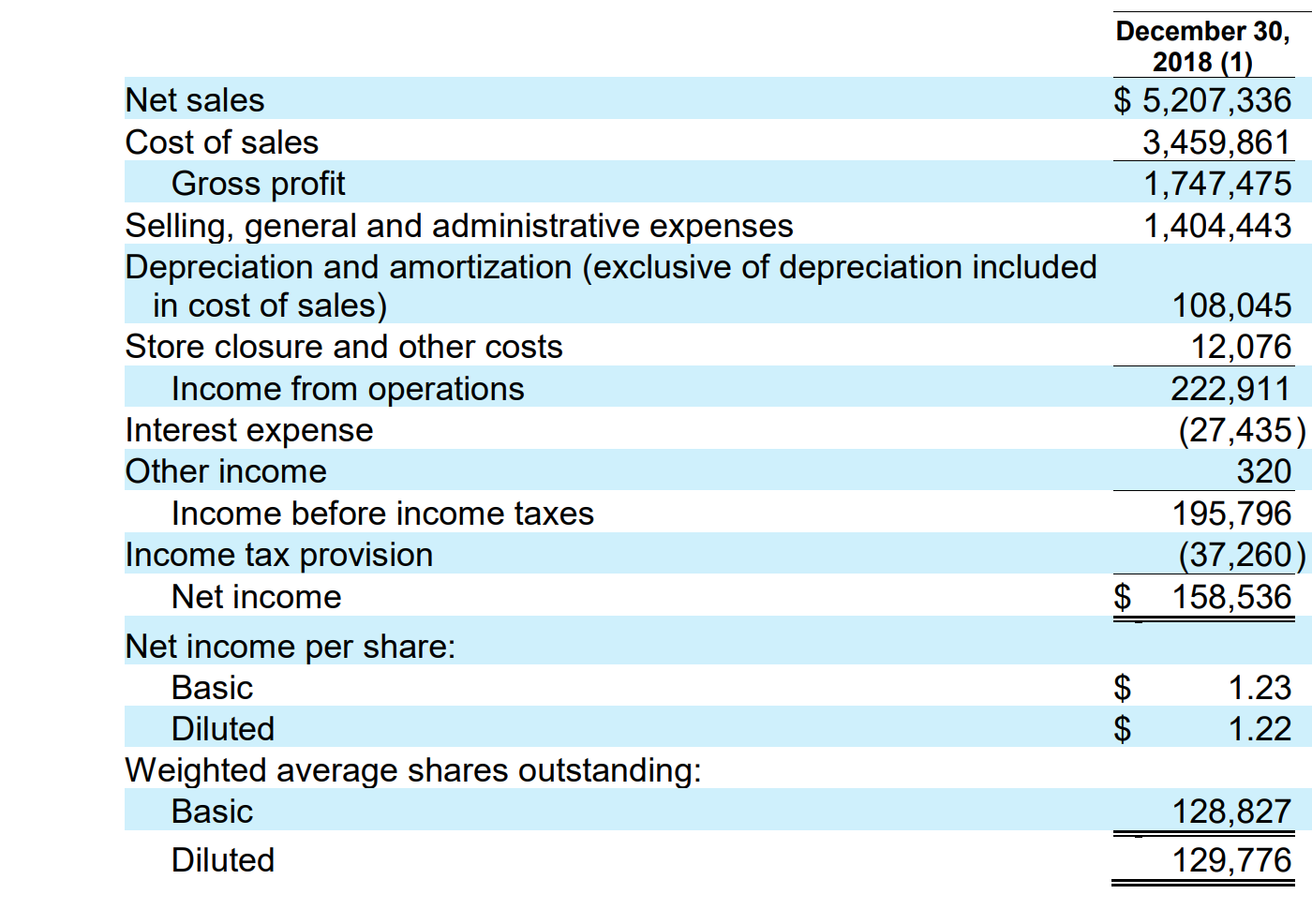

8. (2 points) What is the companys current, Basic EPS? Did EPS vary more than 10% from prior year?

