Answered step by step

Verified Expert Solution

Question

1 Approved Answer

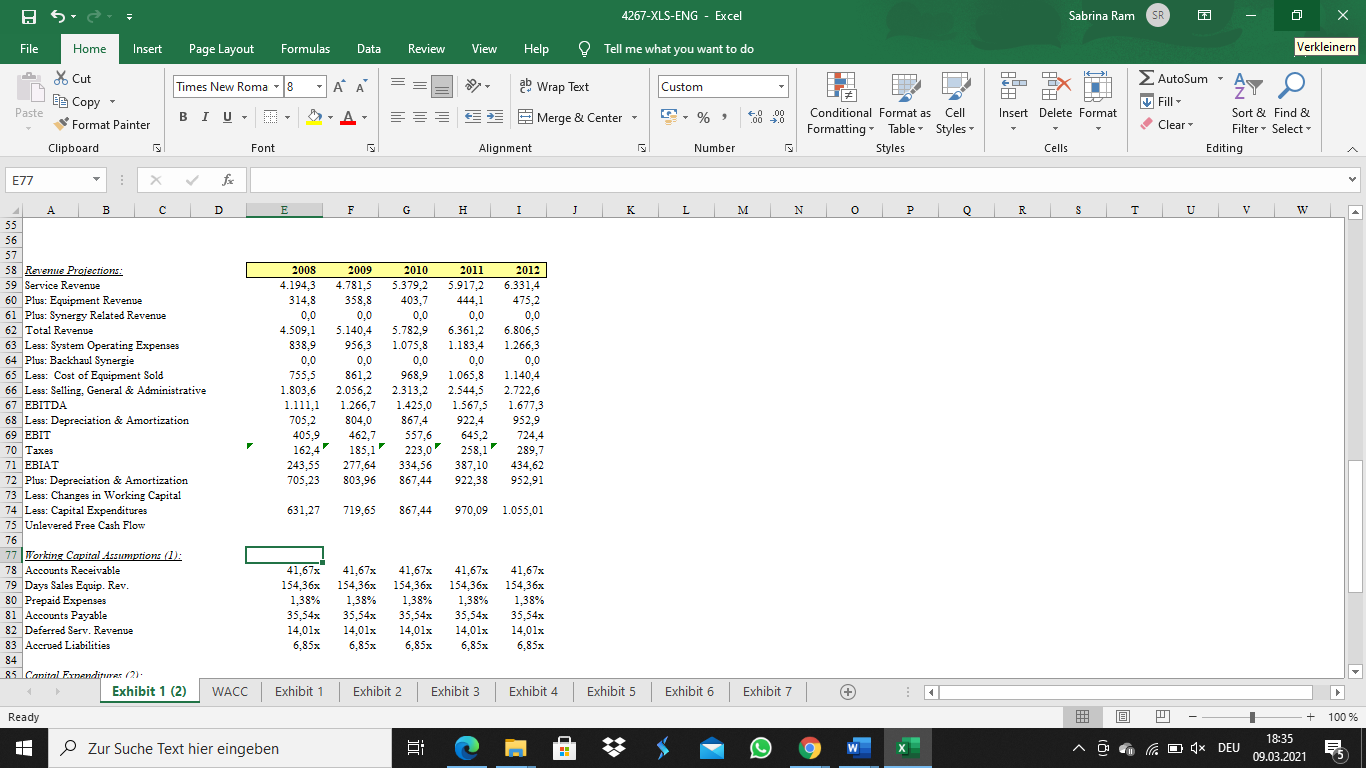

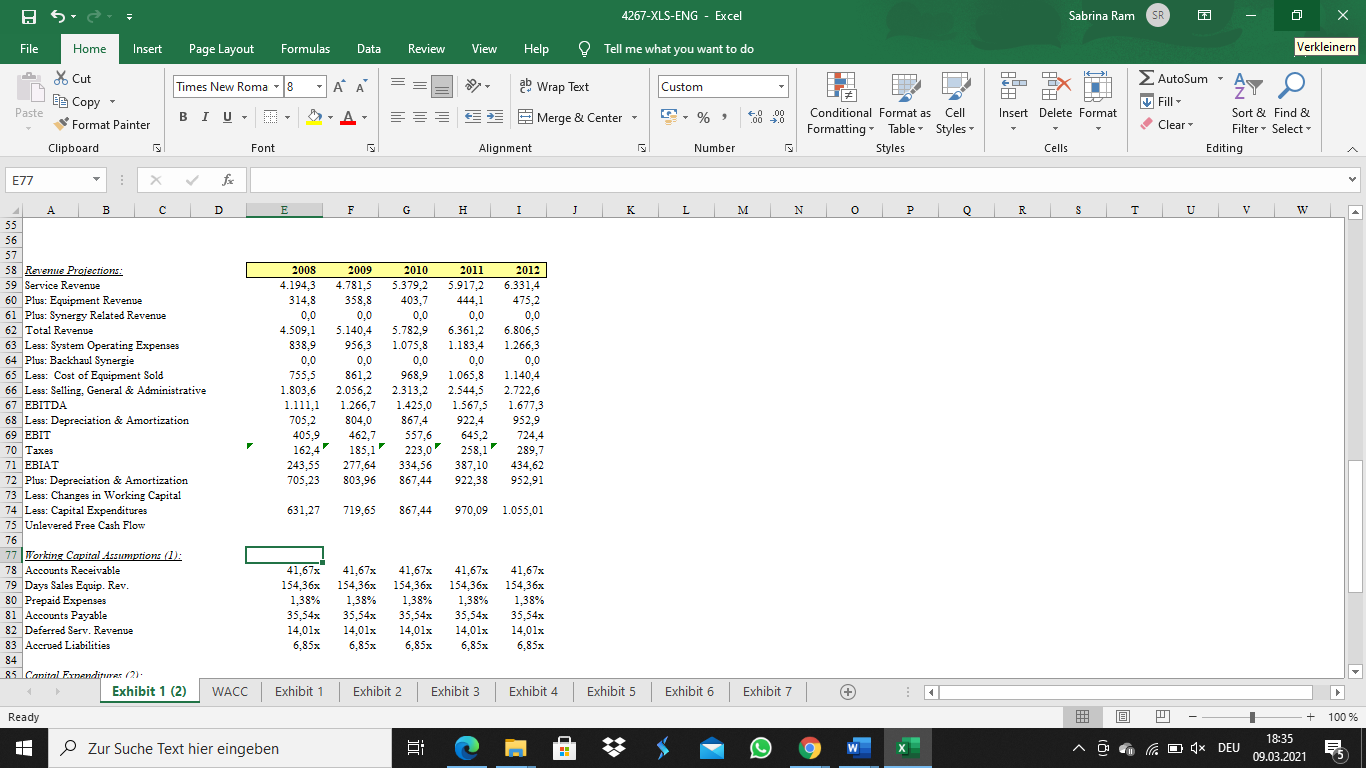

calculate the NWC for the following Assumptions 8 5- File Home Insert Page Layout Formulas Data Review View Help 4267-XLS-ENG - Excel Tell me what

calculate the NWC for the following Assumptions

8 5- File Home Insert Page Layout Formulas Data Review View Help 4267-XLS-ENG - Excel Tell me what you want to do Sabrina Ram SR Cut Times New Roma 8 - ' ' ab Wrap Text Autosum Custom Copy Fill Paste Format Painter BIU 7 Merge & Center % +.0 .00 Conditional Format as Cell Insert Delete Format Verkleinern P Sort & Find & Formatting Clipboard > Font Alignment Number Table Styles Styles Clear Filter Select Cells Editing E77 fx A B C D E F G H I J K L M N P Q R S U V W 55 56 57 58 Revenue Projections: 59 Service Revenue 2008 2009 4.194,3 4.781,5 2010 5.379,2 2011 5.917,2 2012 6.331,4 60 Plus: Equipment Revenue 314,8 61 Plus: Synergy Related Revenue 0,0 62 Total Revenue 4.509,1 358,8 0,0 5.140,4 403,7 0,0 5.782,9 63 Less: System Operating Expenses 838,9 956,3 64 Plus: Backhaul Synergie 0,0 0,0 65 Less: Cost of Equipment Sold 66 Less: Selling, General & Administrative 67 EBITDA 68 Less: Depreciation & Amortization 