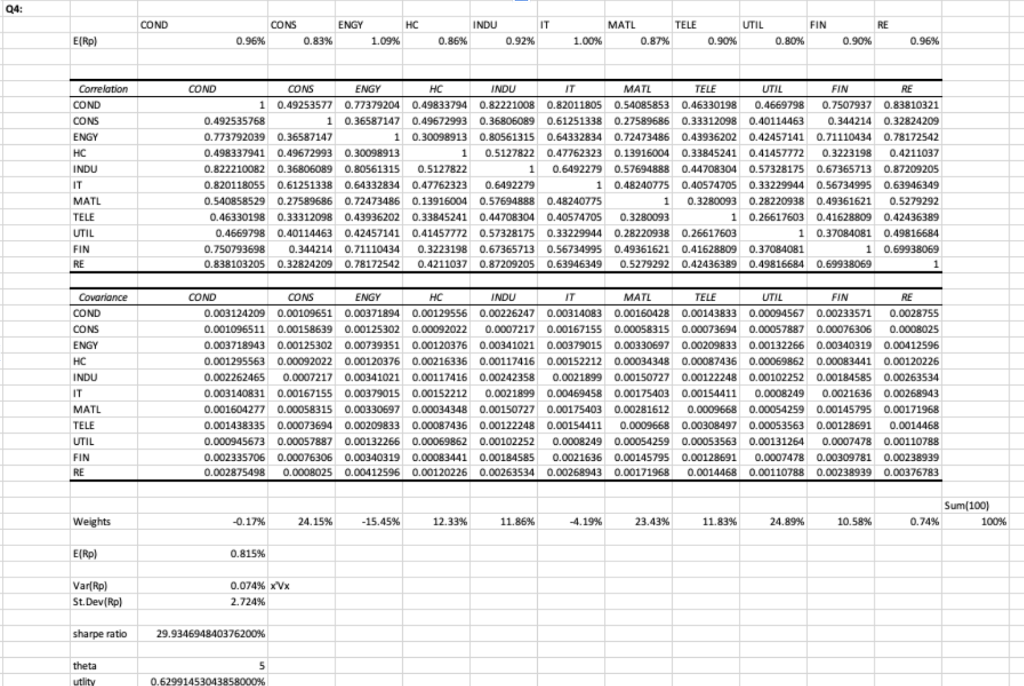

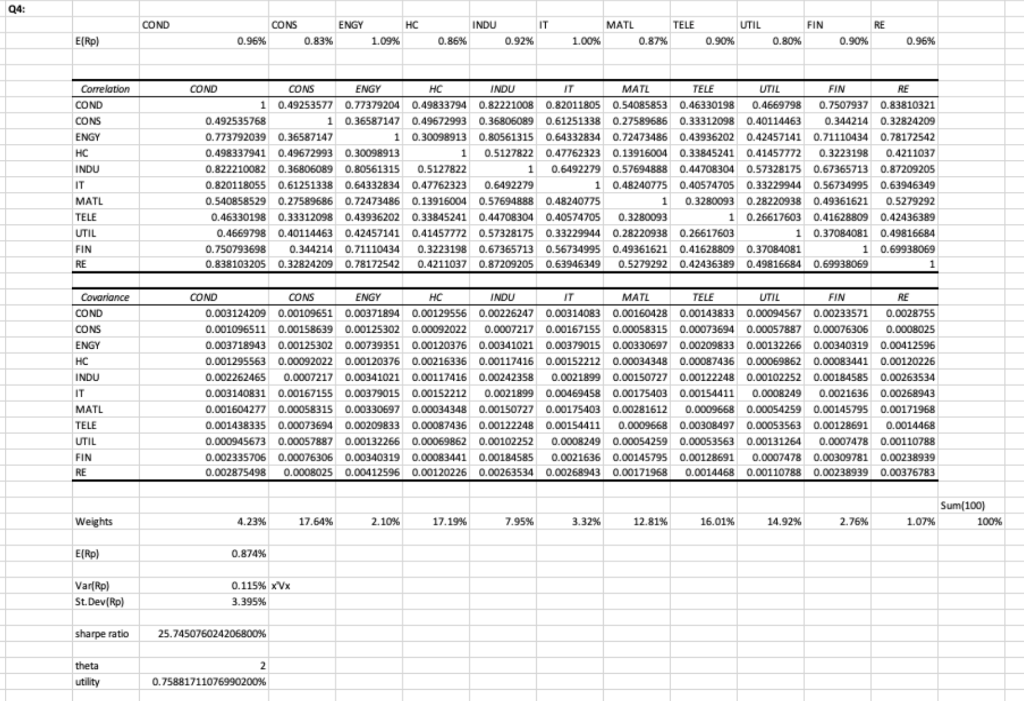

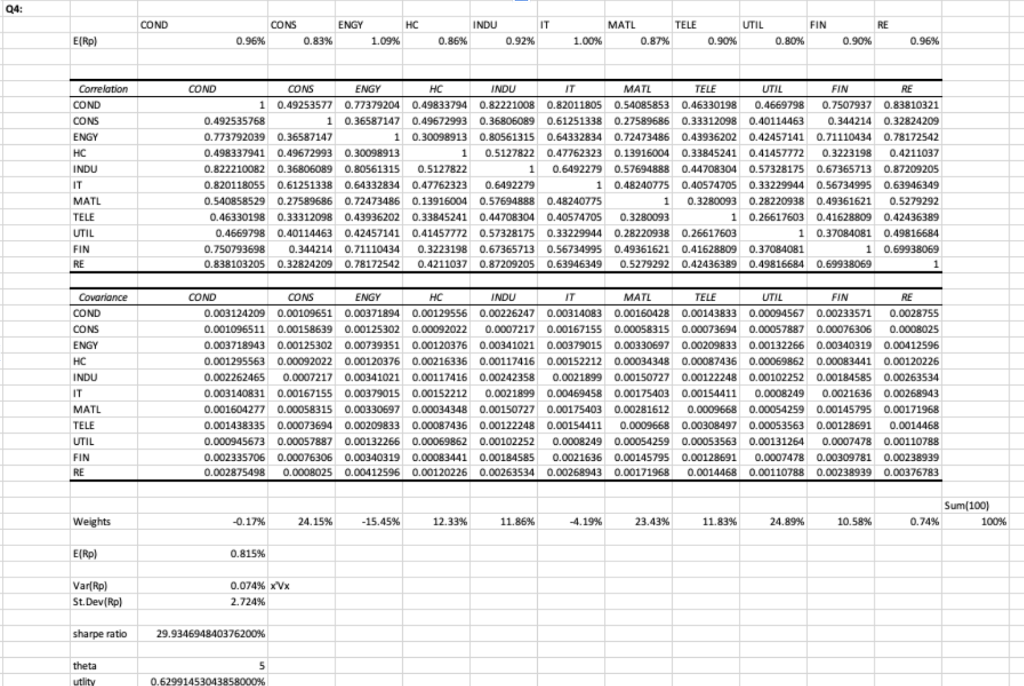

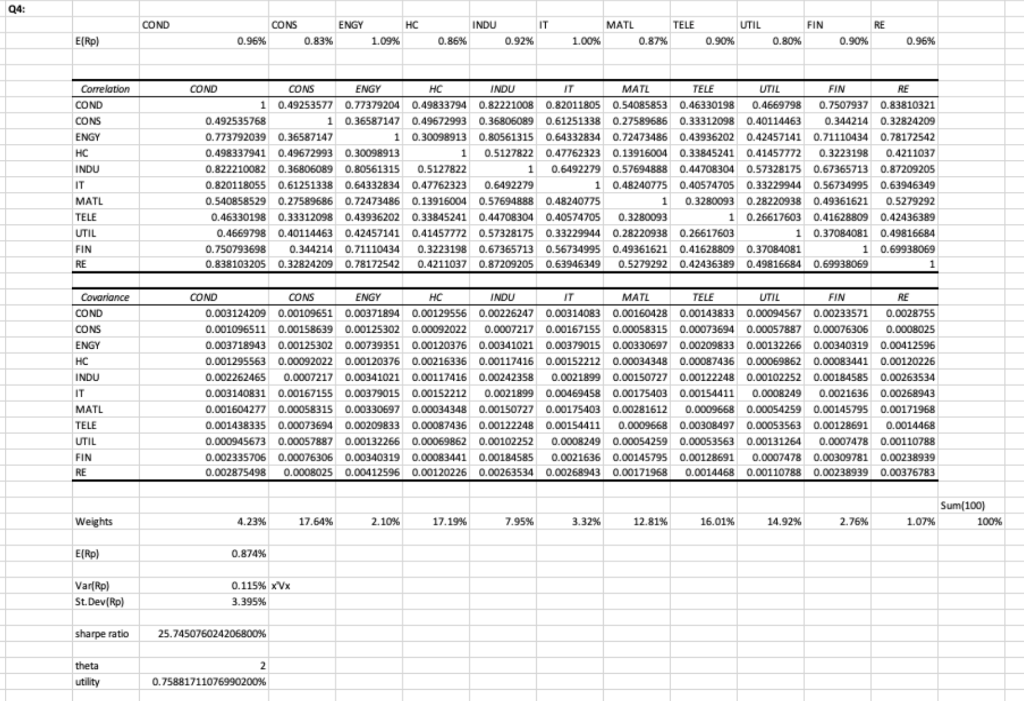

Calculate the optimal portfolio for both investors that consists of all eleven industries. Compare this to the other portfolios you have already estimated in terms of diversification benefits. What do you observe? Contrast the differences in what you observe between the two investors.

24: COND CONS ENGY IT FIN HC 1.09% INDU 0.86% MATL TELE 0.87% UTIL 0.90% RE 0.90% E(Rp) 0.96% 0.83% 0.92% 1.00% 0.80% 0.96% Correlation COND CONS ENGY HC HC INDU IT IT 0.3223198 COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE 1 0.49253577 0.77379204 0.49833794 0.82221008 0.82011805 0.54085853 0.46330198 0.4669798 0.7507937 0.83810321 0.492535768 1 0.36587147 0.49672993 0.36806089 0.61251338 0.27589686 0.33312098 0.40114463 0.344214 0.32824209 0.773792039 0.36587147 1 0.30098913 0.80561315 0.64332834 0.72473486 0.43936202 0.42457141 0.71110434 0.78172542 0.498337941 0.49672993 0.30098913 1 0.5127822 0.47762323 0.13916004 0.33845241 0.41457772 0.4211037 4211037 0.822210082 0.36806089 0.80561315 0.5127822 0.6492279 0.57694888 0.44708304 0.57328175 0.67365713 0.87209205 0.820118055 0.61251338 0.64332834 0.47762323 0.6492279 1 0.48240775 0.40574705 0.33229944 0.56734995 0.63946349 0.540858529 0.27589686 0.72473486 0.13916004 0.57694888 0.48240775 1 0.3280093 0.28220938 0.49361621 0.5279292 0.46330198 0.33312098 0.43936202 0.33845241 0.44708304 0.40574705 0.3280093 1 0.26617603 0.41628809 0.42436389 0.4669798 0.40114463 0.42457141 0.41457772 0.57328175 0.33229944 0.28220938 0.26617603 1 0.37084081 0.49816684 0.750793698 0.344214 0.71110434 0.3223198 0.67365713 0.56734995 0.49361621 0.41628809 0.37084081 1 0.69938069 0.838103205 0.32824209 0.78172542 0.4211037 0.87209205 0.63946349 0.5279292 