Answered step by step

Verified Expert Solution

Question

1 Approved Answer

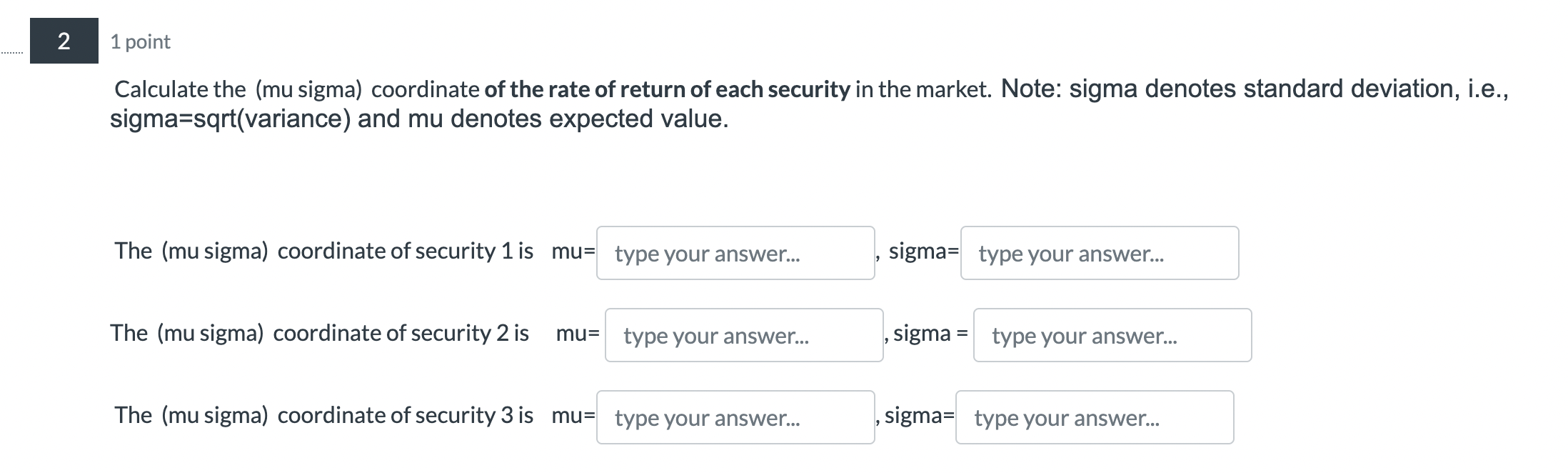

Calculate the (mu sigma) coordinate of the rate of return of each security in the market. Note: sigma denotes standard deviation, i.e., sigma=sqrt(variance) and mu