755,5 861,2 1.075,8 0,0 968,9 1.803,6 2.056,2 2.313,2 444,1 0,0 6.361,2 1.183,4 0,0 1.065,8 2.544,5 475,2 0,0 6.806,5 1.266,3 0,0 1.140,4 2.722,6 69 EBIT 1.111,1 1.266,7 1.425,0 705,2 804,0 405,9 1.567,5 1.677,3 867,4 922,4 952,9 462,7 557,6 645,2 724,4 162,4 185,1 223,0 258,1 289,7 70 Taxes 71 EBIAT 72 Plus: Depreciation & Amortization 73 Less: Changes in Working Capital 74 Less: Capital Expenditures 243,55 277,64 334,56 387,10 434,62 705,23 803,96 867,44 922,38 952,91 631,27 719,65 867,44 970,09 1.055,01 75 Unlevered Free Cash Flow 76 77 Working Capital Assumptions (1): 78 Accounts Receivable 41,67x 79 Days Sales Equip. Rev. 154,36x 80 Prepaid Expenses 81 Accounts Payable 41,67x 41,67x 41,67x 41,67x 154,36x 154,36x 154,36x 154,36x 1,38% 1,38% 1,38% 1,38% 1,38% 35,54x 35,54x 35,54x 35,54x 82 Deferred Serv. Revenue 6,85x 6,85x 14,01x 14,01x 14,01x 14,01x 6,85x 35,54x 14,01x 6,85x 6,85% Exhibit 1 (2) WACC Exhibit 1 Exhibit 2 Exhibit 3 Exhibit 4 Exhibit 5 Exhibit 6 Exhibit 7 83 Accrued Liabilities 84 85 Canital Expenditures (2) Ready H Zur Suche Text hier eingeben + 100% 18:35 DEU 09.03.2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Working Capital NWC based on the given assumptions we will nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started