0.42436389 0.49816684 0.69938069 MATL TELE UTIL FIN RE Covariance COND CONS ENGY HC HC INDU IT MATL TELE UTIL FIN RE COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE 0.003124209 0.00109651 0.00371894 0.00129556 0.00226247 0.00314083 0.00160428 0.00143833 0.00094567 0.00233571 0.0028755 0.001096511 0.00158639 0.00125302 0.00092022 0.0007217 0.00167155 0.00058315 0.00073694 0.00057887 0.00076306 0.0008025 0.003718943 0.00125302 0.00739351 0.00120376 0.00341021 0.00379015 0.00330697 0.00209833 0.00132266 0.00340319 0.00412596 0.001295563 0.00092022 0.00120376 0.00216336 0.00117416 0.00152212 0.00034348 0.00087436 0.00069862 0.00069862 0.00083441 0.00120226 0.002262465 0.0007217 0.00341021 0.00117416 0.00242358 0.0021899 0.00150727 0.00122248 0.00102252 0.00184585 0.00263534 0.003140831 0.00167155 0.00379015 0.00152212 0.0021899 0.00469458 0.00175403 0.00154411 ca 2 0.0008249 0.0021636 0.00268943 0.001604277 0.00058315 0.00330697 0.00034348 0.00150727 0.00175403 0.00281612 0.0009668 0.00054259 0.00145795 0.00171968 merce Co LASTOS 2010 0.001438335 0.00073694 0.00209833 0.00087436 0.00122248 0.00154411 0.0009668 0.00308497 0.00053563 0.00128691 0.0014468 0.000945673 0.00057887 0.00132266 0.00069862 0.00102252 0.0008249 0.00054259 0.00053563 0.00131264 0.0007478 0.00110788 0.002335706 0.00076306 0.00340319 0.00083441 0.00184585 0.0021636 0.00145795 0.00128691 0.0007478 0.00309781 0.00238939 0.002875498 0.0008025 0.00412596 0.00120226 0.00263534 0.00268943 0.00171968 0.0014468 0.00110788 0.00238939 0.00376783 Sum(100) 100% Weights -0.17% 24.15% -15.45% 12.33% 11.86% 4.19% 23.43% 11.83% 24.89% 10.58% 0.74% E(Rp) 0.815% Var(Rp) St.Dev(Rp) 0.074% XVX 2.724% sharpe ratio 29.934694840376200% theta utlity 5 0.62991453043858000% 04: COND FIN RE CONS 0.96% ENGY 0.83% HC 1.09% INDU 0.86% IT 0.92% MATL TELE 1.00% 0.87% UTIL 0.90% E(Rp) 0.80% 0.90% 