Answered step by step

Verified Expert Solution

Question

1 Approved Answer

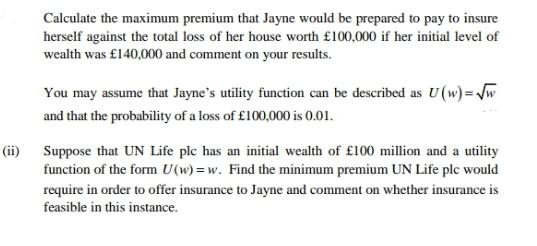

Calculate the maximum premium that Jayne would be prepared to pay to insure herself against the total loss of her house worth 100,000 if

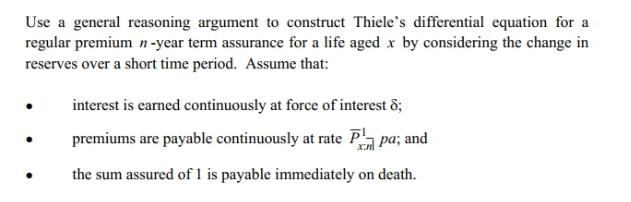

Calculate the maximum premium that Jayne would be prepared to pay to insure herself against the total loss of her house worth 100,000 if her initial level of wealth was 140,000 and comment on your results. You may assume that Jayne's utility function can be described as U (w) = w and that the probability of a loss of 100,000 is 0.01. (ii) Suppose that UN Life plc has an initial wealth of 100 million and a utility function of the form U(w)=w. Find the minimum premium UN Life plc would require in order to offer insurance to Jayne and comment on whether insurance is feasible in this instance. Use a general reasoning argument to construct Thiele's differential equation for a regular premium n-year term assurance for a life aged x by considering the change in reserves over a short time period. Assume that: interest is earned continuously at force of interest 8; premiums are payable continuously at rate Ppa; and the sum assured of 1 is payable immediately on death.

Step by Step Solution

★★★★★

3.32 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

i Jaynes utility if she buys no insurance Uw 140000 11859 Expected utility if she buys insurance Pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started