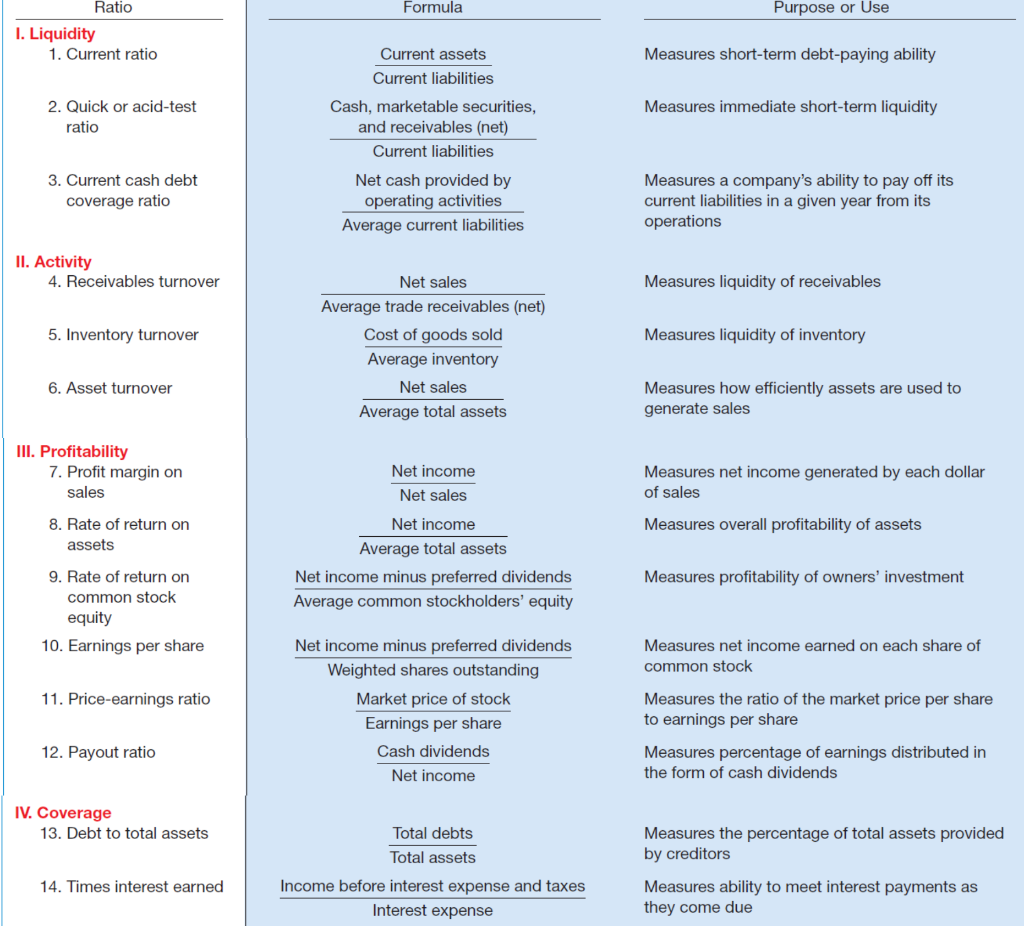

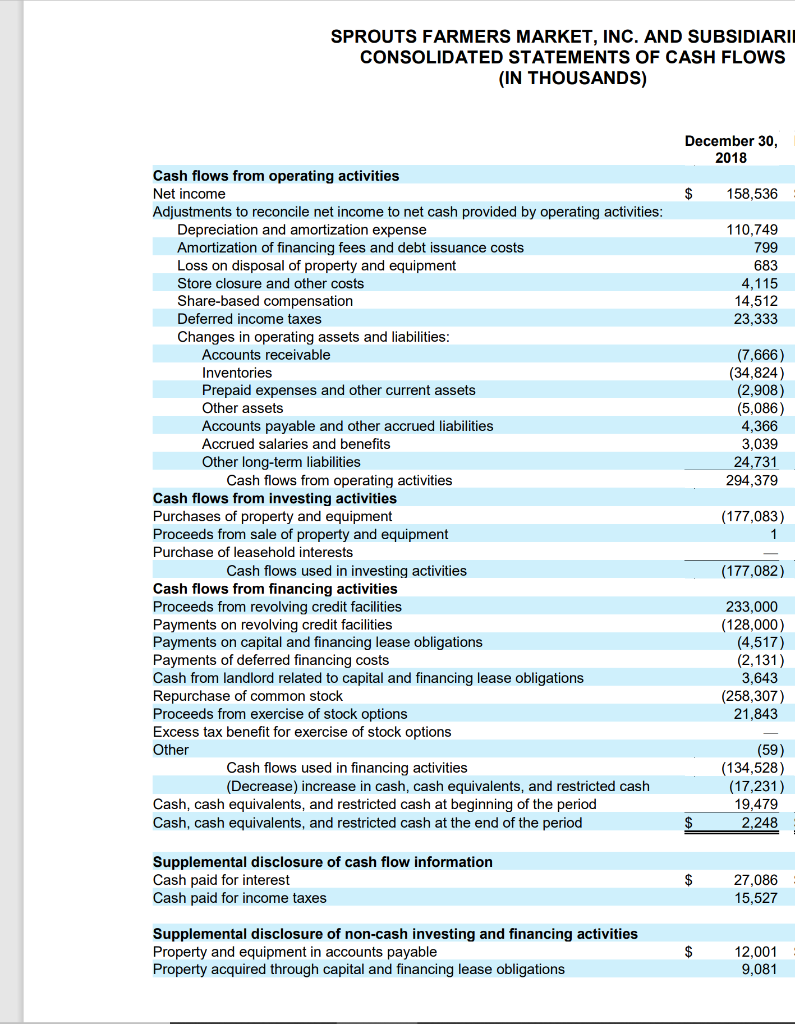

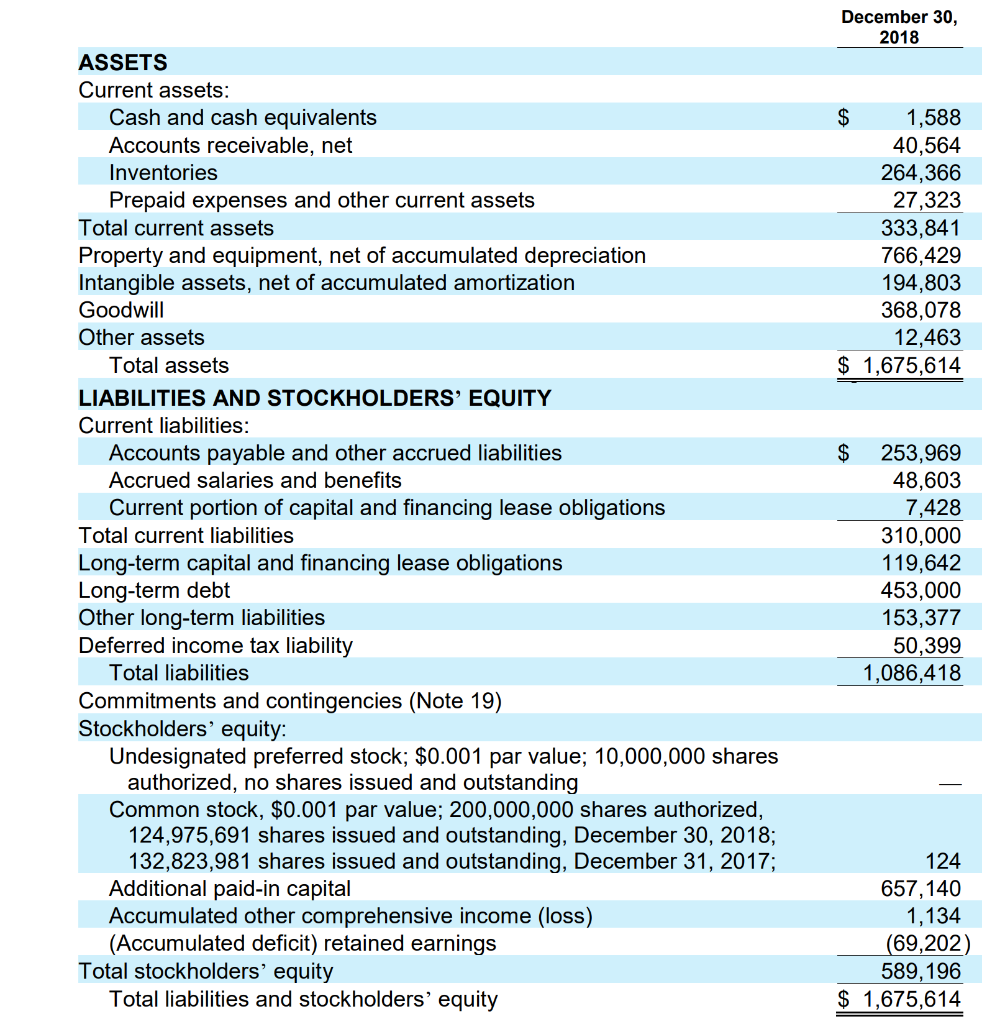

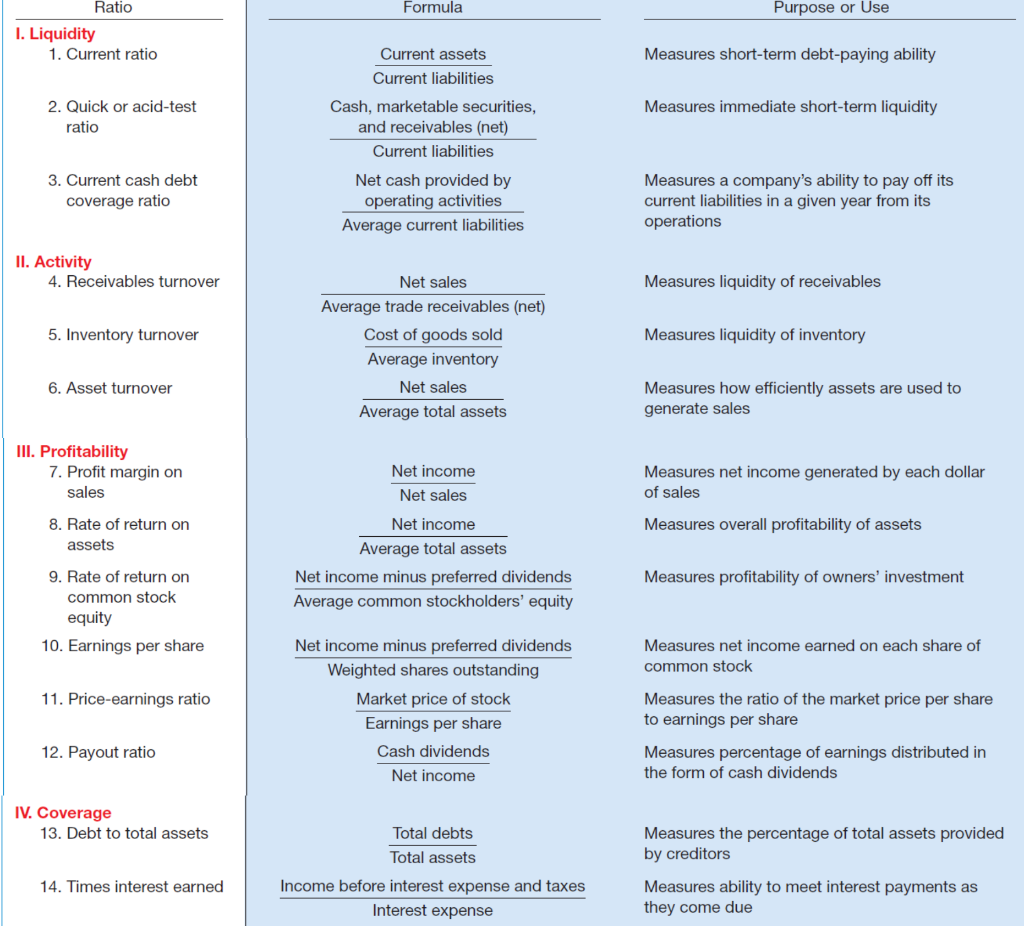

9. (9 points) Calculate the following liquidity ratios for the current year and give a one sentence description of each result. (Assume that all sales are on credit.)

For example: Current Ratio $1,020,000 current assets

344,500 current liabilities

= 2.96 : 1

For every dollar in current liabilities, the company owns $2.96 in current assets to pay for them.

- Current Ratio

- Accounts Receivables Turnover Ratio

- Inventory Turnover

10. (9 points) Calculate the following profitability ratios for the current year and give a one sentence description of each result.

a. Profit Margin Ratio

b. Rate of return on Total Assets

c. Return on Common Stockholders Equity (ROE)

11. (6 points) Calculate the following solvency ratios for the current year and give a one sentence description of each result.

a. Debt to assets ratio

b. Debt to Equity ratio (total liabilities / total equity)

c. Times Interest Earned Ratio

12. (2 points) Calculate the free cash flow of the company for the most current year (Hint: use the formula given in the book on page 17-17)

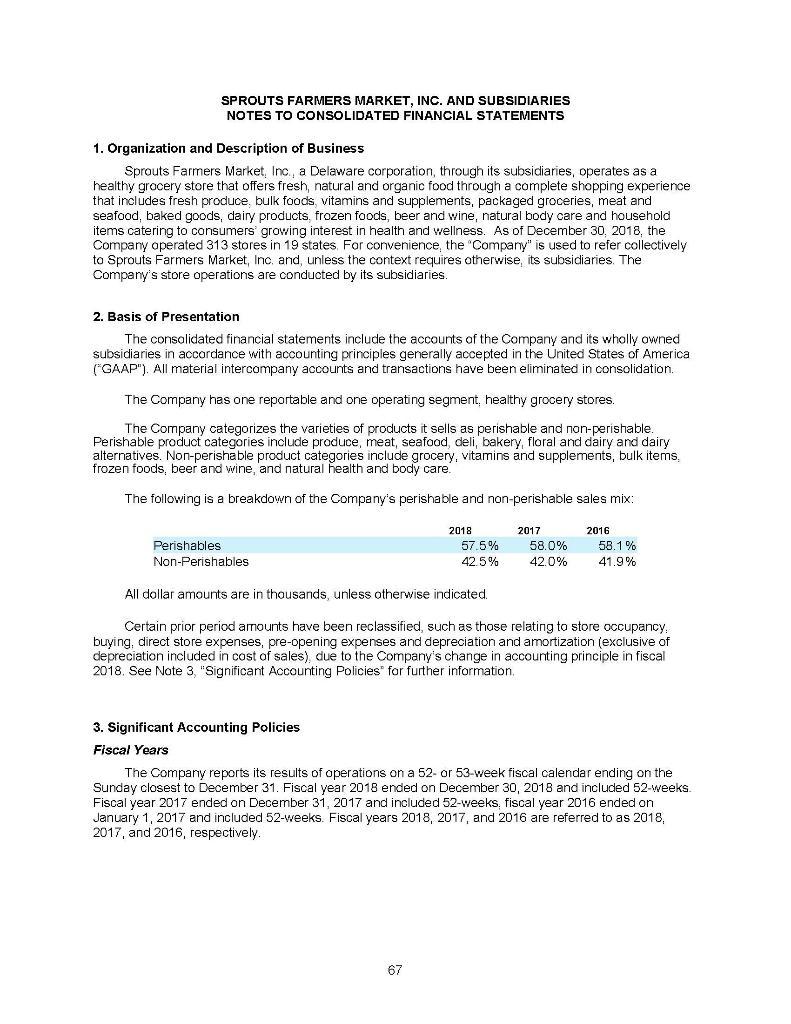

FOR QUESTIONS 13 15: LOOK AT THE NOTES TO THE FINANCIAL STATEMENTS (beginning on page 6)

13. (1 Point) In what state did Sprouts Farmers Market, Inc. incorporate?

14. (1 Point) For 2018, what percentage of the companys sales were from Perishables?

15. (1 Point) What does the company estimate for the useful life of its buildings for depreciation purposes?