0.96% Correlation COND CONS ENGY HC HC INDU IT MATL TELE UTIL FIN RE COND CONS ENGY HC INDU IT MATZ TELE UTIL FIN RE 1 0.49253577 0.77379204 0.49833794 0.82221008 0.82011805 0.54085853 0.46330198 0.4669798 0.7507937 0.83810321 0.492535768 1 0.36587147 0.49672993 0.36806089 0.61251338 0.27589686 0.33312098 0.40114463 0.344214 0.32824209 0.773792039 0.36587147 1 0.30098913 0.80561315 0.64332834 0.72473486 0.43936202 0.42457141 0.71110434 0.78172542 0.498337941 0.49672993 0.30098913 1 0.5127822 0.47762323 0.13916004 0.33845241 0.41457772 0.3223198 0.4211037 0.822210082 0.36806089 0.80561315 0.5127822 1 0.6492279 0.57694888 0.44708304 0.57328175 0.67365713 0.87209205 0.820118055 0.61251338 0.64332834 0.47762323 0.6492279 1 0.48240775 0.40574705 0.33229944 0.56734995 0.63946349 0.540858529 0.27589686 0.72473486 0.13916004 0.57694888 0.48240775 0.3280093 0.28220938 0.49361621 0.5279292 0.46330198 0.33312098 0.43936202 0.33845241 0.44708304 0.40574705 0.3280093 1 0.26617603 0.41628809 0.42436389 0.4669798 0.40114463 0.42457141 0.41457772 0.57328175 0.33229944 0.28220938 0.26617603 1 0.37084081 0.49816684 0.750793698 0.344214 0.71110434 0.3223198 0.67365713 0.56734995 0.49361621 0.41628809 0.37084081 1 0.69938069 0.838103205 0.32824209 0.78172542 0.4211037 0.87209205 0.63946349 0.5279292 0.42436389 0.49816684 0.69938069 1 1 Covariance COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE 0.003124209 0.00109651 0.00371894 0.00129556 0.00226247 0.00314083 0.00160428 0.00143833 0.00094567 0.00233571 0.0028755 0.001096511 0.00158639 0.00125302 0.00092022 0.0007217 0.00167155 0.00058315 0.00073694 0.00057887 0.00076306 0.0008025 0.003718943 0.00125302 0.00739351 0.00120376 0.00341021 0.00379015 0.00330697 0.00209833 0.00132266 0.00340319 0.00412596 0.001295563 0.00092022 0.00120376 0.00216336 0.00117416 0.00152212 0.00034348 0.00087436 0.00069862 0.00083441 