Question: Q. 1) Calculate the NPV for the same 3, 6, and 9 year Cash Flows shown below. Use the discount rates of 9 and

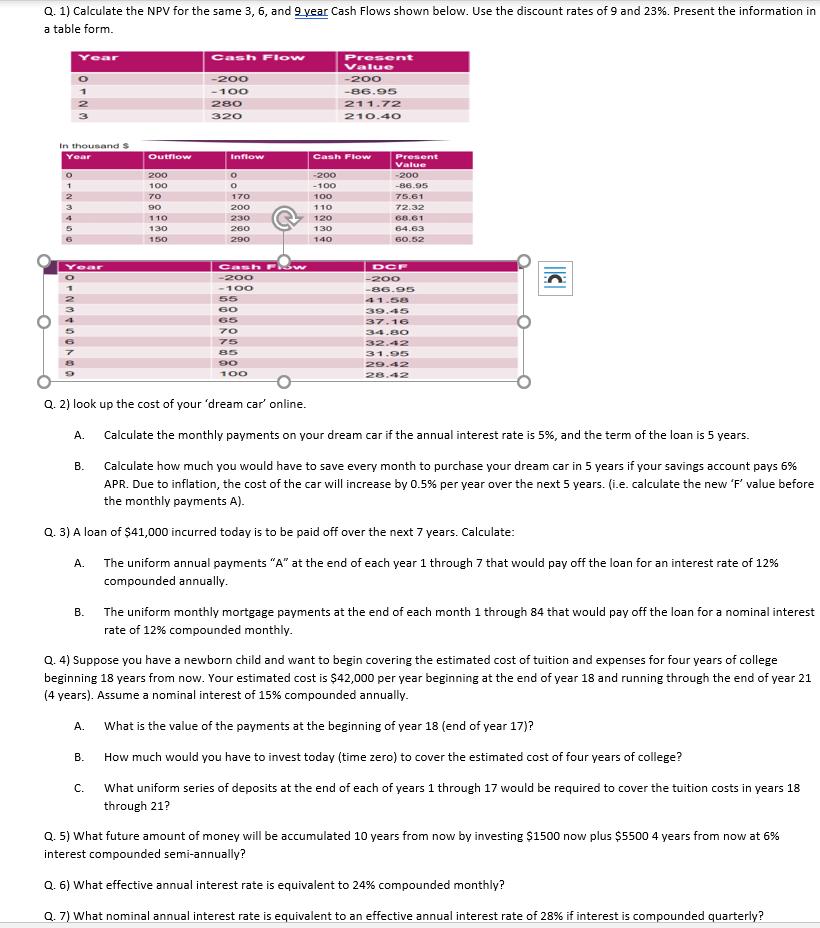

Q. 1) Calculate the NPV for the same 3, 6, and 9 year Cash Flows shown below. Use the discount rates of 9 and 23%. Present the information in a table form. In thousand S Year ON M60 10 0123 5 ear A. B. A. B. Outflow A. 200 100 70 90 B. 110 130 150 C. Cash Flow -200 -100 280 320 Inflow 0 170 200 230 260 290 Cash -200 -100 55 60 70 75 85 90 100 Sw Present Value -200 110 120 130 140 Q. 2) look up the cost of your 'dream car' online. Calculate the monthly payments on your dream car if the annual interest rate is 5%, and the term of the loan is 5 years. -86.95 211.72 210.40 Cash Flow -200 -100 100 Calculate how much you would have to save every month to purchase your dream car in 5 years if your savings account pays 6% APR. Due to inflation, the cost of the car will increase by 0.5% per year over the next 5 years. (i.e. calculate the new 'F' value before the monthly payments A). Q. 3) A loan of $41,000 incurred today is to be paid off over the next 7 years. Calculate: The uniform annual payments "A" at the end of each year 1 through 7 that would pay off the loan for an interest rate of 12% compounded annually. Present Value -200 -86.95 75.61 72.32 68.61 64.63 60.52 DCF -200 -86.95 41.58 39.45 37.16 34.80 32.42 31.95 29.42 28.42 C Q. 4) Suppose you have a newborn child and want to begin covering the estimated cost of tuition and expenses for four years of college beginning 18 years from now. Your estimated cost is $42,000 per year beginning at the end of year 18 and running through the end of year 21 (4 years). Assume a nominal interest of 15% compounded annually. What is the value of the payments at the beginning of year 18 (end of year 17)? How much would you have to invest today (time zero) to cover the estimated cost of four years of college? What uniform series of deposits at the end of each of years 1 through 17 would be required to cover the tuition costs in years 18 through 21? The uniform monthly mortgage payments at the end of each month 1 through 84 that would pay off the loan for a nominal interest rate of 12% compounded monthly. Q. 5) What future amount of money will be accumulated 10 years from now by investing $1500 now plus $5500 4 years from now at 6% interest compounded semi-annually? Q. 6) What effective annual interest rate is equivalent to 24% compounded monthly? Q. 7) What nominal annual interest rate is equivalent to an effective annual interest rate of 28% if interest is compounded quarterly?

Step by Step Solution

3.59 Rating (167 Votes )

There are 3 Steps involved in it

1 Calculating NPV 3 YEARS Year 0 1 2 3 NPV PV of cash flows PV of cas... View full answer

Get step-by-step solutions from verified subject matter experts