Answered step by step

Verified Expert Solution

Question

1 Approved Answer

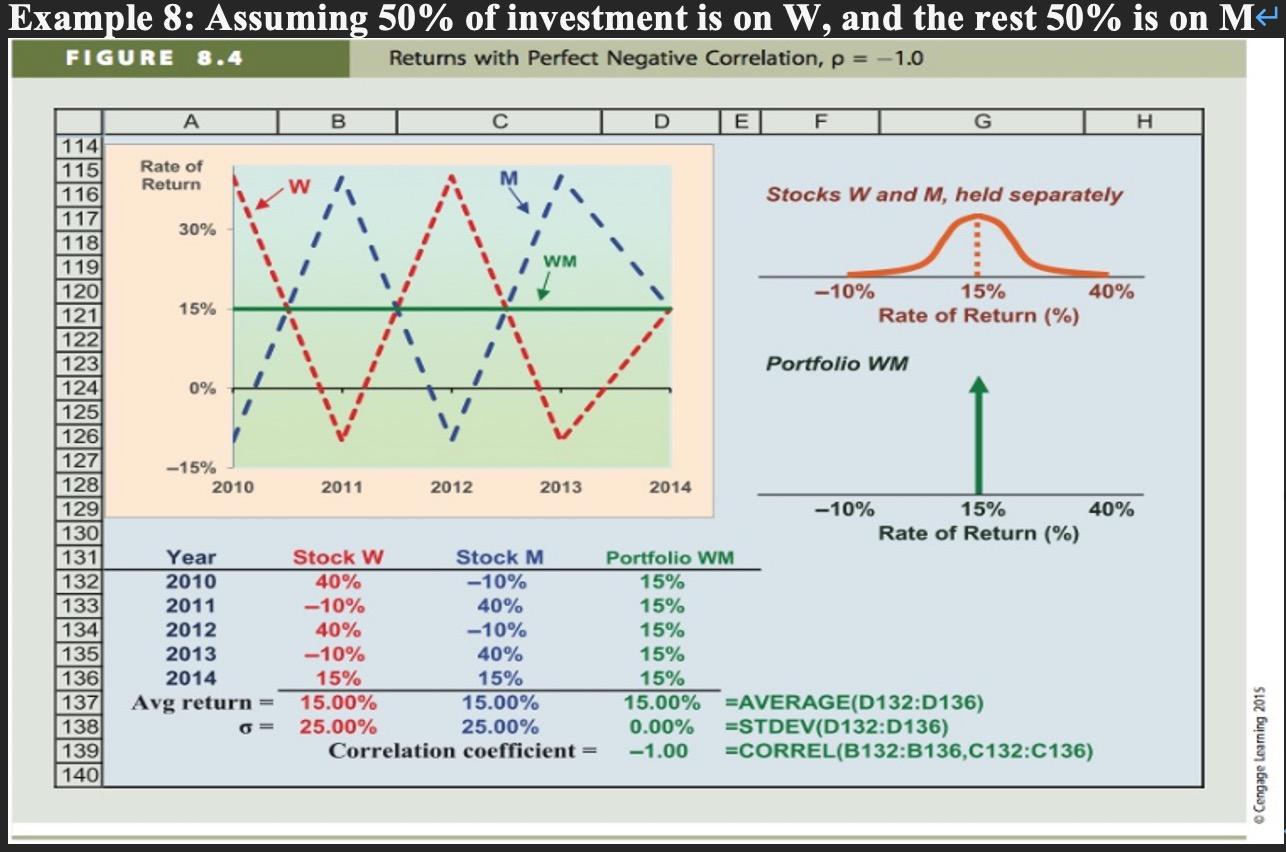

Calculate the portfolio return in each year, and the expected rate of return and standard deviation for stocks w, m and portfolio mw. (We invest

Calculate the portfolio return in each year, and the expected rate of return and standard deviation for stocks w, m and portfolio mw. (We invest 50% in Stock W)

Please don't solve the problem in excel!Thank you!

Example 8: Assuming 50% of investment is on W, and the rest 50% is on M- Returns with Perfect Negative correlation, p = -1.0 FIGURE 8.4 B D E F G H Rate of Return Stocks Wand M, held separately 30% WM 15% -10% 15% 40% Rate of Return (%) Portfolio WM 0% 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 -15% 2010 Year 2010 2011 2012 2013 2014 Avg return = = 2011 2012 2013 2014 -10% 15% 40% Rate of Return (%) Stock W Stock M Portfolio WM 40% -10% 15% -10% 40% 15% 40% -10% 15% -10% 40% 15% 15% 15% 15% 15.00% 15.00% 15.00% =AVERAGE(D132:1136) 25.00% 25.00% 0.00% =STDEV(D132:D136) Correlation coefficient = -1.00 =CORREL(B132:B136,C132:C136) Cengage learning 2015Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started