0.00120226 M 0.002262465 0.0007217 0.00341021 0.00117416 0.00242358 0.0021899 0.00150727 0.00122248 0.00102252 0.00184585 0.00263534 1999 0172 0938 1939 gases sasa watnes ce am 1000 COASE , ce AC002 0.003140831 0.00167155 0.00379015 0.00152212 0.0021899 0.00469458 0.00175403 0.00154411 0.0008249 0.0021636 0.00268943 0.001604277 0.00058315 0.00330697 0.00034348 0.00150727 0.00175403 0.00281612 0.0009668 0.00054259 0.00145795 0.00171968 O 0000668 00054259 00145705 00171968 0.001438335 0.00073694 0.00209833 0.00087436 0.00122248 0.00154411 0.0009668 0.00308497 0.00053563 0.00128691 0.0014468 0.000945673 0.00057887 0.00132266 0.00069862 0.00102252 0.0008249 0.00054259 0.00053563 0.00131264 0.0007478 0.00110788 0.002335706 0.00076306 0.00340319 0.00083441 0.00184585 0.0021636 0.00145795 0.00128691 0.0007478 0.00309781 0.00238939 0.002875498 0.0008025 0.00412596 0.00120226 0.00263534 0.00268943 0.00171968 0.0014468 0.00110788 0.00238939 0.00376783 Sum(100) 100% Weights 4.23% 17.64% 2.10% 17.19% 7.95% 3.32% % 12.81% 16.01% 14.92% 2.76% 1.07% E[Rp) 0.874% Var(Rp) St.DevRp) 0.115% XVX 3.395% sharpe ratio 25.745076024206800% theta utility 2 0.75881711076990200% 24: COND CONS ENGY IT FIN HC 1.09% INDU 0.86% MATL TELE 0.87% UTIL 0.90% RE 0.90% E(Rp) 0.96% 0.83% 0.92% 1.00% 0.80% 0.96% Correlation COND CONS ENGY HC HC INDU IT IT 0.3223198 COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE 1 0.49253577 0.77379204 0.49833794 0.82221008 0.82011805 0.54085853 0.46330198 0.4669798 0.7507937 0.83810321 0.492535768 1 0.36587147 0.49672993 0.36806089 0.61251338 0.27589686 0.33312098 0.40114463 0.344214 0.32824209 0.773792039 0.36587147 1 0.30098913 0.80561315 0.64332834 0.72473486 0.43936202 0.42457141 0.71110434 0.78172542 0.498337941 0.49672993 0.30098913 1 0.5127822 0.47762323 0.13916004 0.33845241 0.41457772 0.4211037 4211037 0.822210082 0.36806089 0.80561315 