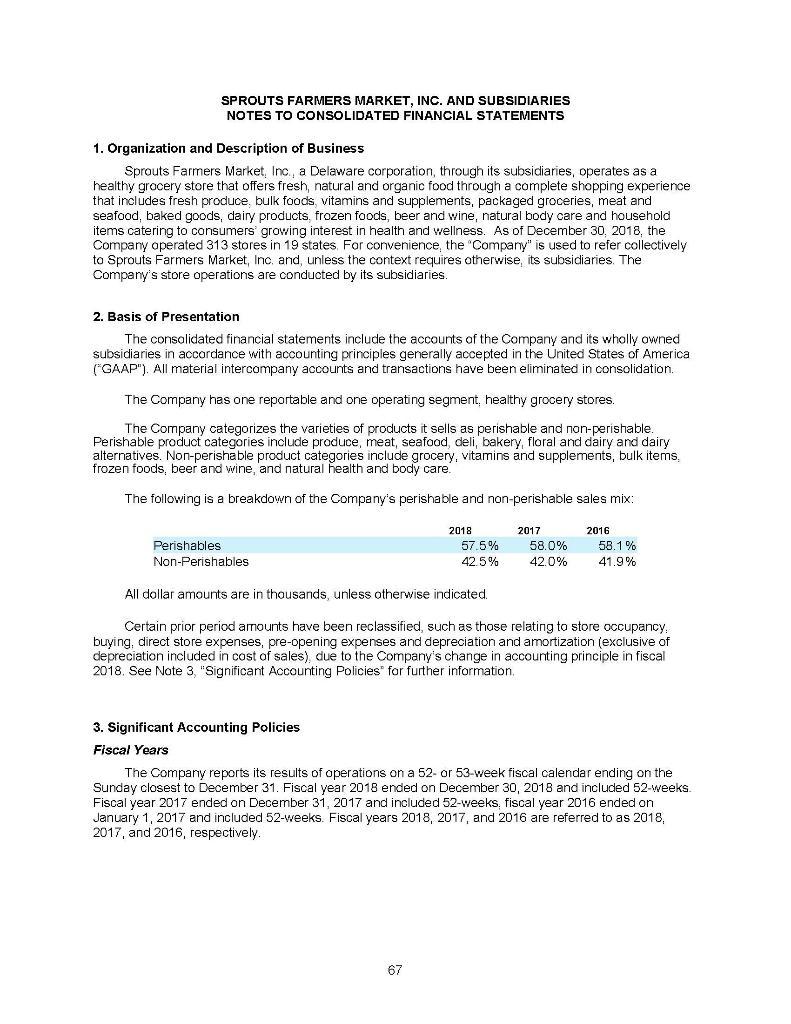

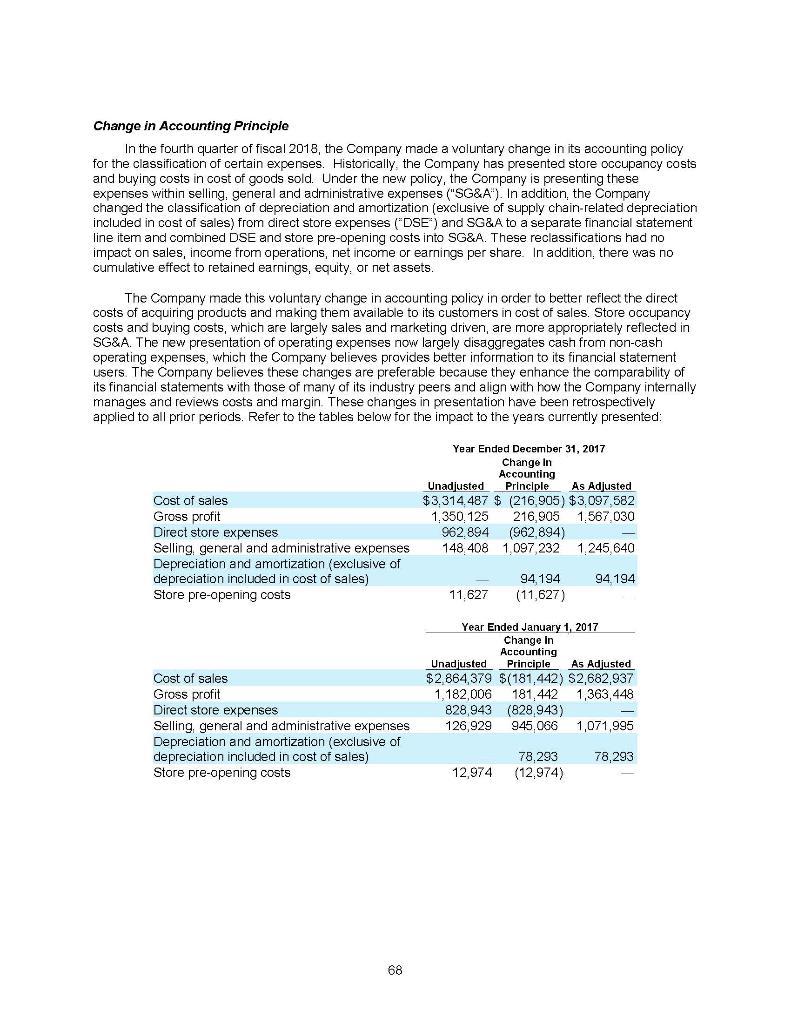

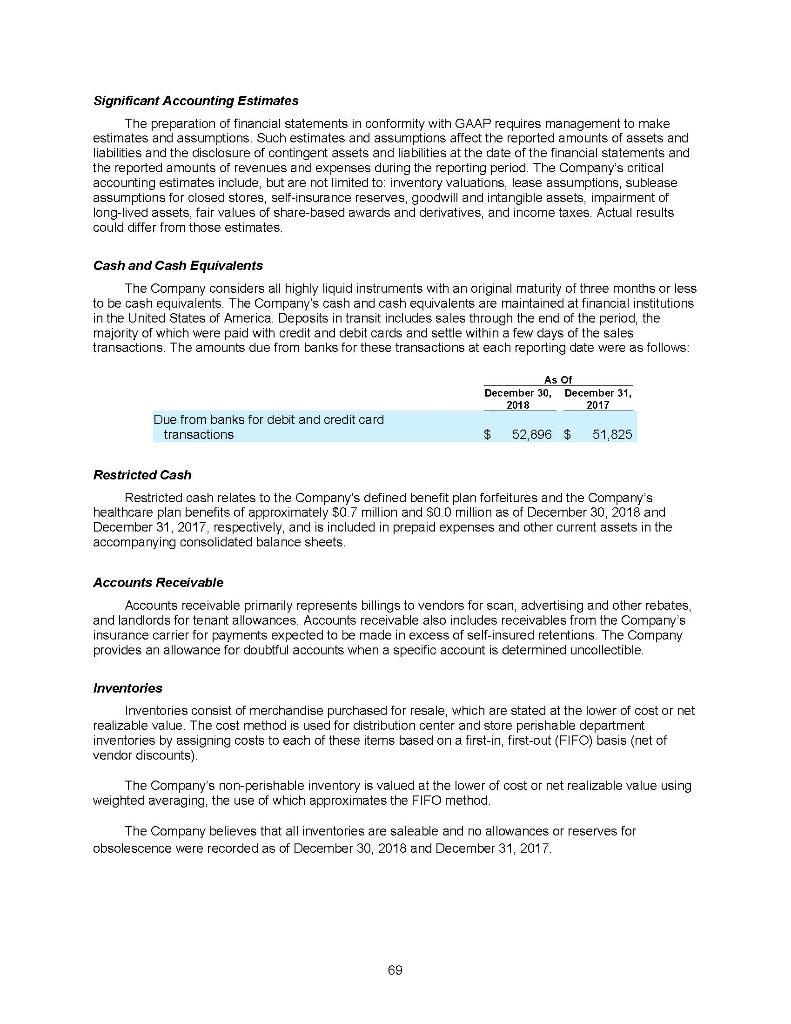

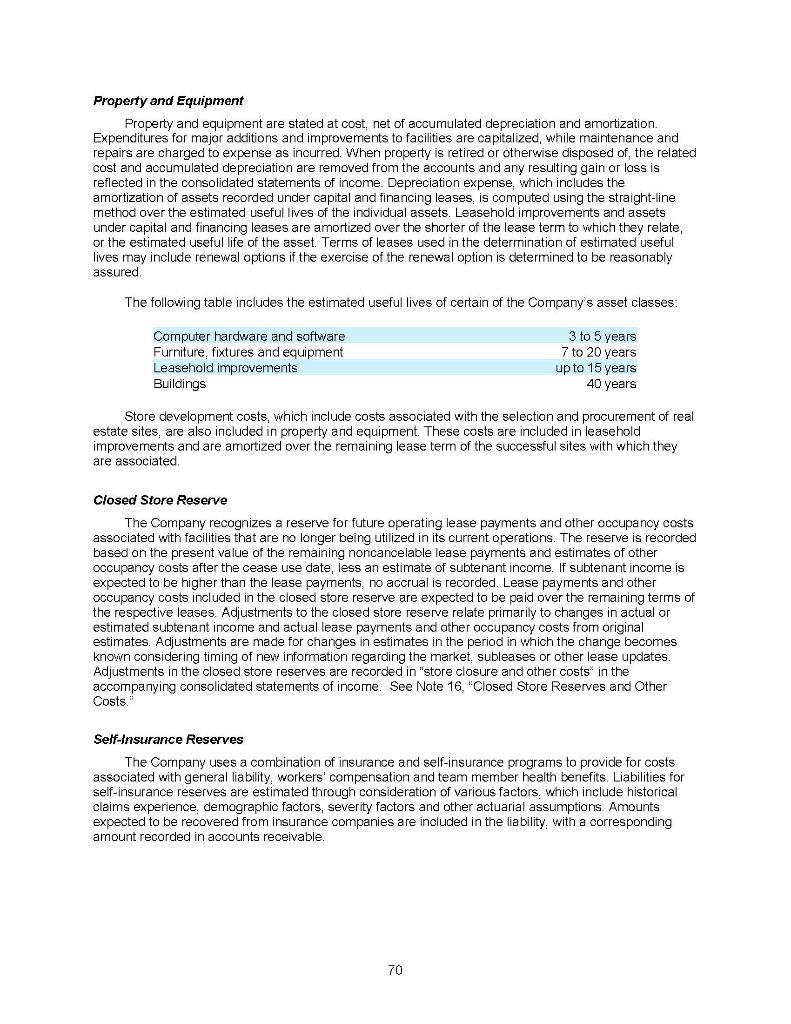

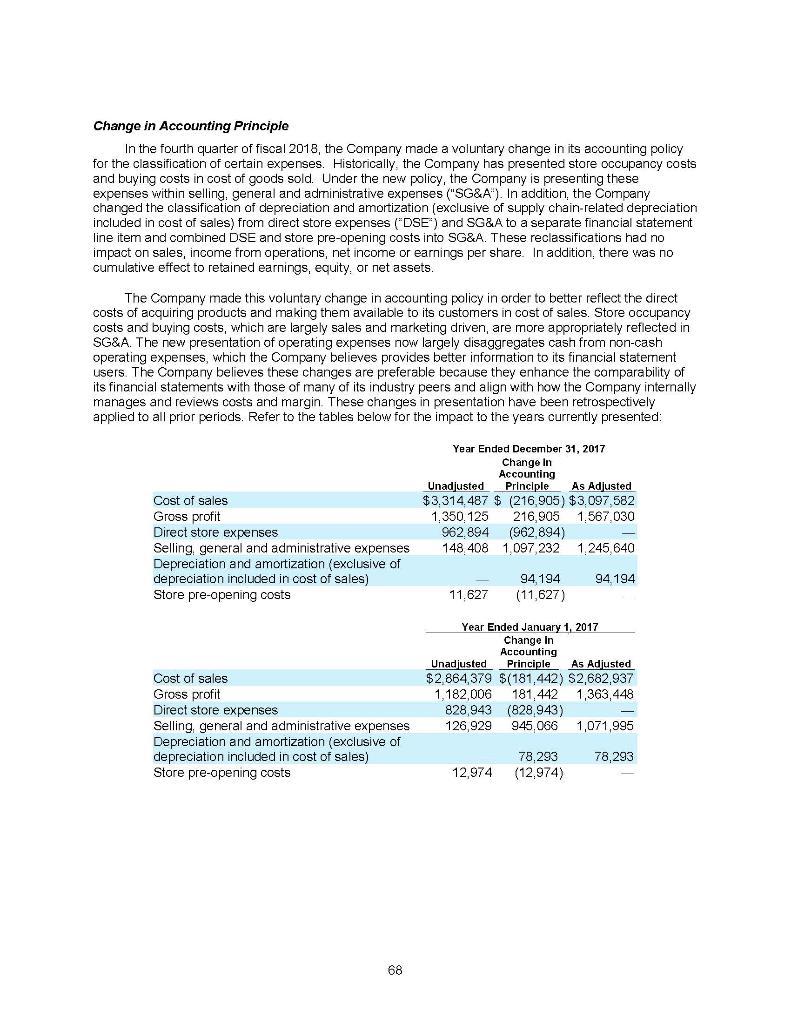

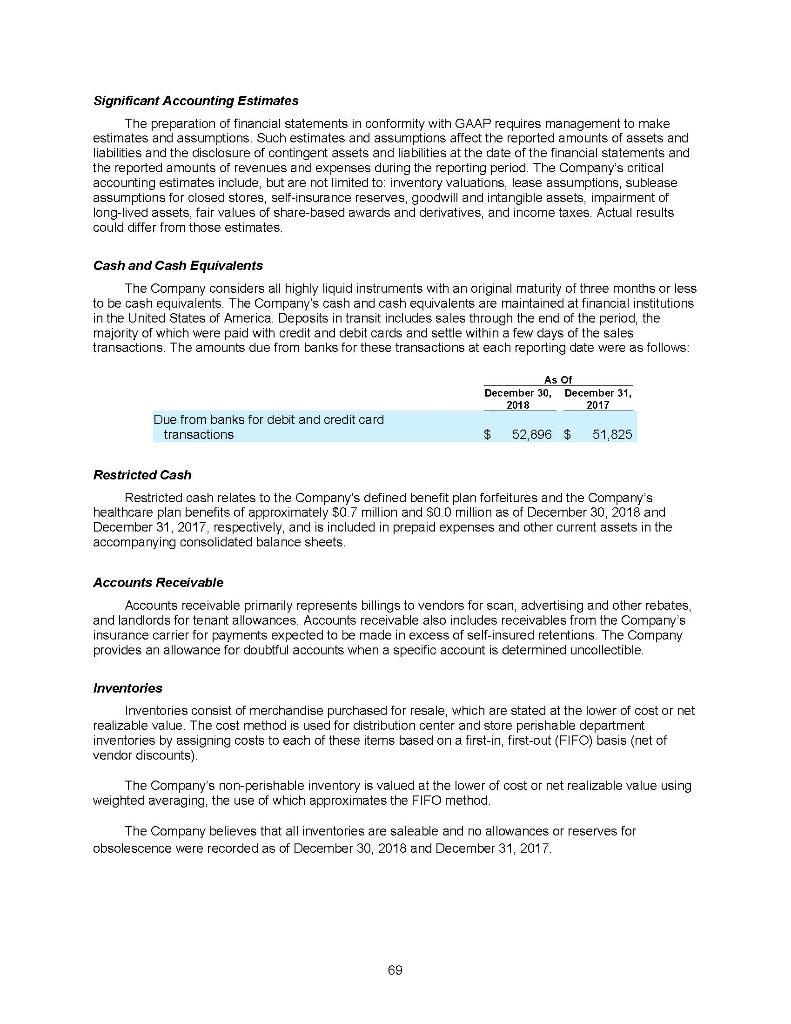

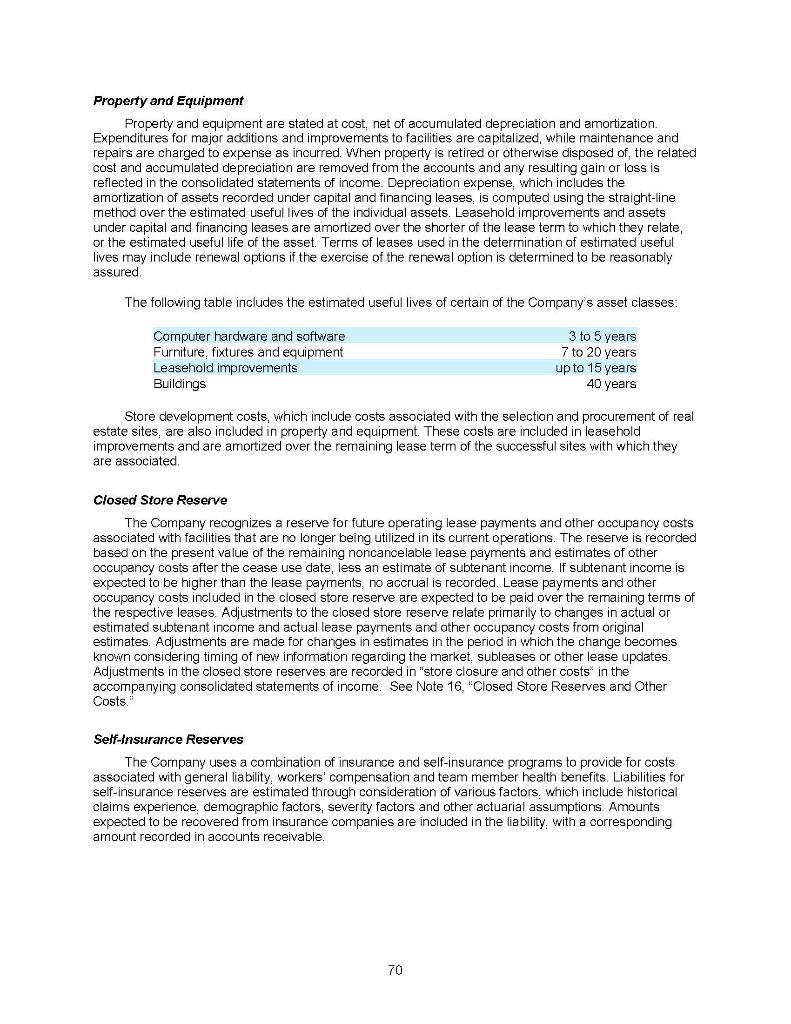

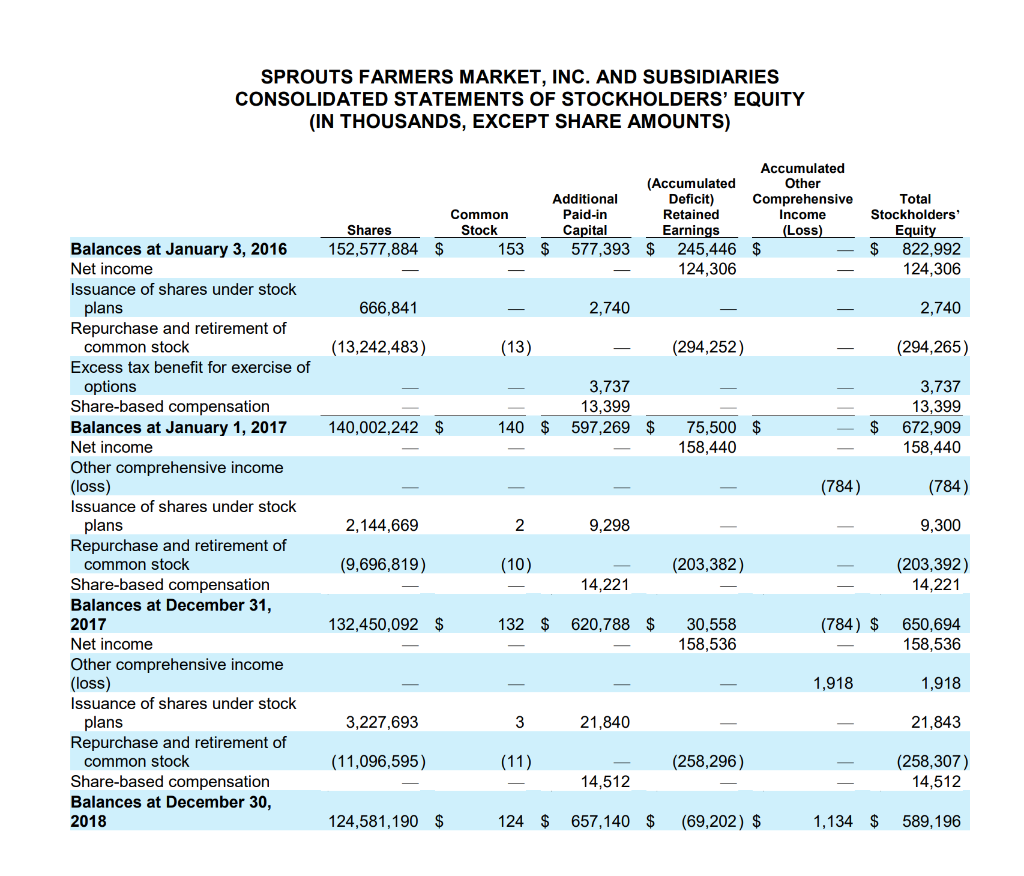

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 1. Organization and Description of Business Sprouts Farmers Market, Inc., a Delaware corporation, through its subsidiaries, operates as a healthy grocery store that offers fresh, natural and organic food through a complete shopping experience that includes fresh produce, bulk foods, vitamins and supplements, packaged groceries, meat and seafood, baked goods, dairy products, frozen foods, beer and wine, natural body care and household items catering to consumers growing interest in health and wellness. As of December 30, 2018, the Company operated 313 stores in 19 states For convenience, the Company" is used to refer collectively to Sprouts Farmers Market, Inc. and, unless the context requires otherwise, its subsidiaries. The Company's store operations are conducted by its subsidiaries. 2. Basis of Presentation The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries in accordance with accounting principles generally accepted in the United States of America ("GAAP"). All material intercompany accounts and transactions have been eliminated in consolidation The Company has one reportable and one operating segment, healthy grocery stores. The Company categorizes the varieties of products it sells as perishable and non-perishable. Perishable product categories include produce, meat, seafood, deli, bakery, floral and dairy and dairy alternatives. Non-perishable product categories include grocery, vitamins and supplements, bulk items. frozen foods, beer and wine, and natural health and body care. The following is a breakdown of the Company's perishable and non-perishable sales mix: Perishables Non-Perishables 2018 57.5% 42.5% 2017 58.0% 42.0% 2016 58.1% 41.9% All dollar amounts are in thousands unless otherwise indicated Certain prior period amounts have been reclassified, such as those relating to store occupancy, buying, direct store expenses, pre-opening expenses and depreciation and amortization (exclusive of depreciation included in cost of sales), due to the Company's change in accounting principle in fiscal 2018. See Note 3, "Significant Accounting Policies for further information 3. Significant Accounting Policies Fiscal Years The Company reports its results of operations on a 52- or 53-week fiscal calendar ending on the Sunday closest to December 31. Fiscal year 2018 ended on December 30, 2018 and included 52-weeks. Fiscal year 2017 ended on December 31, 2017 and included 52-weeks, fiscal year 2016 ended on January 1, 2017 and included 52-weeks. Fiscal years 2018, 2017, and 2016 are referred to as 2018, 2017, and 2016, respectively. 67 Change in Accounting Principle In the fourth quarter of fiscal 2018, the Company made a voluntary change in its accounting policy for the classification of certain expenses. Historically, the Company has presented store occupancy costs and buying costs in cost of goods sold. Under the new policy, the Company is presenting these expenses within selling, general and administrative expenses ("SG&A). In addition, the Company changed the classification of depreciation and amortization (exclusive of supply chain-related depreciation included in cost of sales) from direct store expenses ("DSE") and SG&A to a separate financial statement line item and combined DSE and store pre-opening costs into SG&A. These reclassifications had no impact on sales, income from operations, net income or earnings per share. In addition, there was no cumulative effect to retained earnings, equity. or net assets. The Company made this voluntary change in accounting policy in order to better reflect the direct costs of acquiring products and making them available to its customers cost of sales. Store occupancy costs and buying costs, which are largely sales and marketing driven, are more appropriately reflected in SG&A. The new presentation of operating expenses now largely disaggregates cash from non-cash operating expenses, which the Company believes provides better information to its financial statement users. The Company believes these changes are preferable because they enhance the comparability of its financial statements with those of many of its industry peers and align with how the Company internally manages and reviews costs and margin. These changes in presentation have been retrospectively applied to all prior periods. Refer to the tables below for the impact to the years currently presented: Cost of sales Gross profit Direct store expenses Selling general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Store pre-opening costs Year Ended December 31, 2017 Change in Accounting Unadjusted Principle As Adjusted $3,314.487 $ (216,905) $3.097,582 1,350, 125 216,905 1,567,030 962.894 (962,894) 148 408 1,097,232 1.245 640 94,194 94.194 11,627 (11,627) Cost of sales Gross profit Direct store expenses Selling general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Store pre-opening costs Year Ended January 1, 2017 Change In Accounting Unadjusted Principle As Adjusted $2.864,379 $(181,442) $2,682,937 1,182,006 181,442 1,363,448 828,943 (828,943) 126 929 945,066 1,071,995 78,293 12,974 78,293 (12,974) 68 Significant Accounting Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions. Such estimates and assumptions affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company's critical accounting estimates include, but are not limited to: inventory valuations, lease assumptions, sublease assumptions for closed stores, self-insurance reserves, goodwill and intangible assets, impairment of long-lived assets, fair values of share-based awards and derivatives, and income taxes. Actual results could differ from those estimates. Cash and Cash Equivalents The Company considers all highly liquid instruments with an original maturity of three months or less to be cash equivalents. The Company's cash and cash equivalents are maintained at financial institutions in the United States of America. Deposits in transit includes sales through the end of the period, the majority of which were paid with credit and debit cards and settle within a few days of the sales transactions. The amounts due from banks for these transactions at each reporting date were as follows: As Of December 30, December 31, 2018 2017 Due from banks for debit and credit card transactions $ 52,896 $ 51,825 Restricted Cash Restricted cash relates to the Company's defined benefit plan forfeitures and the Company's healthcare plan benefits of approximately $0.7 million and SO O million as of December 30, 2018 and December 31, 2017, respectively, and is included in prepaid expenses and other current assets in the accompanying consolidated balance sheets Accounts Receivable Accounts receivable primarily represents billings to vendors for scan, advertising and other rebates, and landlords for tenant allowances. Accounts receivable also includes receivables from the Company's insurance carrier for payments expected to be made in excess of self-insured retentions The Company provides an allowance for doubtful accounts when a specific account is determined uncollectible. Inventories Inventories consist of merchandise purchased for resale, which are stated at the lower of cost or net realizable value. The cost method is used for distribution center and store perishable department inventories by assigning costs to each of these items based on a first-in, first-out (FIFO) basis (net of vendor discounts) The Company's non-perishable inventory is valued at the lower of cost or net realizable value using weighted averaging, the use of which approximates the FIFO method. The Company believes that all inventories are saleable and no allowances or reserves for obsolescence were recorded as of December 30, 2018 and December 31, 2017. 