Answered step by step

Verified Expert Solution

Question

1 Approved Answer

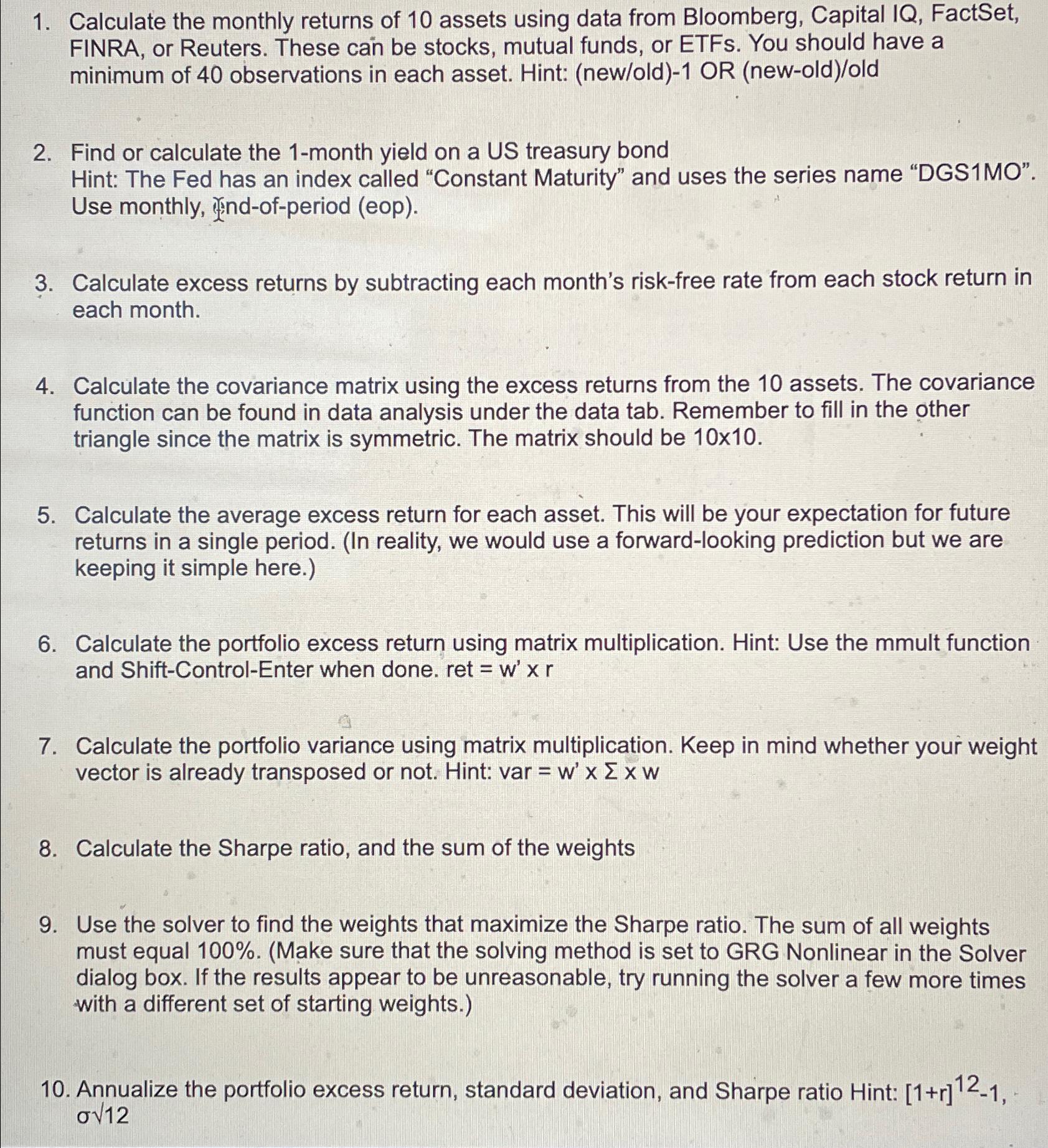

Calculate the monthly returns of 1 0 assets using data from Bloomberg, Capital IQ , FactSet, FINRA, or Reuters. These can be stocks, mutual funds,

Calculate the monthly returns of assets using data from Bloomberg, Capital IQ FactSet, FINRA, or Reuters. These can be stocks, mutual funds, or ETFs. You should have a minimum of observations in each asset. Hint: newold OR newoldold

Find or calculate the month yield on a US treasury bond

Hint: The Fed has an index called "Constant Maturity" and uses the series name DGSMO Use monthly, ndofperiod eop

Calculate excess returns by subtracting each month's riskfree rate from each stock return in each month.

Calculate the covariance matrix using the excess returns from the assets. The covariance function can be found in data analysis under the data tab. Remember to fill in the other triangle since the matrix is symmetric. The matrix should be

Calculate the average excess return for each asset. This will be your expectation for future returns in a single period. In reality, we would use a forwardlooking prediction but we are keeping it simple here.

Calculate the portfolio excess return using matrix multiplication. Hint: Use the mmult function and ShiftControlEnter when done. ret

Calculate the portfolio variance using matrix multiplication. Keep in mind whether your weight vector is already transposed or not. Hint: var

Calculate the Sharpe ratio, and the sum of the weights

Use the solver to find the weights that maximize the Sharpe ratio. The sum of all weights must equal Make sure that the solving method is set to GRG Nonlinear in the Solver dialog box. If the results appear to be unreasonable, try running the solver a few more times with a different set of starting weights.

Annualize the portfolio excess return, standard deviation, and Sharpe ratio Hint:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started