Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the NPV of this investment Calculate the IRR for this investment Determine the simple payback period using (1) before-tax cash flows and (2) after-tax

- Calculate the NPV of this investment

- Calculate the IRR for this investment

- Determine the simple payback period using (1) before-tax cash flows and (2) after-tax cash flows

- Determine the discounted payback period using after-tax cash flows

- Find the ARR

- Calculate the profitability index for this investment

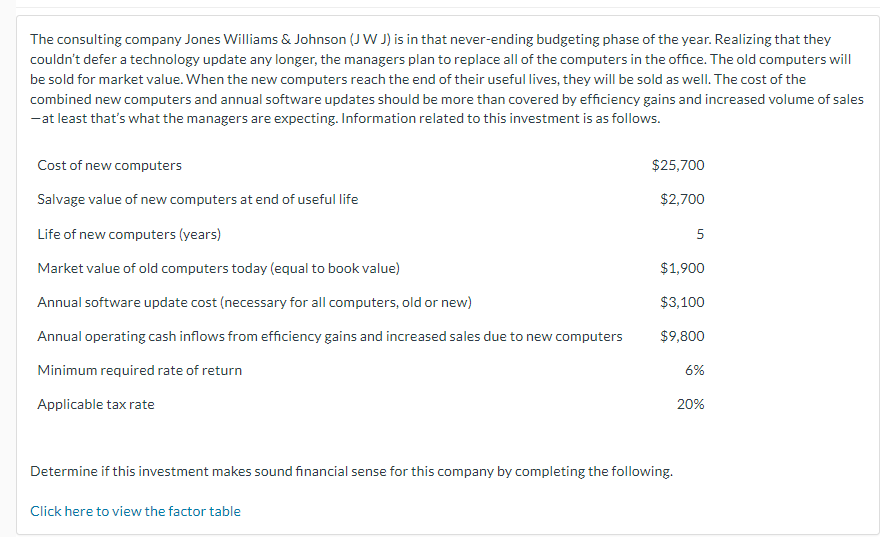

The consulting company Jones Williams \& Johnson (JW J) is in that never-ending budgeting phase of the year. Realizing that they couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales -at least that's what the managers are expecting. Information related to this investment is as follows. Determine if this investment makes sound financial sense for this company by completing the following. Click here to view the factor table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started