Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate the NPV and express the answers in millions of dollars rounded to two decimal places. The Sopwith Aviation Company is considering building a new

calculate the NPV and express the answers in millions of dollars rounded to two decimal places.

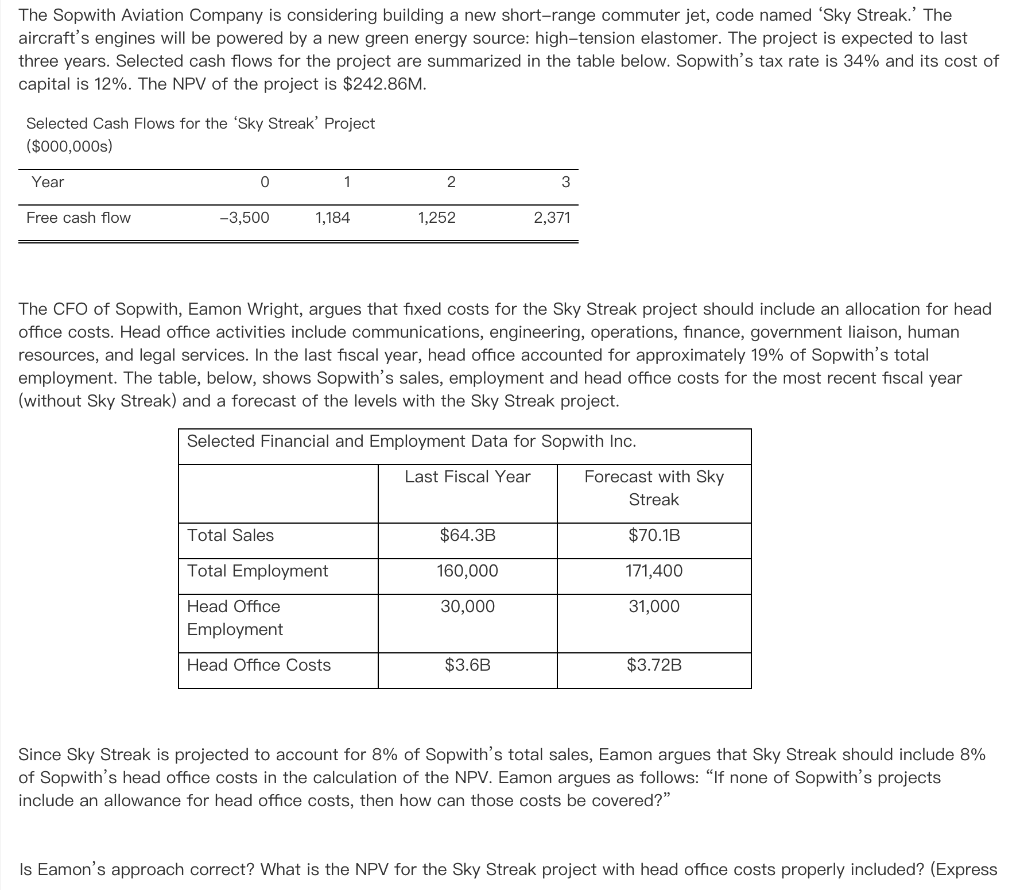

The Sopwith Aviation Company is considering building a new short-range commuter jet, code named 'Sky Streak.' The aircraft's engines will be powered by a new green energy source: high-tension elastomer. The project is expected to last three years. Selected cash flows for the project are summarized in the table below. Sopwith's tax rate is 34% and its cost of capital is 12%. The NPV of the project is $242.86M. Selected Cash Flows for the 'Sky Streak' Project ($000,000s) Year 0 1 2 3 Free cash flow -3,500 1,184 1,252 2,371 The CFO of Sopwith, Eamon Wright, argues that fixed costs for the Sky Streak project should include an allocation for head office costs. Head office activities include communications, engineering, operations, finance, government liaison, human resources, and legal services. In the last fiscal year, head office accounted for approximately 19% of Sopwith's total employment. The table, below, shows Sopwith's sales, employment and head office costs for the most recent fiscal year (without Sky Streak) and a forecast of the levels with the Sky Streak project. Selected Financial and Employment Data for Sopwith Inc. Last Fiscal Year Forecast with Sky Streak Total Sales $64.3B $70.1B Total Employment 160,000 171,400 30,000 31,000 Head Office Employment Head Office Costs $3.6B $3.72B Since Sky Streak is projected to account for 8% of Sopwith's total sales, Eamon argues that Sky Streak should include 8% of Sopwith's head office costs in the calculation of the NPV. Eamon argues as follows: "If none of Sopwith's projects include an allowance for head office costs, then how can those costs be covered?" Is Eamon's approach correct? What is the NPV for the Sky Streak project with head office costs properly included? (Express The Sopwith Aviation Company is considering building a new short-range commuter jet, code named 'Sky Streak.' The aircraft's engines will be powered by a new green energy source: high-tension elastomer. The project is expected to last three years. Selected cash flows for the project are summarized in the table below. Sopwith's tax rate is 34% and its cost of capital is 12%. The NPV of the project is $242.86M. Selected Cash Flows for the 'Sky Streak' Project ($000,000s) Year 0 1 2 3 Free cash flow -3,500 1,184 1,252 2,371 The CFO of Sopwith, Eamon Wright, argues that fixed costs for the Sky Streak project should include an allocation for head office costs. Head office activities include communications, engineering, operations, finance, government liaison, human resources, and legal services. In the last fiscal year, head office accounted for approximately 19% of Sopwith's total employment. The table, below, shows Sopwith's sales, employment and head office costs for the most recent fiscal year (without Sky Streak) and a forecast of the levels with the Sky Streak project. Selected Financial and Employment Data for Sopwith Inc. Last Fiscal Year Forecast with Sky Streak Total Sales $64.3B $70.1B Total Employment 160,000 171,400 30,000 31,000 Head Office Employment Head Office Costs $3.6B $3.72B Since Sky Streak is projected to account for 8% of Sopwith's total sales, Eamon argues that Sky Streak should include 8% of Sopwith's head office costs in the calculation of the NPV. Eamon argues as follows: "If none of Sopwith's projects include an allowance for head office costs, then how can those costs be covered?" Is Eamon's approach correct? What is the NPV for the Sky Streak project with head office costs properly included? (ExpressStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started