0.5127822 0.6492279 0.57694888 0.44708304 0.57328175 0.67365713 0.87209205 0.820118055 0.61251338 0.64332834 0.47762323 0.6492279 1 0.48240775 0.40574705 0.33229944 0.56734995 0.63946349 0.540858529 0.27589686 0.72473486 0.13916004 0.57694888 0.48240775 1 0.3280093 0.28220938 0.49361621 0.5279292 0.46330198 0.33312098 0.43936202 0.33845241 0.44708304 0.40574705 0.3280093 1 0.26617603 0.41628809 0.42436389 0.4669798 0.40114463 0.42457141 0.41457772 0.57328175 0.33229944 0.28220938 0.26617603 1 0.37084081 0.49816684 0.750793698 0.344214 0.71110434 0.3223198 0.67365713 0.56734995 0.49361621 0.41628809 0.37084081 1 0.69938069 0.838103205 0.32824209 0.78172542 0.4211037 0.87209205 0.63946349 0.5279292 0.42436389 0.49816684 0.69938069 MATL TELE UTIL FIN RE Covariance COND CONS ENGY HC HC INDU IT MATL TELE UTIL FIN RE COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE 0.003124209 0.00109651 0.00371894 0.00129556 0.00226247 0.00314083 0.00160428 0.00143833 0.00094567 0.00233571 0.0028755 0.001096511 0.00158639 0.00125302 0.00092022 0.0007217 0.00167155 0.00058315 0.00073694 0.00057887 0.00076306 0.0008025 0.003718943 0.00125302 0.00739351 0.00120376 0.00341021 0.00379015 0.00330697 0.00209833 0.00132266 0.00340319 0.00412596 0.001295563 0.00092022 0.00120376 0.00216336 0.00117416 0.00152212 0.00034348 0.00087436 0.00069862 0.00069862 0.00083441 0.00120226 0.002262465 0.0007217 0.00341021 0.00117416 0.00242358 0.0021899 0.00150727 0.00122248 0.00102252 0.00184585 0.00263534 0.003140831 0.00167155 0.00379015 0.00152212 0.0021899 0.00469458 0.00175403 0.00154411 ca 2 0.0008249 0.0021636 0.00268943 0.001604277 0.00058315 0.00330697 0.00034348 0.00150727 0.00175403 0.00281612 0.0009668 0.00054259 0.00145795 0.00171968 merce Co LASTOS 2010 0.001438335 0.00073694 0.00209833 0.00087436 0.00122248 0.00154411 0.0009668 0.00308497 0.00053563 0.00128691 