69 Property and Equipment Property and equipment are stated at cost, net of accumulated depreciation and amortization. Expenditures for major additions and improvements to facilities are capitalized, while maintenance and repairs are charged to expense as incurred. When property is retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in the consolidated statements of income. Depreciation expense, which includes the amortization of assets recorded under capital and financing leases, is computed using the straight-line method over the estimated useful lives of the individual assets. Leasehold improvements and assets under capital and financing leases are amortized over the shorter of the lease term to which they relate, or the estimated useful life of the asset. Terms of leases used in the determination of estimated useful lives may include renewal options if the exercise of the renewal option determined to be reasonably assured The following table includes the estimated useful lives of certain of the Company's asset classes Computer hardware and software Furniture, fixtures and equipment Leasehold improvements Buildings 3 to 5 years 7 to 20 years up to 15 years 40 years Store development costs, which include costs associated with the selection and procurement of real estate sites, are also included in property and equipment. These costs are included in leasehold improvements and are amortized over the remaining lease term of the successful sites with which they are associated Closed Store Reserve The Company recognizes a reserve for future operating lease payments and other occupancy costs associated with facilities that are no longer being utilized in its current operations. The reserve is recorded based on the present value of the remaining noncancelable lease payments and estimates of other occupancy costs after the cease use date, less an estimate of subtenant income. If subtenant income is expected to be higher than the lease payments, no accrual is recorded. Lease payments and other occupancy costs included in the closed store reserve are expected to be paid over the remaining terms of the respective leases. Adjustments to the closed store reserve relate primarily to changes actual or estimated subtenant income and actual lease payments and other occupancy costs from original estimates. Adjustments are made for changes in estimates in the period in which the change becomes known considering timing of new information regarding the market, subleases or other lease updates. Adjustments in the closed store reserves are recorded in "store closure and other costs in the accompanying consolidated statements of income. See Note 16, "Closed Store Reserves and Other Costs. Self-Insurance Reserves The Company uses a combination of insurance and self-insurance programs to provide for costs associated with general liability, workers' compensation and team member health benefits. Liabilities for self-insurance reserves are estimated through consideration of various factors, which include historical claims experience demographic factors, severity factors and other actuarial assumptions. Amounts expected to be recovered from insurance companies are included in the liability, with a corresponding amount recorded in accounts receivable. 70 Goodwill and Intangible Assets Goodwill represents the cost of acquired businesses in excess of the fair value of assets and liabilities acquired. The Company's indefinite-lived intangible assets consist of trade names related to "Sprouts Farmers Markets and liquor licenses. The Company also holds intangible assets with finite useful lives, consisting of favorable and unfavorable leasehold interests and the "Sunflower Farmers Market trade name Goodwill is evaluated for impairment on an annual basis or more frequently if events or changes in circumstances indicate that the asset might be impaired. The Company's impairment evaluation of goodwill consists of a qualitative assessment to determine if it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the Company's qualitative assessment indicates it is more likely than not that the estimated fair value of a reporting unit exceeds its carrying value, no further analysis is required and goodwill is not impaired. Otherwise, the Company follows a two-step quantitative goodwill impairment test to determine if goodwill is impaired. The first step of the quantitative goodwill impairment test compares the fair value of a reporting unit with its carrying amount including goodwill. If the fair value of the Company's reporting unit exceeds its carrying value, no further analysis or impairment of goodwill is required. If the carrying value of the Company's reporting unit exceeds its fair value, the fair value of the reporting unit would be allocated to the reporting unit's assets and liabilities based on the relative fair value, with goodwill written down to its implied fair value, if necessary. Indefinite-lived assets are evaluated for impairment on an annual basis or more frequently if events or changes in circumstances indicate that the asset might be impaired. The Company's impairment evaluation for its indefinite-lived intangible assets consists of a qualitative assessment similar to that for goodwill. If the Company's qualitative assessment indicates it is more likely than not that the estimated fair value of an indefinite-lived intangible asset exceeds its carrying value, no further analysis is required and the asset is not impaired. Otherwise, the Company compares the estimated fair value of the asset to its carrying amount with an impairment loss recognized for the amount, if any, by which carrying value exceeds estimated fair value. The Company can elect to bypass the qualitative assessments approach for goodwill and indefinite- lived intangible assets and proceed directly to the quantitative assessments for goodwill or any indefinite- lived intangible assets in any period. The Company has determined its business consists of a single reporting unit, healthy grocery stores. When applying the quantitative test, the Company determines the fair value of its reporting unit using the income approach methodology of valuation that includes the discounted cash flow method as well as other generally accepted valuation methodologies. The Company has had no goodwill impairment charges for the past three fiscal years. See Note 7, "Intangible Assets and Note 8, "Goodwill for further discussion. The trade name related to "Sunflower Farmers Market" meets the definition of a defensive intangible asset and is amortized on a straight-line basis over an estimated useful life of 10 years from the date of its acquisition by the Company. Favorable and unfavorable leasehold interests are amortized on a straight-line basis over the lease term. 71 Impairment of Long-Lived Assets The Company assesses its long-lived assets, including property and equipment and finite-lived intangible assets for potential impairment each quarter based on whether certain triggering events have occurred or changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. These events include current period losses combined with a history of losses or a projection of continuing losses, a significant decrease in the market value of an asset or a significant negative industry or economic trend. The Company groups and evaluates long-lived assets for impairment at the individual store level, which is the lowest level at which independent identifiable cash flows are available. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by that asset. If impairment is indicated a loss is recognized for any excess of the carrying value over the estimated fair value of the asset group The fair value is estimated based on the discounted future cash flows or comparable market values, if available. The Company recorded an impairment loss during 2018 related to the write-off of leasehold improvements, furniture, fixtures and equipment due to the two stores closed in the period: see Note 16, "Closed Store Reserves and Other Costs". No impairment was recognized in 2017 or 2016 Deferred Financing Costs The Company capitalizes certain fees and costs incurred in connection with the issuance of debt. Deferred financing costs are amortized to interest expense over the term of the debt using the effective interest method. For the Amended and Restated Credit Agreement and Former Credit Facility (as defined in Note 12. Long-Term Debt"), deferred financing costs are amortized on a straight-line basis over the term of the facility. Upon prepayment, redemption or conversion of debt, the Company accelerates the recognition of an appropriate amount of financing costs as loss on extinguishment of debt. The current and noncurrent portions of deferred financing costs are included in prepaid expenses and other current assets and other assets, respectively, in the accompanying consolidated balance sheets. Lease Classification The Company leases certain stores, distribution centers and administrative offices under operating leases. The most significant estimates used by management in accounting for leases as operating or capital is the incremental borrowing rate, the fair market value of the leased asset, and expected lease term. The expected lease term includes both contractual lease periods and cancelable option periods where failure to exercise such options would result in an economic penalty. With certain leases, the Company is involved in the construction of the building (or certain significant changes to an existing building), and the Company is considered owner of the building for accounting purposes. As a result, the Company capitalizes the amount of the lessor's total project costs incurred during the construction period with a corresponding financing obligation. At the completion of the construction project, the Company evaluates whether the transfer to the landlord meets the requirements for sale-leaseback accounting treatment to determine if these assets and related financing obligation can be derecognized. If the Company does not pass the criteria for sale-lease back accounting, the leased asset and financing obligation remain on its consolidated balance sheets, which are included with "Property and equipment, net of accumulated depreciation" and "Capital and financing lease obligations". The Company allocates each lease payment between reduction of the lease obligation and interest expense using the effective interest method. 