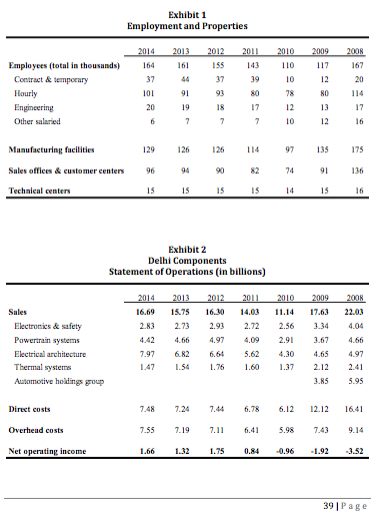

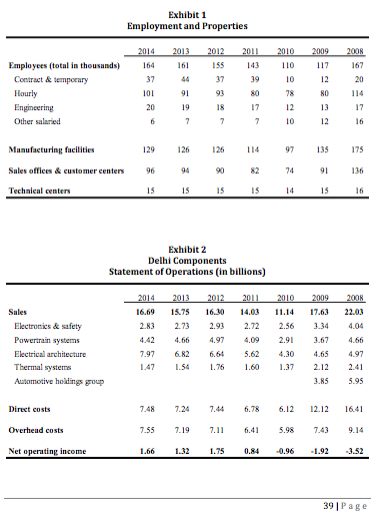

- Calculate the overhead allocation rate for each of the years 20082014. Why has the rate gone up significantly in 2010? (I attached all the info I have on the "company" I just have no idea where or how to get the overhead allocation rate)

