Answered step by step

Verified Expert Solution

Question

1 Approved Answer

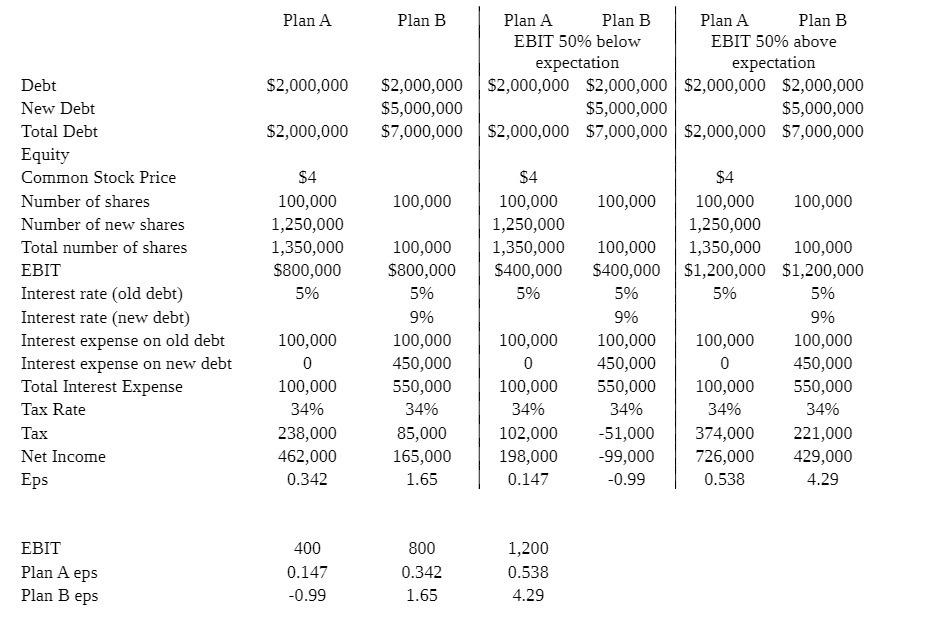

Calculate the weighted cost of debt for plan B from the following information. Debt New Debt Total Debt Equity Common Stock Price Number of shares

Calculate the weighted cost of debt for plan B from the following information.

Debt New Debt Total Debt Equity Common Stock Price Number of shares Number of new shares Total number of shares EBIT Interest rate (old debt) Interest rate (new debt) Interest expense on old debt Interest expense on new debt Total Interest Expense Tax Rate Tax Net Income Eps EBIT Plan A eps Plan B eps Plan A $2,000,000 $2,000,000 $4 100,000 1,250,000 1,350,000 $800,000 5% 100,000 0 100,000 34% 238,000 462,000 0.342 400 0.147 -0.99 Plan B 100,000 $2,000,000 $2,000,000 $2,000,000 $2,000,000 $2,000,000 $5,000,000 $5,000,000 $5,000,000 $7,000,000 $2,000,000 $7,000,000 $2,000,000 $7,000,000 100,000 $800,000 5% 9% 100,000 450,000 550,000 34% 85,000 165,000 1.65 Plan A Plan B EBIT 50% below expectation 800 0.342 1.65 $4 100,000 1,250,000 1,350,000 100,000 $400,000 $400,000 5% 5% 9% 100,000 450,000 550,000 34% 100,000 0 100,000 34% 102,000 198,000 0.147 1,200 0.538 4.29 Plan A Plan B EBIT 50% above expectation 100,000 $4 100,000 1,250,000 1,350,000 100,000 $1,200,000 $1,200,000 5% 5% 9% 100,000 450,000 550,000 34% 100,000 0 100,000 34% -51,000 374,000 -99,000 726,000 -0.99 0.538 100,000 221,000 429,000 4.29

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The weighted cost of debt for plan B is 0 Here is the working Interest rate on old debt 5 Interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started