Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the net income for tax porposes. Calculate the net federal tax owed. Care for the children: food and clothing for Joey and Chandler babysitter

Calculate the net income for tax porposes.

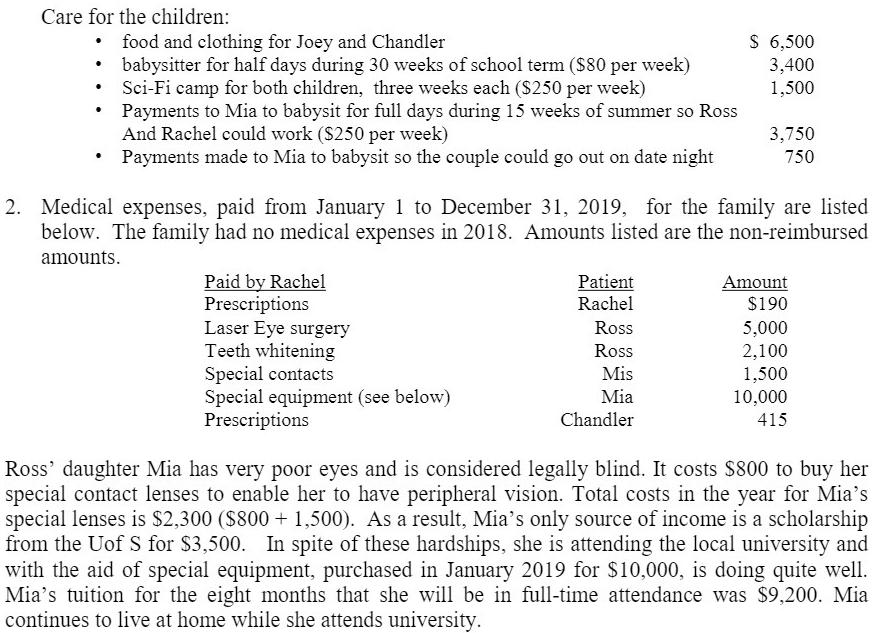

Care for the children: food and clothing for Joey and Chandler babysitter for half days during 30 weeks of school term ($80 per week) Sci-Fi camp for both children, three weeks each ($250 per week) Payments to Mia to babysit for full days during 15 weeks of summer so Ross And Rachel could work ($250 per week) Payments made to Mia to babysit so the couple could go out on date night . . . . Paid by Rachel Prescriptions 2. Medical expenses, paid from January 1 to December 31, 2019, for the family are listed below. The family had no medical expenses in 2018. Amounts listed are the non-reimbursed amounts. Laser Eye surgery Teeth whitening Special contacts Special equipment (see below) Prescriptions Patient Rachel $ 6,500 3,400 1,500 Ross Ross Mis Mia Chandler 3,750 750 Amount $190 5,000 2,100 1,500 10,000 415 Ross' daughter Mia has very poor eyes and is considered legally blind. It costs $800 to buy her special contact lenses to enable her to have peripheral vision. Total costs in the year for Mia's special lenses is $2,300 ($800 + 1,500). As a result, Mia's only source of income is a scholarship from the Uof S for $3,500. In spite of these hardships, she is attending the local university and with the aid of special equipment, purchased in January 2019 for $10,000, is doing quite well. Mia's tuition for the eight months that she will be in full-time attendance was $9,200. Mia continues to live at home while she attends university.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the net income for tax purposes and the net federal tax owed 1 Calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started