-

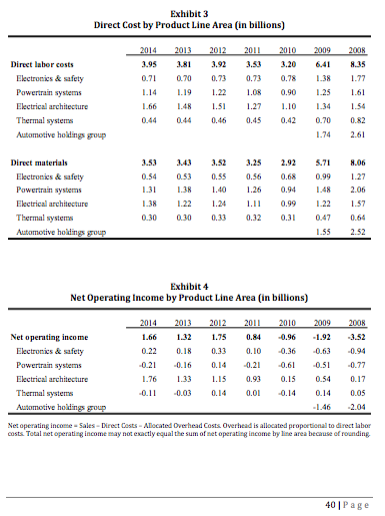

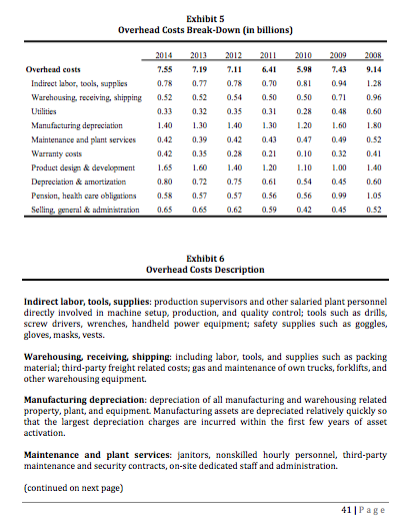

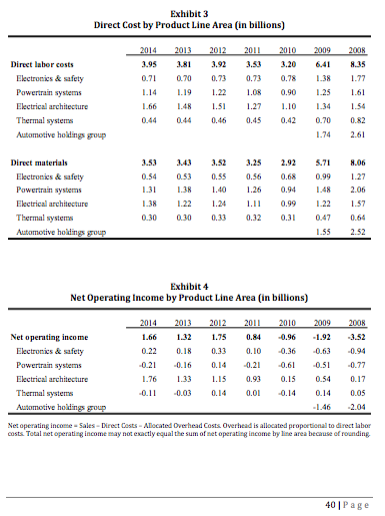

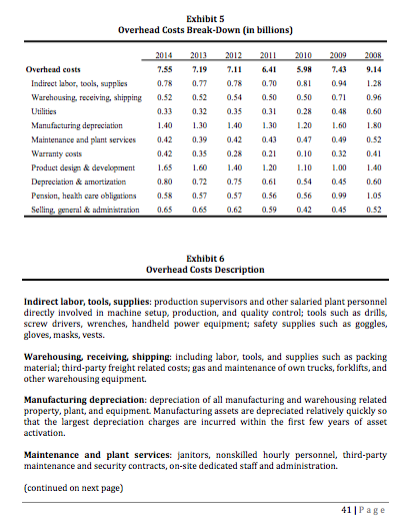

Exhibit 1 Employment and Properties Employees (total in thousands) 64 55 1430 7 167 Contract& temporary 10 12 101 114 17 16 12 13 12 Other salaried 10 135 Manufacturing faeilities Sales effices & customer eenters Techaieal centers 175 136 16 126 126 114 91 Exhibit 2 Delhi Components Statement of Operations (in billions) Electronics&safety Powertrain systems Electrical architecture Thermal systems Automotive holdings group 16.69 15.75 16.1014.03 11.14 17.63 22.03 2.83 2.73 2.93 2.72 2.56 3.34 4.0 442 4.66 4.974.09 2.93.67 4.66 .97 6.82 6.64 5.62 430 65 4.97 147 154 1.76 1.60 1.37 2.12 2.41 85 5.95 Direct costs 748 7.24 7.44 6.78 6.12 12.12 1641 7.55 7.19 7.11 6.41 5.98 7439.14 1.66 .32.50.840.96 1.92 3.52 Overhead costs Net operating income 391Page Exhibit 3 Direct Cost by Product Line Area (in billions) Direct lahor costs Electronics&safety Powertrain systems Electrical architecture Thermal systems Automotive hodings roup .95 3.81 3.923.53 3.20 6.4 8.35 0.7 0.70 0.73 0.73 0.78 38 77 114 119 2 1080.90 125 1.61 166 1.48 15 127 110 1.34 1.54 0.44 044 0.46 0.45 0.42 0.70 0.82 1.74 2.61 .53 3,43 3,523,25 2.92 5.7 N.06 0.54 053 0.550.56 0,68099 27 13 138 4026 .94 482.06 1381.22 1.24 11 0.99 122 157 0.30 030 0,33 0,32 0.3 047 0.64 55 2.52 Direet materials Ekctronies&safety Powertran systems Eleetrical architecture Thermal systems Exhibit 4 Net Operating Income by Product Line Area (in billions) Net operating income Electronics& safety Powertrain systems Electrical architecture Thermal systems 1.66 132 1.75 0.84 -0.96 -1.92 3.52 0.22 0.18 0.33 0.10 0.36 0.630.94 0.2 0.16 0.14 0 0.6 0.5 0.77 1.76 133 15 0.93 0.15 0540.17 0.11 0.03 0140.00.140.140.05 1.46 2.04 Net operating incomse-Sales-irect Costs-Atocated Overhead Costs Overhead is allocated propoetional to direct labor costs Total set operating income may notexactly equal the sum of met operat gincome by lse area because of rounding 401Page 1 Exhibit 5 Overhead Costs Break-Down (in billions) Overhead costs 7.55 7.19 7.1 64 5.98 7.439.14 0.78 0.77 0.780.700.8 0.94 28 Warehousing, receiving, shipping 0.52 0.52 0.54 0500.500.7 0.96 0.33 0.32 0.35 0.30.28 0.480.60 1.40 1.30 140 130 20 .60 1.80 Maintenance and plant services 0.42 0.39 0.42 43 047 0490.52 0,42 0.350.28020.10 032 0.41 Produet desin& development65 60 140 .20 .10 1.00 140 0,80 0.72 0.75 0.60.54 045 0.60 Pension, heath care oblis 0.58 0.7 0.57 0.56 0.56 09905 & admeistration 06 5 0,62 59 0.42 045 052 Indirect lubor, tools, supplies Utilities Warranty costs Sellin Exhibit 6 Overhead Costs Description Indirect labor, tools, supplies: production supervisors and other salaried plant personnel directly involved in machine setup, production, and quality control; tools such as drills, screw drivers, wrenches, handheld power equipment: safety supplies such as goggles, gloves, masks, vests. Warehousing, receiving, shipping: including labor, tools, and supplies such as packing material; third-party freight related costs; gas and maintenance of own trucks, forklifts, and other warehousing equipment. Manufacturing depreciation: depreciation of all manufacturing and warehousing related property, plant, and equipment Manufacturing assets are depreciated relatively quickly so that the largest depreciation charges are incurred within the first few years of asset Maintenance and plant services: janitors, nonskilled hourly personne, third-party maintenance and security