Answered step by step

Verified Expert Solution

Question

1 Approved Answer

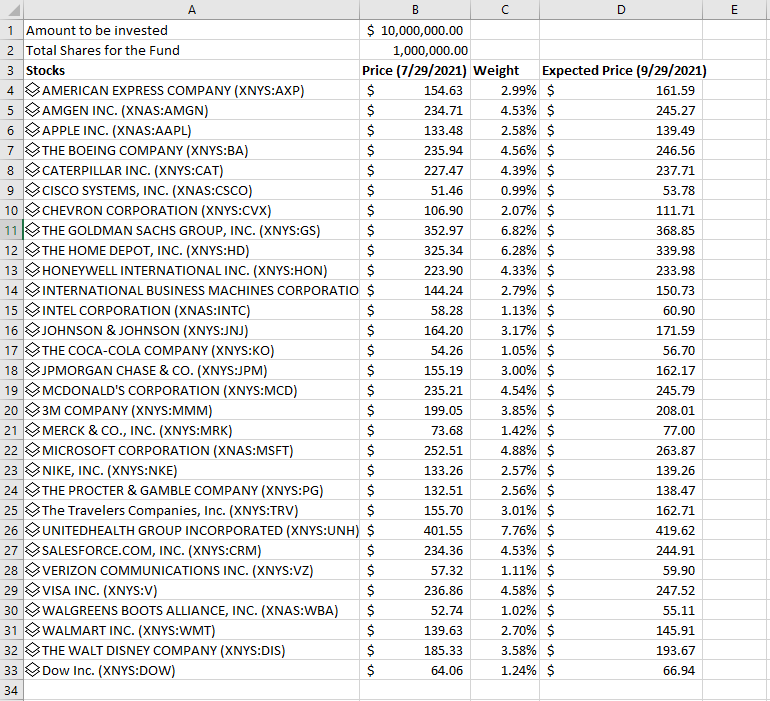

Calculate the Net Asset Value (NAV) of a mutual fund on 7/29/2021 that contains 30 Dow Jones Industrial Stocks and their given weights in the

Calculate the Net Asset Value (NAV) of a mutual fund on 7/29/2021 that contains 30 Dow Jones Industrial Stocks and their given weights in the file posted on MOLE titled, "Dow Stocks".

Calculate the % change in price of the NAV on the 9/29/2021 using the expected prices given if no more shares are purchased. Assume fractional shares can be purchased.

Please upload the excel file.

