Answered step by step

Verified Expert Solution

Question

1 Approved Answer

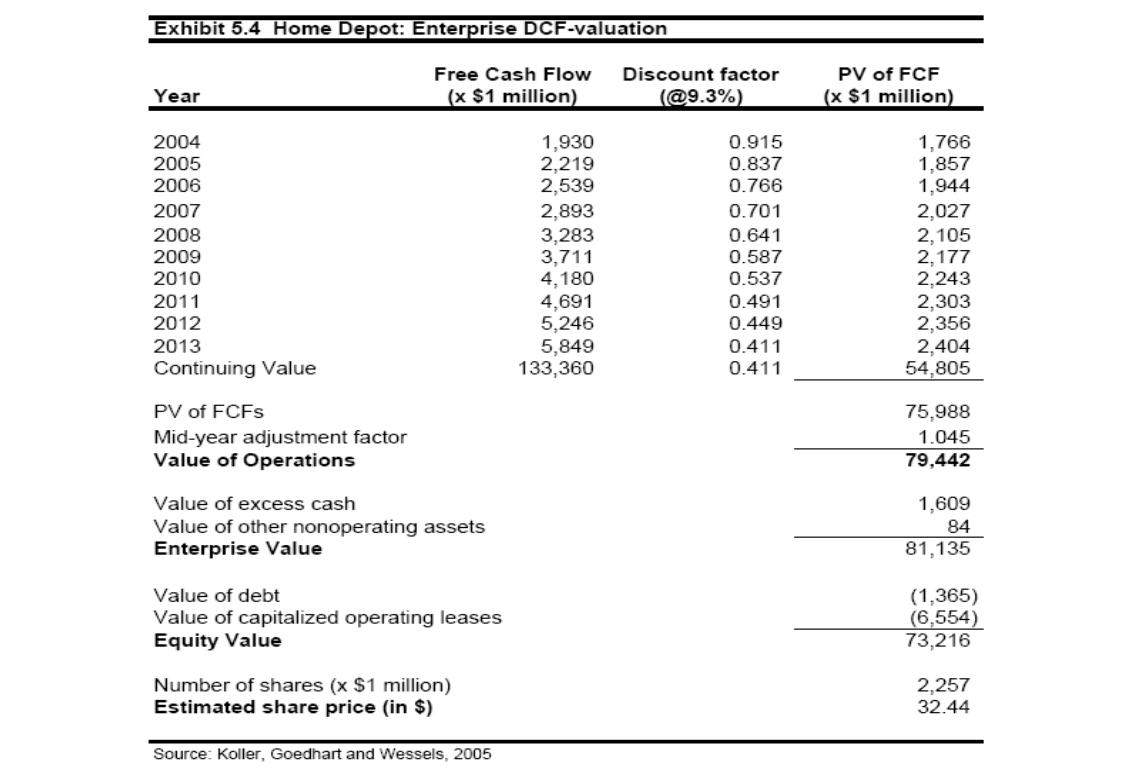

Calculate the new price per share of The Home Depot as of the end of the year 2003 under the assumption that the cost of

Calculate the new price per share of The Home Depot as of the end of the year 2003 under the assumption that the cost of capital and the Free Cash Flow projections of the firm for the years 2004 through 2013 remain unchanged.

Exhibit 5.4 Home Depot: Enterprise DCF-valuation Free Cash Flow (x $1 million) Year 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Continuing Value PV of FCFS Mid-year adjustment factor Value of Operations Value of excess cash Value of other nonoperating assets Enterprise Value Value of debt Value of capitalized operating leases Equity Value Number of shares (x $1 million) Estimated share price (in $) Source: Koller, Goedhart and Wessels, 2005 1,930 2,219 2,539 2,893 3,283 3,711 4,180 4,691 5,246 5,849 133,360 Discount factor (@9.3%) 0.915 0.837 0.766 0.701 0.641 0.587 0.537 0.491 0.449 0.411 0.411 PV of FCF (x $1 million) 1,766 1,857 1,944 2,027 2,105 2,177 2,243 2,303 2,356 2,404 54,805 75,988 1.045 79,442 1,609 84 81,135 (1,365) (6,554) 73,216 2,257 32.44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the new price per share of The Home Depot as of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started