72 Operating Leases Incentives received from lessors are deferred and recorded as a reduction of rental expense over the lease term using the straight-line method. The current portion of unamortized lease incentives is included in other accrued liabilities and the noncurrent portion is included in other long-term liabilities in the accompanying consolidated balance sheets. Store lease agreements generally include rent abatements and rent escalation provisions and may include contingent rent provisions based on a percentage of sales in excess of specified levels. The Company recognizes escalations of minimum rents and/or abatements as deferred rent and amortizes these balances on a straight-line basis over the term of the lease. For lease agreements that require the payment of contingent rents based on a percentage of sales above stipulated minimums, the Company begins accruing an estimate for contingent rent when it i determined that it is probable the specified levels of sales in excess of the stipulated minimums will be reached during the year. The Company expensed $1.9 million $1 9 million and $1.8 million for the years ended December 30, 2018, December 31, 2017 and January 1, 2017, respectively for contingent rent. Financing Lease Obligations Financing lease obligations are recorded for store building leases in which the Company was deemed to be the owner during the construction period under lease accounting guidance. Further, each lease contains provisions indicating continuing involvement with the property at the end of the construction period, which include either an affiliate guaranty or contingent collateral. As a result, in accordance with applicable accounting guidance, buildings and related assets subject to the leases are reflected on the Company's balance sheets and depreciated over their remaining useful lives The present value of the lease payments associated with these buildings is recorded as financing lease obligations. Monthly lease payments are allocated between the land element of the lease (which accounted for as an operating lease) and the financing obligation The financing obligation is amortized using the effective interest method and the interest rate is determined in accordance with the requirements of sale leaseback accounting. Lease payments less the portion allocated to the land element of the lease and that portion considered to be interest expense decrease the financing liability. At the end of the initial lease term, should the Company decide not to renew the lease, the net book value of the asset and the corresponding financing obligation would be reversed. The outflows from the construction of the buildings are classified as investing activities, and the outflows associated with the financing obligations principal payments and inflows from the associated financing proceeds are classified as financing activities in the accompanying consolidated statements of cash flows. See "Recently Issued Accounting Pronouncements Not Yet Adopted" below. Fair Value Measurements The Company records its financial assets and liabilities in accordance with the framework for measuring fair value in accordance with GAAP. This framework establishes a fair value hierarchy that prioritizes the inputs used to measure fair value: Level 1: Quoted prices for identical instruments in active markets. Level 2 Quoted prices for similar instruments in active markets: quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 3: Valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable. 73 Fair value measurements of nonfinancial assets and nonfinancial liabilities are primarily used in the valuation of derivative instruments, impairment analysis of goodwill, intangible assets, and long-lived assets. Cash, cash equivalents and restricted cash, accounts receivable, prepaid expenses and other current assets, accounts payable, accrued salaries and benefits and other accrued liabilities approximate fair value because of the short maturity of those instruments. Derivative Financial Instruments The Company records derivatives at fair value. The designation of a derivative instrument as a hedge and its ability to meet the hedge accounting criteria determine how the Company reflects the change in fair value of the derivative instrument in its financial statements. A derivative qualifies for hedge accounting if, at inception, the derivative is expected to be highly effective in offsetting the underlying hedged cash flows, and the Company fulfills the hedge documentation standards at the time it enters into the derivative contract. The Company designates its hedge based on the exposure it is hedging. For qualifying cash flow hedges, the Company records changes in fair value in other comprehensive income (OCI"). The Company releases the derivative's gain or loss from OCI to match the timing of the underlying hedged item's effect on earnings. The Company reviews the effectiveness of its hedging instruments quarterly. The Company recognizes changes in the fair value for derivatives not designated as hedges or those not qualifying for hedge accounting in current period earnings. The Company discontinues hedge accounting for any hedge that is no longer evaluated to be highly effective The Company does not enter into derivative financial instruments for trading or speculative purposes, and it monitors the financial stability and credit standing of its counterparties in these transactions Share-Based Compensation The Company measures share-based compensation cost at the grant date based on the fair value of the award and recognizes share-based compensation cost as expense over the vesting period. As share-based compensation expense recognized in the consolidated statements of income is based on awards ultimately expected to vest the amount of expense has been reduced for actual forfeitures as they occur. The Company uses the Black-Scholes option pricing model to determine the grant date fair value for each option grant. The Black-Scholes option-pricing model requires extensive use of subjective assumptions. See Note 26, "Share-Based Compensation" for a discussion of assumptions used in the calculation of fair values. Application of alternative assumptions could produce different estimates of the fair value of share-based compensation and consequently, the related amounts recognized in the accompanying consolidated statements of income. The grant date fair value of restricted stock units ("RSUS"), performance share awards ("PSAs"), and restricted stock awards ("RSAs") is based on the closing price per share of the Company's stock on the grant date. The Company recognizes compensation expense for time-based awards on a straight-line basis and for performance-based awards on the graded-vesting method over the vesting period of the awards. Revenue Recognition The Company adopted Accounting Standards Codification (ASC) 606, "Revenue from Contracts with Customers" in the first quarter of fiscal year 2018, with a date of initial application of January 1, 2018, using the modified retrospective approach. Comparative information presented has not been adjusted and continues to be reported under ASC 605. The Company applied ASC 606 to all of its contracts with customers. As a result of the adoption, there is no impact to any financial statement line item, and the Company has recorded no impact to opening retained earnings as of January 1, 2018 74 The Company does not have any material contract assets or receivables from contracts with customers, any revenue recognized in the current period from performance obligations satisfied in previous periods, any contract performance obligations, or any material costs to obtain or fulfill a contract as of December 30, 2018. The Company had a net gift card liability balance of S14.6 million as of December 30, 2018 and 513.1 million as of December 31, 2017, of which 59.5 million was recognized as revenue during the year ended December 30, 2018 Revenue is recognized at the point of sale. The Company's performance obligations are satisfied upon the transfer of goods to the customer, at the point of sale and payment from customers is also due at the time of sale. Proceeds from the sale of gift cards are recorded as a liability at the time of sale, and recognized as sales when they are redeemed by the customer and the performance obligation is satisfied by the Company The nature of goods the Company transfers to customers at the point of sale are inventories, consisting of merchandise purchased for resale. Cost of Sales Cost of sales includes the cost of inventory sold during the period, including the direct costs of purchased merchandise (net of discounts and allowances), distribution and supply chain costs, supplies and depreciation and amortization for distribution centers and supply chain related assets. The Company recognizes vendor allowances and merchandise volume related rebate allowances as a reduction of inventories during the period when earned and reflects the allowances as a component of cost of sales as the inventory is sold. The Company's largest supplier accounted for approximately 34%, 34% and 33% of total purchases during 2018, 2017, and 2016, respectively Selling, General and Administrative Expenses Selling general and administrative expenses primarily consist of salaries, wages and benefits costs, share-based compensation, occupancy costs (including rent, property taxes, utilities, common area maintenance and insurance) advertising costs, buying cost, pre-opening and other administrative costs. The Company charges third-parties to place advertisements in the Company's in-store guide and circulars. The Company records rebates received from vendors in connection with cooperative advertising programs as a reduction to advertising costs when the allowance represents a reimbursement of a specific incremental and identifiable cost. Advertising costs are expensed as incurred. Advertising expense, net of rebates, was $50.2 million S42.3 million and $37.0 million for 2018, 2017 and 2016, respectively Depreciation and amortization Depreciation and amortization expense (exclusive of depreciation included in cost of sales) primarily consists of depreciation and amortization for buildings, store leasehold improvements, and equipment. 