Answered step by step

Verified Expert Solution

Question

1 Approved Answer

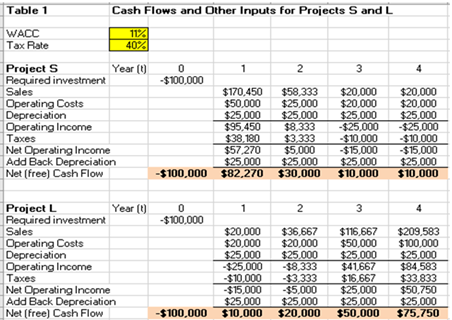

Calculate the Payback, NPV, IRR, and modified IRR (MIRR) for Projects S and L. If these projects are independent, do the criteria indicate that either,

- Calculate the Payback, NPV, IRR, and modified IRR (MIRR) for Projects S and L. If these projects are independent, do the criteria indicate that either, or both, should be accepted? Postpone a consideration of the situation if the projects are mutually exclusive until later, after the pros and cons of the various methods have been analyzed.

- Surveys by various academics indicate that most companies, large and small, calculate the payback and apparently give it some weight in their capital budgeting decisions. Small companies often rely exclusively on the payback. What are the pros and cons of this criterion, and do you think ABC should give it any weight in its capital budgeting decision process?

- If some of ABCs directors feel strongly that the IRR should be given significant weight in the decision process, would you recommend that they focus on the regular IRR, the MIRR, or both? Why?

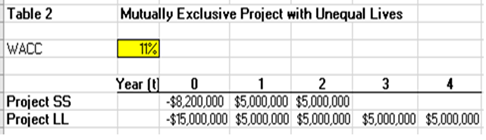

- The expected cash flows for Projects SS and LL are shown in Table 2. Explain why a problem exists, and then recommend which of these projects, if either, ABC should choose. Calculation Required

If S and L are mutually exclusive, which project would you recommend? Explain your choice in a manner that should satisfy the President and the other directors. HINT: Calculate the crossover rate and create a NPV profile. Show the Graph

Table 2 Mutually Exclusive Project with Unequal Lives WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started