E B D 1 Amount to be invested $ 10,000,000.00 2 Total Shares for the Fund 1,000,000.00 3 Stocks Price (7/29/2021) Weight Expected Price (9/29/2021) 4 AMERICAN EXPRESS COMPANY (XNYS:AXP) $ 154.63 2.99% $ 161.59 5 AMGEN INC. (XNAS:AMGN) $ 234.71 4.53% $ 245.27 6 APPLE INC. (XNAS:AAPL) $ 133.48 2.58% $ 139.49 7 THE BOEING COMPANY (XNYS:BA) $ 235.94 4.56% $ 246.56 8 CATERPILLAR INC. (XNYS:CAT) $ 227.47 4.39% $ 237.71 9 CISCO SYSTEMS, INC. (XNAS:CSCO) $ 51.46 0.99% $ 53.78 10 CHEVRON CORPORATION (XNYS:CVX) $ 106.90 2.07% $ 111.71 11 THE GOLDMAN SACHS GROUP, INC. (XNYS:GS) $ 352.97 6.82% $ 368.85 12 THE HOME DEPOT, INC. (XNYS:HD) $ 325.34 6.28% $ 339.98 13 HONEYWELL INTERNATIONAL INC. (XNYS:HON) $ 223.90 4.33% $ 233.98 14 INTERNATIONAL BUSINESS MACHINES CORPORATIO $ 144.24 2.79% $ 150.73 15 INTEL CORPORATION (XNAS:INTC) $ 58.28 1.13% $ 60.90 16 JOHNSON & JOHNSON (XNYS:JNJ) $ 164.20 3.17% $ 171.59 17 THE COCA-COLA COMPANY (XNYS:KO) $ 54.26 1.05% $ 56.70 18 JPMORGAN CHASE & CO. (XNYS:JPM) $ 155.19 3.00% $ 162.17 19 MCDONALD'S CORPORATION (XNYS:MCD) $ 235.21 4.54% $ 245.79 20 3M COMPANY (XNYS:MMM) $ 199.05 3.85% $ 208.01 21 MERCK & CO., INC. (XNYS:MRK) $ 73.68 1.42% $ 77.00 22 MICROSOFT CORPORATION (XNAS:MSFT) $ 252.51 4.88% $ 263.87 23 NIKE, INC. (XNYS:NKE) $ 133.26 2.57% $ 139.26 24 THE PROCTER & GAMBLE COMPANY (XNYS:PG) $ 132.51 2.56% $ 138.47 25 The Travelers Companies, Inc. (XNYS:TRV) $ 155.70 3.01% $ 162.71 26 UNITEDHEALTH GROUP INCORPORATED (XNYS:UNH) $ 401.55 7.76% $ 419.62 27 SALESFORCE.COM, INC. (XNYS:CRM) $ 234.36 4.53% $ 244.91 28 VERIZON COMMUNICATIONS INC. (XNYS:VZ) $ 57.32 1.11% $ 59.90 29 VISA INC. (XNYS:V) $ 236.86 4.58% $ 247.52 30 WALGREENS BOOTS ALLIANCE, INC. (XNAS:WBA) $ 52.74 1.02% $ 55.11 31 WALMART INC. (XNYS:WMT) $ 139.63 2.70% $ 145.91 32 THE WALT DISNEY COMPANY (XNYS:DIS) $ 185.33 3.58% $ 193.67 33 Dow Inc. (XNYS:DOW) $ 64.06 1.24% $ 66.94 34 E B D 1 Amount to be invested $ 10,000,000.00 2 Total Shares for the Fund 1,000,000.00 3 Stocks Price (7/29/2021) Weight Expected Price (9/29/2021) 4 AMERICAN EXPRESS COMPANY (XNYS:AXP) $ 154.63 2.99% $ 161.59 5 AMGEN INC. (XNAS:AMGN) $ 234.71 4.53% $ 245.27 6 APPLE INC. (XNAS:AAPL) $ 133.48 2.58% $ 139.49 7 THE BOEING COMPANY (XNYS:BA) $ 235.94 4.56% $ 246.56 8 CATERPILLAR INC. (XNYS:CAT) $ 227.47 4.39% $ 237.71 9 CISCO SYSTEMS, INC. (XNAS:CSCO) $ 51.46 0.99% $ 53.78 10 CHEVRON CORPORATION (XNYS:CVX) $ 106.90 2.07% $ 111.71 11 THE GOLDMAN SACHS GROUP, INC. (XNYS:GS) $ 352.97 6.82% $ 368.85 12 THE HOME DEPOT, INC. (XNYS:HD) $ 325.34 6.28% $ 339.98 13 HONEYWELL INTERNATIONAL INC. (XNYS:HON) $ 223.90 4.33% $ 233.98 14 INTERNATIONAL BUSINESS MACHINES CORPORATIO $ 144.24 2.79% $ 150.73 15 INTEL CORPORATION (XNAS:INTC) $ 58.28 1.13% $ 60.90 16 JOHNSON & JOHNSON (XNYS:JNJ) $ 164.20 3.17% $ 171.59 17 THE COCA-COLA COMPANY (XNYS:KO) $ 54.26 1.05% $ 56.70 18 JPMORGAN CHASE & CO. (XNYS:JPM) $ 155.19 3.00% $ 162.17 19 MCDONALD'S CORPORATION (XNYS:MCD) $ 235.21 4.54% $ 245.79 20 3M COMPANY (XNYS:MMM) $ 199.05 3.85% $ 208.01 21 MERCK & CO., INC. (XNYS:MRK) $ 73.68 1.42% $ 77.00 22 MICROSOFT CORPORATION (XNAS:MSFT) $ 252.51 4.88% $ 263.87 23 NIKE, INC. (XNYS:NKE) $ 133.26 2.57% $ 139.26 24 THE PROCTER & GAMBLE COMPANY (XNYS:PG) $ 132.51 2.56% $ 138.47 25 The Travelers Companies, Inc. (XNYS:TRV) $ 155.70 3.01% $ 162.71 26 UNITEDHEALTH GROUP INCORPORATED (XNYS:UNH) $ 401.55 7.76% $ 419.62 27 SALESFORCE.COM, INC. (XNYS:CRM) $ 234.36 4.53% $ 244.91 28 VERIZON COMMUNICATIONS INC. (XNYS:VZ) $ 57.32 1.11% $ 59.90 29 VISA INC. (XNYS:V) $ 236.86 4.58% $ 247.52 30 WALGREENS BOOTS ALLIANCE, INC. (XNAS:WBA) $ 52.74 1.02% $ 55.11 31 WALMART INC. (XNYS:WMT) $ 139.63 2.70% $ 145.91 32 THE WALT DISNEY COMPANY (XNYS:DIS) $ 185.33 3.58% $ 193.67 33 Dow Inc. (XNYS:DOW) $ 64.06 1.24% $ 66.94 34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started