75 Income Taxes Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company's deferred tax assets are subject to periodic recoverability assessments. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount that more likely than not will be realized. Realization of the deferred tax assets is principally dependent upon achievement of projected future taxable income offset by deferred tax liabilities. Changes in recognition or measurement are reflected in the period in which the judgment occurs. The Company recognizes the effect of uncertain income tax positions only if those positions are more likely than not of being sustained Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. The Company records interest and penalties related to unrecognized tax benefits as part of income tax expense. Share Repurchases The Company has elected to retire shares repurchased to date Shares retired become part of the pool of authorized but unissued shares. The Company has elected to record purchase price of the retired shares in excess of par value directly as a reduction of retained earnings. Net Income per Share Basic net income per share is calculated by dividing net income by the weighted average number of shares outstanding during the fiscal period. Diluted net income per share is based on the weighted average number of shares outstanding, plus, where applicable, shares that would have been outstanding related to dilutive options, PSAs, RSAs, and RSUS Comprehensive Income Comprehensive income consists of net income and the unrealized gains or losses on derivative instruments that qualify for and have been designated as cash flow hedges, for all periods presented. Recently Adopted Accounting Pronouncements Revenue In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2014-09, "Revenue from Contracts with Customers." ASU No. 2014-09 provides guidance for revenue recognition. The standard's core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under current guidance. These may include identifying performance obligations in the contract, and estimating the amount of variable consideration to include in the transaction price attributable to each separate performance obligation. Subsequent to the initial standards, the FASB has also issued several ASUS to clarify specific revenue recognition topics. The Company adopted ASC 606 effective January 1, 2018 using the modified retrospective approach. As noted above, there is no impact to any financial statement line item as a result of the adoption, and the Company has recorded no impact to opening retained earnings as of January 1, 2018. The Company has added additional disclosures of disaggregated revenue by type in Note 25 "Segments. 76 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (IN THOUSANDS, EXCEPT SHARE AMOUNTS) Accumulated Other Comprehensive Income (Loss) (Accumulated Additional Deficit) Common Paid-in Retained Stock Capital Earnings 153 $ 577,393 $ 245,446 124,306 Shares 152,577,884 $ Total Stockholders' Equity 822,992 124,306 666,841 2,740 2,740 (13,242,483) (13) (294,252) (294,265) 3,737 13,399 597,269 $ 3,737 13,399 672,909 158,440 140,002,242 $ 140 $ 75,500 158,440 (784) (784) 2,144,669 2 9,298 9,300 Balances at January 3, 2016 Net income Issuance of shares under stock plans Repurchase and retirement of common stock Excess tax benefit for exercise of options Share-based compensation Balances at January 1, 2017 Net income Other comprehensive income (loss) Issuance of shares under stock plans Repurchase and retirement of common stock Share-based compensation Balances at December 31, 2017 Net income Other comprehensive income (loss) Issuance of shares under stock plans Repurchase and retirement of common stock Share-based compensation Balances at December 30, 2018 (9,696,819) (10) (203,382) (203,392) 14,221 14,221 132,450,092 $ 132 $ 620,788 $ (784) $ 30,558 158,536 650,694 158,536 1,918 1,918 3,227,693 3 21,840 21,843 (11,096,595) (11) (258,296) (258,307) 14,512 14,512 124,581,190 $ 124 $ 657,140 $ (69,202) $ 1,134 $ 589, 196 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARII CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS) December 30, 2018 $ 158,536 110,749 799 683 4,115 14,512 23,333 (7,666) (34,824) (2,908) (5,086) 4,366 3,039 24,731 294,379 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense Amortization of financing fees and debt issuance costs Loss on disposal of property and equipment Store closure and other costs Share-based compensation Deferred income taxes Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets Other assets Accounts payable and other accrued liabilities Accrued salaries and benefits Other long-term liabilities Cash flows from operating activities Cash flows from investing activities Purchases of property and equipment Proceeds from sale of property and equipment Purchase of leasehold interests Cash flows used in investing activities Cash flows from financing activities Proceeds from revolving credit facilities Payments on revolving credit facilities Payments on capital and financing lease obligations Payments of deferred financing costs Cash from landlord related to capital and financing lease obligations Repurchase of common stock Proceeds from exercise of stock options Excess tax benefit for exercise of stock options Other Cash flows used in financing activities (Decrease) increase in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of the period Cash, cash equivalents, and restricted cash at the end of the period (177,083) (177,082) 233,000 (128,000) (4,517) (2,131) 3,643 (258,307) 21,843 (59) (134,528) (17,231) 19,479 2,248 $ Supplemental disclosure of cash flow information Cash paid for interest Cash paid for income taxes $ 27,086 15,527 Supplemental disclosure of non-cash investing and financing activities Property and equipment in accounts payable Property acquired through capital and financing lease obligations $ 12,001 9,081 December 30, 2018 $ 1,588 40,564 264,366 27,323 333,841 766,429 194,803 368,078 12,463 $ 1,675,614 $ ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable and other accrued liabilities Accrued salaries and benefits Current portion of capital and financing lease obligations Total current liabilities Long-term capital and financing lease obligations Long-term debt Other long-term liabilities Deferred income tax liability Total liabilities Commitments and contingencies (Note 19) Stockholders' equity: Undesignated preferred stock; $0.001 par value; 10,000,000 shares authorized, no shares issued and outstanding Common stock, $0.001 par value; 200,000,000 shares authorized, 124,975,691 shares issued and outstanding, December 30, 2018; 132,823,981 shares issued and outstanding, December 31, 2017; Additional paid-in capital Accumulated other comprehensive income (loss) (Accumulated deficit) retained earnings Total stockholders' equity Total liabilities and stockholders' equity 253,969 48,603 7,428 310,000 119,642 453,000 153,377 50,399 1,086,418 124 657,140 1,134 (69,202) 589, 196 $ 1,675,614 December 30, 2018 (1) Net sales $ 5,207,336 Cost of sales 3,459,861 Gross profit 1,747,475 Selling, general and administrative expenses 1,404,443 Depreciation and amortization (exclusive of depreciation included in cost of sales) 108,045 Store closure and other costs 12,076 Income from operations 222,911 Interest expense (27,435) Other income 320 Income before income taxes 195,796 Income tax provision (37,260) Net income $ 158,536 Net income per share: Basic 1.23 Diluted 1.22 Weighted average shares outstanding: Basic 128,827 Diluted 129,776 A A Formula Purpose or Use Ratio 1. Liquidity 1. Current ratio Measures short-term debt-paying ability Current assets Current liabilities 2. Quick or acid-test ratio Measures immediate short-term liquidity Cash, marketable securities, and receivables (net) Current liabilities Net cash provided by operating activities Average current liabilities 3. Current cash debt coverage ratio Measures a company's ability to pay off its current liabilities in a given year from its operations II. Activity 4. Receivables turnover Measures liquidity of receivables 5. Inventory turnover Measures liquidity of inventory Net sales Average trade receivables (net) Cost of goods sold Average inventory Net sales Average total assets 6. Asset turnover Measures how efficiently assets are used to generate sales III. Profitability 7. Profit margin on sales Net income Net sales Measures net income generated by each dollar of sales 8. Rate of return on assets Measures overall profitability of assets Net income Average total assets Net income minus preferred dividends Average common stockholders' equity Measures profitability of owners' investment 9. Rate of return on common stock equity 10. Earnings per share Measures net income earned on each share of common stock 11. Price-earnings ratio Net income minus preferred dividends Weighted shares outstanding Market price of stock Earnings per share Cash dividends Net income Measures the ratio of the market price per share to earnings per share Measures percentage of earnings distributed in the form of cash dividends 12. Payout ratio IV. Coverage 13. Debt to total assets Measures the percentage of total assets provided by creditors Total debts Total assets Income before interest expense and taxes Interest expense 14. Times interest earned Measures ability to meet interest payments as they come due SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 1. Organization and Description of Business Sprouts Farmers Market, Inc., a Delaware corporation, through its subsidiaries, operates as a healthy grocery store that offers fresh, natural and organic food through a complete shopping experience that includes fresh produce, bulk foods, vitamins and supplements, packaged groceries, meat and seafood, baked goods, dairy products, frozen foods, beer and wine, natural body care and household items catering to consumers growing interest in health and wellness. As of December 30, 2018, the Company operated 313 stores in 19 states For convenience, the Company" is used to refer collectively to Sprouts Farmers Market, Inc. and, unless the context requires otherwise, its subsidiaries. The Company's store operations are conducted by its subsidiaries. 