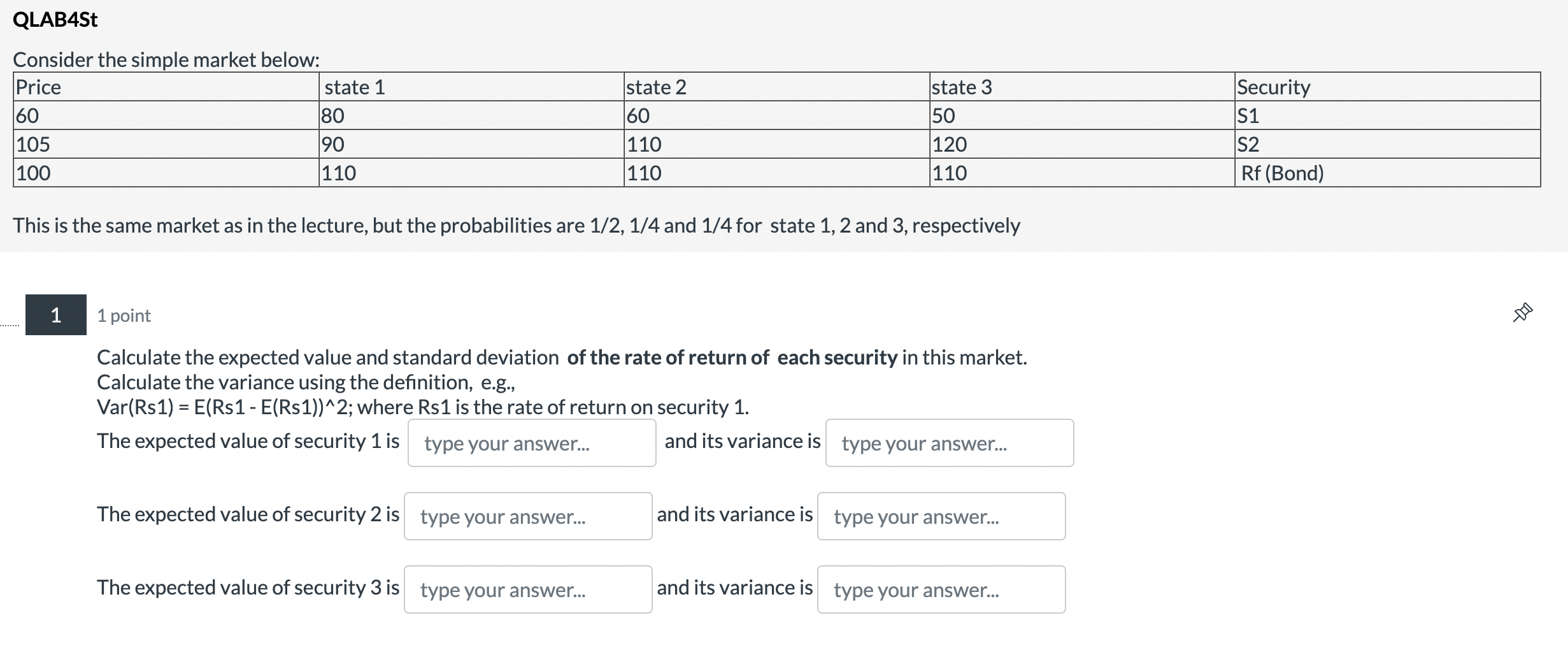

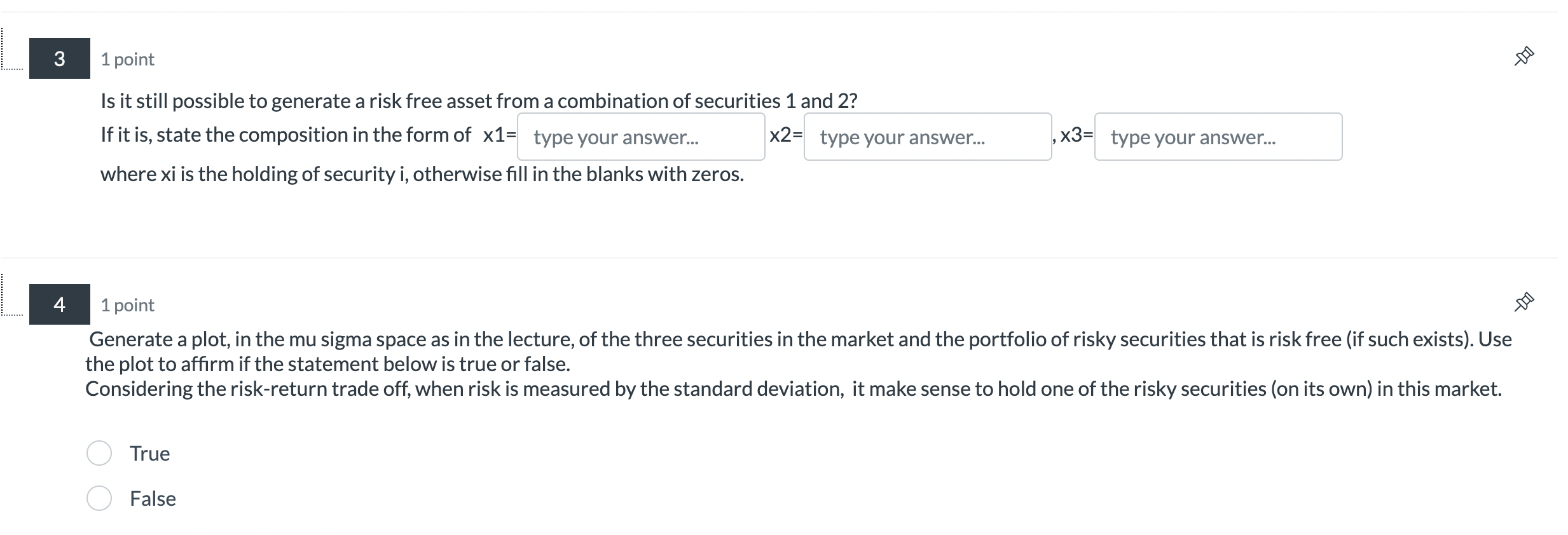

Calculate the (mu sigma) coordinate of the rate of return of each security in the market. Note: sigma denotes standard deviation, i.e., sigma=sqrt(variance) and mu denotes expected value. The (mu sigma) coordinate of security 1 is mu= The (mu sigma) coordinate of security 2 is mu= The (mu sigma) coordinate of security 3 is mu= sigma = , sigma = sigma = Cons \begin{tabular}{|l} \hline Pric \\ \hline 60 \\ \hline 105 \\ \hline 100 \\ \hline \end{tabular} This is the same market as in the lecture, but the probabilities are 1/2,1/4 and 1/4 for state 1,2 and 3 , respectively 1 point Calculate the expected value and standard deviation of the rate of return of each security in this market. Calculate the variance using the definition, e.g., Var(Rs1)=E(Rs1E(Rs1))2; where Rs1 is the rate of return on security 1. The expected value of security 1 is and its variance is The expected value of security 2 is and its variance is The expected value of security 3 is and its variance is 1 point Is it still possible to generate a risk free asset from a combination of securities 1 and 2 ? If it is, state the composition in the form of x1= x2= , 3= where xi is the holding of security i, otherwise fill in the blanks with zeros. 1 point Generate a plot, in the mu sigma space as in the lecture, of the three securities in the market and the portfolio of risky securities that is risk free (if such exists). Use the plot to affirm if the statement below is true or false. Considering the risk-return trade off, when risk is measured by the standard deviation, it make sense to hold one of the risky securities (on its own) in this market. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started