contracts, on-site dedicated staff and administration. (continued on next page) 411 Page Exhibit 1 Employment and Properties Employees (total in thousands) 64 55 1430 7 167 Contract& temporary 10 12 101 114 17 16 12 13 12 Other salaried 10 135 Manufacturing faeilities Sales effices & customer eenters Techaieal centers 175 136 16 126 126 114 91 Exhibit 2 Delhi Components Statement of Operations (in billions) Electronics&safety Powertrain systems Electrical architecture Thermal systems Automotive holdings group 16.69 15.75 16.1014.03 11.14 17.63 22.03 2.83 2.73 2.93 2.72 2.56 3.34 4.0 442 4.66 4.974.09 2.93.67 4.66 .97 6.82 6.64 5.62 430 65 4.97 147 154 1.76 1.60 1.37 2.12 2.41 85 5.95 Direct costs 748 7.24 7.44 6.78 6.12 12.12 1641 7.55 7.19 7.11 6.41 5.98 7439.14 1.66 .32.50.840.96 1.92 3.52 Overhead costs Net operating income 391Page Exhibit 3 Direct Cost by Product Line Area (in billions) Direct lahor costs Electronics&safety Powertrain systems Electrical architecture Thermal systems Automotive hodings roup .95 3.81 3.923.53 3.20 6.4 8.35 0.7 0.70 0.73 0.73 0.78 38 77 114 119 2 1080.90 125 1.61 166 1.48 15 127 110 1.34 1.54 0.44 044 0.46 0.45 0.42 0.70 0.82 1.74 2.61 .53 3,43 3,523,25 2.92 5.7 N.06 0.54 053 0.550.56 0,68099 27 13 138 4026 .94 482.06 1381.22 1.24 11 0.99 122 157 0.30 030 0,33 0,32 0.3 047 0.64 55 2.52 Direet materials Ekctronies&safety Powertran systems Eleetrical architecture Thermal systems Exhibit 4 Net Operating Income by Product Line Area (in billions) Net operating income Electronics& safety Powertrain systems Electrical architecture Thermal systems 1.66 132 1.75 0.84 -0.96 -1.92 3.52 0.22 0.18 0.33 0.10 0.36 0.630.94 0.2 0.16 0.14 0 0.6 0.5 0.77 1.76 133 15 0.93 0.15 0540.17 0.11 0.03 0140.00.140.140.05 1.46 2.04 Net operating incomse-Sales-irect Costs-Atocated Overhead Costs Overhead is allocated propoetional to direct labor costs Total set operating income may notexactly equal the sum of met operat gincome by lse area because of rounding 401Page 1 Exhibit 5 Overhead Costs Break-Down (in billions) Overhead costs 7.55 7.19 7.1 64 5.98 7.439.14 0.78 0.77 0.780.700.8 0.94 28 Warehousing, receiving, shipping 0.52 0.52 0.54 0500.500.7 0.96 0.33 0.32 0.35 0.30.28 0.480.60 1.40 1.30 140 130 20 .60 1.80 Maintenance and plant services 0.42 0.39 0.42 43 047 0490.52 0,42 0.350.28020.10 032 0.41 Produet desin& development65 60 140 .20 .10 1.00 140 0,80 0.72 0.75 0.60.54 045 0.60 Pension, heath care oblis 0.58 0.7 0.57 0.56 0.56 09905 & admeistration 06 5 0,62 59 0.42 045 052 Indirect lubor, tools, supplies Utilities Warranty costs Sellin Exhibit 6 Overhead Costs Description Indirect labor, tools, supplies: production supervisors and other salaried plant personnel directly involved in machine setup, production, and quality control; tools such as drills, screw drivers, wrenches, handheld power equipment: safety supplies such as goggles, gloves, masks, vests. Warehousing, receiving, shipping: including labor, tools, and supplies such as packing material; third-party freight related costs; gas and maintenance of own trucks, forklifts, and other warehousing equipment. Manufacturing depreciation: depreciation of all manufacturing and warehousing related property, plant, and equipment Manufacturing assets are depreciated relatively quickly so that the largest depreciation charges are incurred within the first few years of asset Maintenance and plant services: janitors, nonskilled hourly personne, third-party maintenance and security contracts, on-site dedicated staff and administration. (continued on next page) 411 Page