'G. Motors is the manufacturer of sophisticated cranes. The Production manager of the company, reported to the Chief Executive Officer, Ashish Jain that one

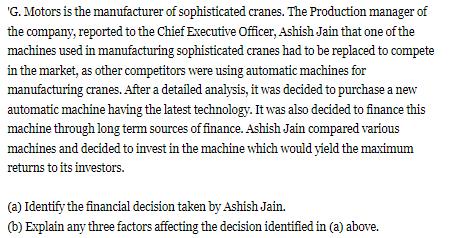

'G. Motors is the manufacturer of sophisticated cranes. The Production manager of the company, reported to the Chief Executive Officer, Ashish Jain that one of the machines used in manufacturing sophisticated cranes had to be replaced to compete in the market, as other competitors were using automatic machines for manufacturing cranes. After a detailed analysis, it was decided to purchase a new automatic machine having the latest technology. It was also decided to finance this machine through long term sources of finance. Ashish Jain compared various machines and decided to invest in the machine which would yield the maximum returns to its investors. (a) Identify the financial decision taken by Ashish Jain. (b) Explain any three factors affecting the decision identified in (a) above. Name the concept of financial management which increases the return to equity shareholders due to the presence of fixed financial charges. Raj has two projects A and B in hand. The same amount of risk is involved in both the projects. If the rate of return of project A and B is 20% and 15% respectively, then under normal circumstance, which of the two projects is likely to be selected?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Financing Decision Financing Decision is concerned with the decisions about how much funds are to ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started