2. Basis of Presentation The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries in accordance with accounting principles generally accepted in the United States of America ("GAAP"). All material intercompany accounts and transactions have been eliminated in consolidation The Company has one reportable and one operating segment, healthy grocery stores. The Company categorizes the varieties of products it sells as perishable and non-perishable. Perishable product categories include produce, meat, seafood, deli, bakery, floral and dairy and dairy alternatives. Non-perishable product categories include grocery, vitamins and supplements, bulk items. frozen foods, beer and wine, and natural health and body care. The following is a breakdown of the Company's perishable and non-perishable sales mix: Perishables Non-Perishables 2018 57.5% 42.5% 2017 58.0% 42.0% 2016 58.1% 41.9% All dollar amounts are in thousands unless otherwise indicated Certain prior period amounts have been reclassified, such as those relating to store occupancy, buying, direct store expenses, pre-opening expenses and depreciation and amortization (exclusive of depreciation included in cost of sales), due to the Company's change in accounting principle in fiscal 2018. See Note 3, "Significant Accounting Policies for further information 3. Significant Accounting Policies Fiscal Years The Company reports its results of operations on a 52- or 53-week fiscal calendar ending on the Sunday closest to December 31. Fiscal year 2018 ended on December 30, 2018 and included 52-weeks. Fiscal year 2017 ended on December 31, 2017 and included 52-weeks, fiscal year 2016 ended on January 1, 2017 and included 52-weeks. Fiscal years 2018, 2017, and 2016 are referred to as 2018, 2017, and 2016, respectively. 67 Change in Accounting Principle In the fourth quarter of fiscal 2018, the Company made a voluntary change in its accounting policy for the classification of certain expenses. Historically, the Company has presented store occupancy costs and buying costs in cost of goods sold. Under the new policy, the Company is presenting these expenses within selling, general and administrative expenses ("SG&A). In addition, the Company changed the classification of depreciation and amortization (exclusive of supply chain-related depreciation included in cost of sales) from direct store expenses ("DSE") and SG&A to a separate financial statement line item and combined DSE and store pre-opening costs into SG&A. These reclassifications had no impact on sales, income from operations, net income or earnings per share. In addition, there was no cumulative effect to retained earnings, equity. or net assets. The Company made this voluntary change in accounting policy in order to better reflect the direct costs of acquiring products and making them available to its customers cost of sales. Store occupancy costs and buying costs, which are largely sales and marketing driven, are more appropriately reflected in SG&A. The new presentation of operating expenses now largely disaggregates cash from non-cash operating expenses, which the Company believes provides better information to its financial statement users. The Company believes these changes are preferable because they enhance the comparability of its financial statements with those of many of its industry peers and align with how the Company internally manages and reviews costs and margin. These changes in presentation have been retrospectively applied to all prior periods. Refer to the tables below for the impact to the years currently presented: Cost of sales Gross profit Direct store expenses Selling general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Store pre-opening costs Year Ended December 31, 2017 Change in Accounting Unadjusted Principle As Adjusted $3,314.487 $ (216,905) $3.097,582 1,350, 125 216,905 1,567,030 962.894 (962,894) 148 408 1,097,232 1.245 640 94,194 94.194 11,627 (11,627) Cost of sales Gross profit Direct store expenses Selling general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Store pre-opening costs Year Ended January 1, 2017 Change In Accounting Unadjusted Principle As Adjusted $2.864,379 $(181,442) $2,682,937 1,182,006 181,442 1,363,448 828,943 (828,943) 126 929 945,066 1,071,995 78,293 12,974 78,293 (12,974) 68 Significant Accounting Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions. Such estimates and assumptions affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company's critical accounting estimates include, but are not limited to: inventory valuations, lease assumptions, sublease assumptions for closed stores, self-insurance reserves, goodwill and intangible assets, impairment of long-lived assets, fair values of share-based awards and derivatives, and income taxes. Actual results could differ from those estimates. Cash and Cash Equivalents The Company considers all highly liquid instruments with an original maturity of three months or less to be cash equivalents. The Company's cash and cash equivalents are maintained at financial institutions in the United States of America. Deposits in transit includes sales through the end of the period, the majority of which were paid with credit and debit cards and settle within a few days of the sales transactions. The amounts due from banks for these transactions at each reporting date were as follows: As Of December 30, December 31, 2018 2017 Due from banks for debit and credit card transactions $ 52,896 $ 51,825 Restricted Cash Restricted cash relates to the Company's defined benefit plan forfeitures and the Company's healthcare plan benefits of approximately $0.7 million and SO O million as of December 30, 2018 and December 31, 2017, respectively, and is included in prepaid expenses and other current assets in the accompanying consolidated balance sheets Accounts Receivable Accounts receivable primarily represents billings to vendors for scan, advertising and other rebates, and landlords for tenant allowances. Accounts receivable also includes receivables from the Company's insurance carrier for payments expected to be made in excess of self-insured retentions The Company provides an allowance for doubtful accounts when a specific account is determined uncollectible. Inventories Inventories consist of merchandise purchased for resale, which are stated at the lower of cost or net realizable value. The cost method is used for distribution center and store perishable department inventories by assigning costs to each of these items based on a first-in, first-out (FIFO) basis (net of vendor discounts) The Company's non-perishable inventory is valued at the lower of cost or net realizable value using weighted averaging, the use of which approximates the FIFO method. The Company believes that all inventories are saleable and no allowances or reserves for obsolescence were recorded as of December 30, 2018 and December 31, 2017. 