0.0014468 0.000945673 0.00057887 0.00132266 0.00069862 0.00102252 0.0008249 0.00054259 0.00053563 0.00131264 0.0007478 0.00110788 0.002335706 0.00076306 0.00340319 0.00083441 0.00184585 0.0021636 0.00145795 0.00128691 0.0007478 0.00309781 0.00238939 0.002875498 0.0008025 0.00412596 0.00120226 0.00263534 0.00268943 0.00171968 0.0014468 0.00110788 0.00238939 0.00376783 Sum(100) 100% Weights -0.17% 24.15% -15.45% 12.33% 11.86% 4.19% 23.43% 11.83% 24.89% 10.58% 0.74% E(Rp) 0.815% Var(Rp) St.Dev(Rp) 0.074% XVX 2.724% sharpe ratio 29.934694840376200% theta utlity 5 0.62991453043858000% 04: COND FIN RE CONS 0.96% ENGY 0.83% HC 1.09% INDU 0.86% IT 0.92% MATL TELE 1.00% 0.87% UTIL 0.90% E(Rp) 0.80% 0.90% 0.96% Correlation COND CONS ENGY HC HC INDU IT MATL TELE UTIL FIN RE COND CONS ENGY HC INDU IT MATZ TELE UTIL FIN RE 1 0.49253577 0.77379204 0.49833794 0.82221008 0.82011805 0.54085853 0.46330198 0.4669798 0.7507937 0.83810321 0.492535768 1 0.36587147 0.49672993 0.36806089 0.61251338 0.27589686 0.33312098 0.40114463 0.344214 0.32824209 0.773792039 0.36587147 1 0.30098913 0.80561315 0.64332834 0.72473486 0.43936202 0.42457141 0.71110434 0.78172542 0.498337941 0.49672993 0.30098913 1 0.5127822 0.47762323 0.13916004 0.33845241 0.41457772 0.3223198 0.4211037 0.822210082 0.36806089 0.80561315 0.5127822 1 0.6492279 0.57694888 0.44708304 0.57328175 0.67365713 0.87209205 0.820118055 0.61251338 0.64332834 0.47762323 0.6492279 1 0.48240775 0.40574705 0.33229944 0.56734995 0.63946349 0.540858529 0.27589686 0.72473486 0.13916004 0.57694888 0.48240775 0.3280093 0.28220938 0.49361621 0.5279292 0.46330198 0.33312098 0.43936202 0.33845241 0.44708304 0.40574705 0.3280093 1 0.26617603 0.41628809 0.42436389 0.4669798 0.40114463 0.42457141 0.41457772 0.57328175 0.33229944 0.28220938 0.26617603 1 0.37084081 0.49816684 0.750793698 0.344214 0.71110434 0.3223198 0.67365713 