Answered step by step

Verified Expert Solution

Question

1 Approved Answer

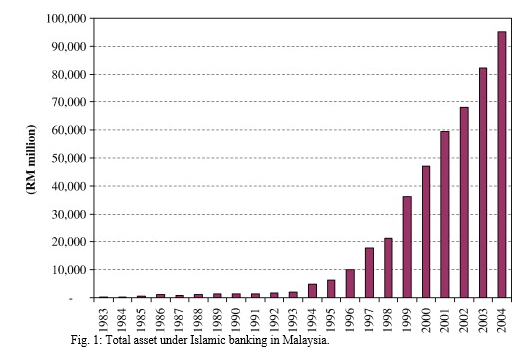

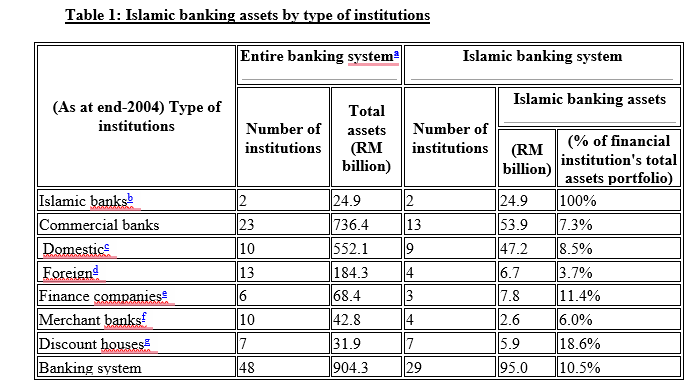

Calculate the percentage change in Total asset under Islamic banking in Malaysia between 1996 and 2001; and between 2001 and 2004. and calculate the ratio

Calculate the percentage change in Total asset under Islamic banking in Malaysia between 1996 and 2001; and between 2001 and 2004. and calculate the ratio of Islamic banks total asset to the entire banking system.

(RM million) 1983 1984 1985 1986 1987 Fig. 1: Total asset under Islamic banking in Malaysia. 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Table 1: Islamic banking assets by type of institutions Entire banking system Islamic banking system (As at end-2004) Type of institutions Number of institutions Total assets (RM billion) Islamic banks Commercial banks Domestic Foreign Finance companies Merchant banks! Discount houses Banking system 2 23 10 13 16 10 24.9 736.4 552.1 184.3 |68.4 Islamic banking assets Number of institutions (% of financial (RM billion) institution's total assets portfolio) 12 24.9 100% 13 53.9 7.3% 9 47.2 8.5% 14 6.7 3.7% 3 17.8 11.4% 14 2.6 6.0% 7 5.9 18.6% 129 95.0 10.5% ||42.8 7 31.9 904.3 48 (RM million) 1983 1984 1985 1986 1987 Fig. 1: Total asset under Islamic banking in Malaysia. 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Table 1: Islamic banking assets by type of institutions Entire banking system Islamic banking system (As at end-2004) Type of institutions Number of institutions Total assets (RM billion) Islamic banks Commercial banks Domestic Foreign Finance companies Merchant banks! Discount houses Banking system 2 23 10 13 16 10 24.9 736.4 552.1 184.3 |68.4 Islamic banking assets Number of institutions (% of financial (RM billion) institution's total assets portfolio) 12 24.9 100% 13 53.9 7.3% 9 47.2 8.5% 14 6.7 3.7% 3 17.8 11.4% 14 2.6 6.0% 7 5.9 18.6% 129 95.0 10.5% ||42.8 7 31.9 904.3 48Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started