69 Property and Equipment Property and equipment are stated at cost, net of accumulated depreciation and amortization. Expenditures for major additions and improvements to facilities are capitalized, while maintenance and repairs are charged to expense as incurred. When property is retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in the consolidated statements of income. Depreciation expense, which includes the amortization of assets recorded under capital and financing leases, is computed using the straight-line method over the estimated useful lives of the individual assets. Leasehold improvements and assets under capital and financing leases are amortized over the shorter of the lease term to which they relate, or the estimated useful life of the asset. Terms of leases used in the determination of estimated useful lives may include renewal options if the exercise of the renewal option determined to be reasonably assured The following table includes the estimated useful lives of certain of the Company's asset classes Computer hardware and software Furniture, fixtures and equipment Leasehold improvements Buildings 3 to 5 years 7 to 20 years up to 15 years 40 years Store development costs, which include costs associated with the selection and procurement of real estate sites, are also included in property and equipment. These costs are included in leasehold improvements and are amortized over the remaining lease term of the successful sites with which they are associated Closed Store Reserve The Company recognizes a reserve for future operating lease payments and other occupancy costs associated with facilities that are no longer being utilized in its current operations. The reserve is recorded based on the present value of the remaining noncancelable lease payments and estimates of other occupancy costs after the cease use date, less an estimate of subtenant income. If subtenant income is expected to be higher than the lease payments, no accrual is recorded. Lease payments and other occupancy costs included in the closed store reserve are expected to be paid over the remaining terms of the respective leases. Adjustments to the closed store reserve relate primarily to changes actual or estimated subtenant income and actual lease payments and other occupancy costs from original estimates. Adjustments are made for changes in estimates in the period in which the change becomes known considering timing of new information regarding the market, subleases or other lease updates. Adjustments in the closed store reserves are recorded in "store closure and other costs in the accompanying consolidated statements of income. See Note 16, "Closed Store Reserves and Other Costs. Self-Insurance Reserves The Company uses a combination of insurance and self-insurance programs to provide for costs associated with general liability, workers' compensation and team member health benefits. Liabilities for self-insurance reserves are estimated through consideration of various factors, which include historical claims experience demographic factors, severity factors and other actuarial assumptions. Amounts expected to be recovered from insurance companies are included in the liability, with a corresponding amount recorded in accounts receivable. 70 Goodwill and Intangible Assets Goodwill represents the cost of acquired businesses in excess of the fair value of assets and liabilities acquired. The Company's indefinite-lived intangible assets consist of trade names related to "Sprouts Farmers Markets and liquor licenses. The Company also holds intangible assets with finite useful lives, consisting of favorable and unfavorable leasehold interests and the "Sunflower Farmers Market trade name Goodwill is evaluated for impairment on an annual basis or more frequently if events or changes in circumstances indicate that the asset might be impaired. The Company's impairment evaluation of goodwill consists of a qualitative assessment to determine if it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the Company's qualitative assessment indicates it is more likely than not that the estimated fair value of a reporting unit exceeds its carrying value, no further analysis is required and goodwill is not impaired. Otherwise, the Company follows a two-step quantitative goodwill impairment test to determine if goodwill is impaired. The first step of the quantitative goodwill impairment test compares the fair value of a reporting unit with its carrying amount including goodwill. If the fair value of the Company's reporting unit exceeds its carrying value, no further analysis or impairment of goodwill is required. If the carrying value of the Company's reporting unit exceeds its fair value, the fair value of the reporting unit would be allocated to the reporting unit's assets and liabilities based on the relative fair value, with goodwill written down to its implied fair value, if necessary. Indefinite-lived assets are evaluated for impairment on an annual basis or more frequently if events or changes in circumstances indicate that the asset might be impaired. The Company's impairment evaluation for its indefinite-lived intangible assets consists of a qualitative assessment similar to that for goodwill. If the Company's qualitative assessment indicates it is more likely than not that the estimated fair value of an indefinite-lived intangible asset exceeds its carrying value, no further analysis is required and the asset is not impaired. Otherwise, the Company compares the estimated fair value of the asset to its carrying amount with an impairment loss recognized for the amount, if any, by which carrying value exceeds estimated fair value. The Company can elect to bypass the qualitative assessments approach for goodwill and indefinite- lived intangible assets and proceed directly to the quantitative assessments for goodwill or any indefinite- lived intangible assets in any period. The Company has determined its business consists of a single reporting unit, healthy grocery stores. When applying the quantitative test, the Company determines the fair value of its reporting unit using the income approach methodology of valuation that includes the discounted cash flow method as well as other generally accepted valuation methodologies. The Company has had no goodwill impairment charges for the past three fiscal years. See Note 7, "Intangible Assets and Note 8, "Goodwill for further discussion. The trade name related to "Sunflower Farmers Market" meets the definition of a defensive intangible asset and is amortized on a straight-line basis over an estimated useful life of 10 years from the date of its acquisition by the Company. Favorable and unfavorable leasehold interests are amortized on a straight-line basis over the lease term. 71 Impairment of Long-Lived Assets The Company assesses its long-lived assets, including property and equipment and finite-lived intangible assets for potential impairment each quarter based on whether certain triggering events have occurred or changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. These events include current period losses combined with a history of losses or a projection of continuing losses, a significant decrease in the market value of an asset or a significant negative industry or economic trend. The Company groups and evaluates long-lived assets for impairment at the individual store level, which is the lowest level at which independent identifiable cash flows are available. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by that asset. If impairment is indicated a loss is recognized for any excess of the carrying value over the estimated fair value of the asset group The fair value is estimated based on the discounted future cash flows or comparable market values, if available. The Company recorded an impairment loss during 2018 related to the write-off of leasehold improvements, furniture, fixtures and equipment due to the two stores closed in the period: see Note 16, "Closed Store Reserves and Other Costs". No impairment was recognized in 2017 or 2016 Deferred Financing Costs The Company capitalizes certain fees and costs incurred in connection with the issuance of debt. Deferred financing costs are amortized to interest expense over the term of the debt using the effective interest method. For the Amended and Restated Credit Agreement and Former Credit Facility (as defined in Note 12. Long-Term Debt"), deferred financing costs are amortized on a straight-line basis over the term of the facility. Upon prepayment, redemption or conversion of debt, the Company accelerates the recognition of an appropriate amount of financing costs as loss on extinguishment of debt. The current and noncurrent portions of deferred financing costs are included in prepaid expenses and other current assets and other assets, respectively, in the accompanying consolidated balance sheets. Lease Classification The Company leases certain stores, distribution centers and administrative offices under operating leases. The most significant estimates used by management in accounting for leases as operating or capital is the incremental borrowing rate, the fair market value of the leased asset, and expected lease term. The expected lease term includes both contractual lease periods and cancelable option periods where failure to exercise such options would result in an economic penalty. With certain leases, the Company is involved in the construction of the building (or certain significant changes to an existing building), and the Company is considered owner of the building for accounting purposes. As a result, the Company capitalizes the amount of the lessor's total project costs incurred during the construction period with a corresponding financing obligation. At the completion of the construction project, the Company evaluates whether the transfer to the landlord meets the requirements for sale-leaseback accounting treatment to determine if these assets and related financing obligation can be derecognized. If the Company does not pass the criteria for sale-lease back accounting, the leased asset and financing obligation remain on its consolidated balance sheets, which are included with "Property and equipment, net of accumulated depreciation" and "Capital and financing lease obligations". The Company allocates each lease payment between reduction of the lease obligation and interest expense using the effective interest method. 72 Operating Leases Incentives received from lessors are deferred and rec