0.56734995 0.49361621 0.41628809 0.37084081 1 0.69938069 0.838103205 0.32824209 0.78172542 0.4211037 0.87209205 0.63946349 0.5279292 0.42436389 0.49816684 0.69938069 1 1 Covariance COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE 0.003124209 0.00109651 0.00371894 0.00129556 0.00226247 0.00314083 0.00160428 0.00143833 0.00094567 0.00233571 0.0028755 0.001096511 0.00158639 0.00125302 0.00092022 0.0007217 0.00167155 0.00058315 0.00073694 0.00057887 0.00076306 0.0008025 0.003718943 0.00125302 0.00739351 0.00120376 0.00341021 0.00379015 0.00330697 0.00209833 0.00132266 0.00340319 0.00412596 0.001295563 0.00092022 0.00120376 0.00216336 0.00117416 0.00152212 0.00034348 0.00087436 0.00069862 0.00083441 0.00120226 M 0.002262465 0.0007217 0.00341021 0.00117416 0.00242358 0.0021899 0.00150727 0.00122248 0.00102252 0.00184585 0.00263534 1999 0172 0938 1939 gases sasa watnes ce am 1000 COASE , ce AC002 0.003140831 0.00167155 0.00379015 0.00152212 0.0021899 0.00469458 0.00175403 0.00154411 0.0008249 0.0021636 0.00268943 0.001604277 0.00058315 0.00330697 0.00034348 0.00150727 0.00175403 0.00281612 0.0009668 0.00054259 0.00145795 0.00171968 O 0000668 00054259 00145705 00171968 0.001438335 0.00073694 0.00209833 0.00087436 0.00122248 0.00154411 0.0009668 0.00308497 0.00053563 0.00128691 0.0014468 0.000945673 0.00057887 0.00132266 0.00069862 0.00102252 0.0008249 0.00054259 0.00053563 0.00131264 0.0007478 0.00110788 0.002335706 0.00076306 0.00340319 0.00083441 0.00184585 0.0021636 0.00145795 0.00128691 0.0007478 0.00309781 0.00238939 0.002875498 0.0008025 0.00412596 0.00120226 0.00263534 0.00268943 0.00171968 0.0014468 0.00110788 0.00238939 0.00376783 Sum(100) 100% Weights 4.23% 17.64% 2.10% 17.19% 7.95% 3.32% % 12.81% 16.01% 14.92% 2.76% 1.07% E[Rp) 0.874% Var(Rp) St.DevRp) 0.115% XVX 3.395% sharpe ratio 25.745076024206800% theta utility 2 0.75881711076990200%