Calculate the present value of the following amounts:

| 1. | $14 comma 00014,000 at the end of tenten years at 88% |

| 2. | $14 comma 00014,000 a year at the end of the next tenten years at 88% |

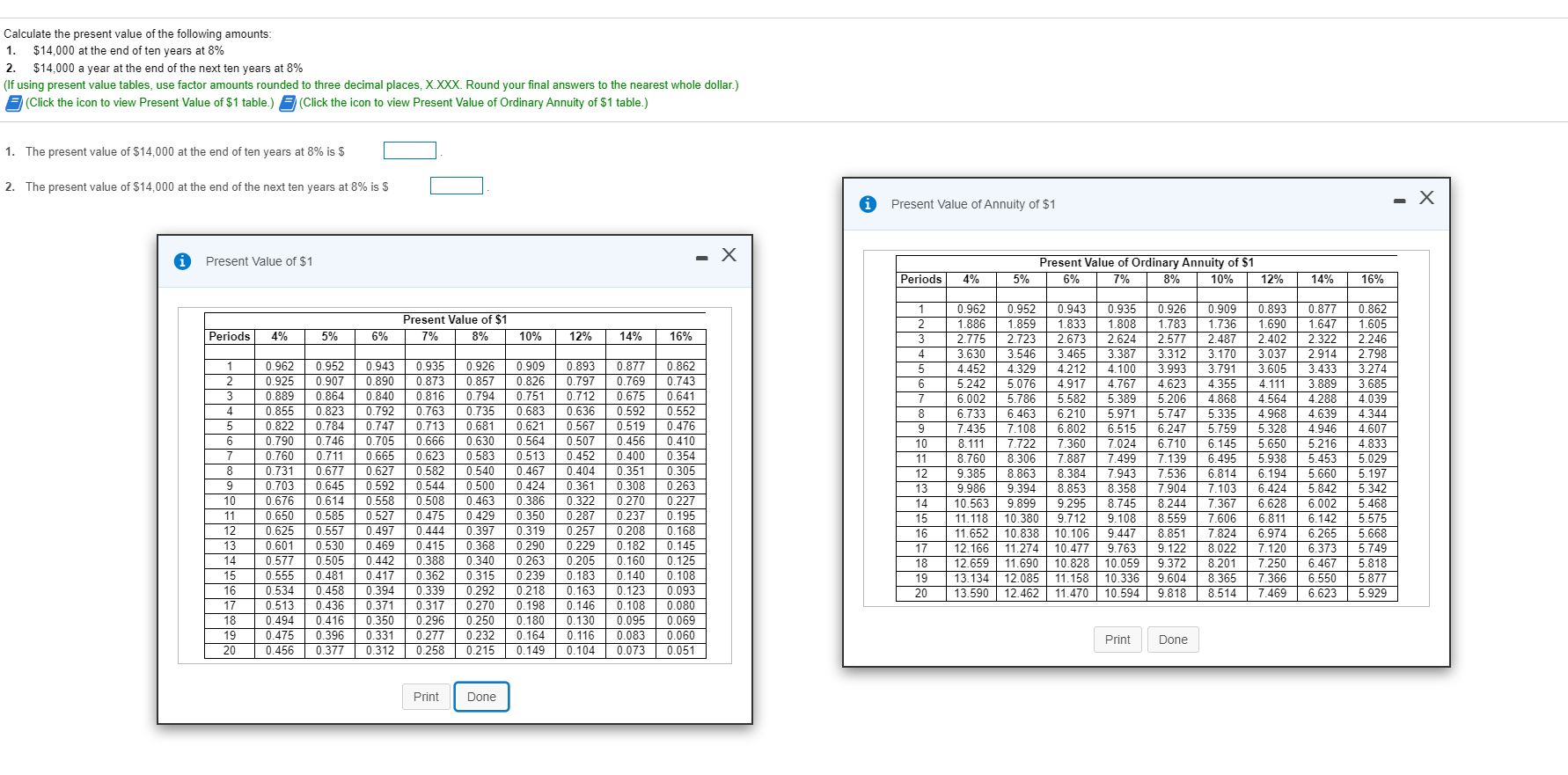

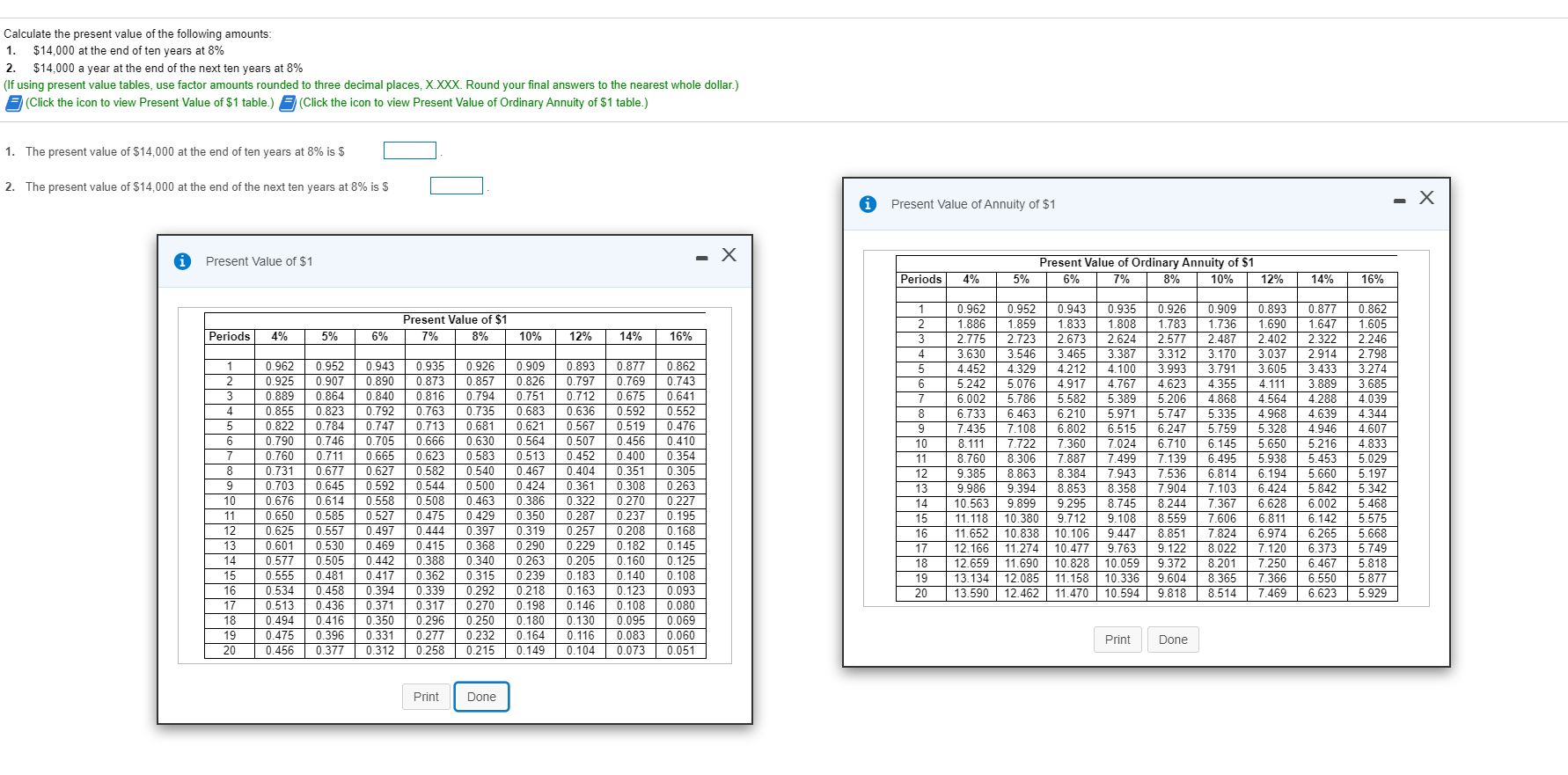

(If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round your final answers to the nearest whole dollar.)

LOADING...

(Click the icon to view Present Value of $1 table.)

LOADING...

(Click the icon to view Present Value of Ordinary Annuity of $1 table.)

| 1. | The present value of $14,000 at the end of ten years at 8% is $ | | . |

| 2. | The present value of $14,000 at the end of the next ten years at 8% is $ | | . |

Calculate the present value of the following amounts: $14,000 at the end of ten years at 8% 1. 2. $14.000 a year at the end of the next ten years at 8% (If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round your final answers to the nearest whole dollar.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) 1. The present value of $14,000 at the end of ten years at 8% is $ 2. The present value of $14,000 at the end of the next ten years at 8% is $ - X Present Value of Annuity of $1 - X Present Value of Ordinary Annuity of $1 5% Present Value of $1 Periods 4% 6% 7% 8% 10% 12% 14% 16% 0.935 1.808 2.624 3.387 0.926 1.783 2.577 3312 3.993 0.909 0.862 1.605 2.246 2.798 3.274 0.962 1 0.952 1.859 2.723 0.943 0.893 1.690 2.402 0.877 Present Value of $1 10% 1.647 2,322 1.886 2.775 1.736 2.487 2 1.833 Periods 5% 2.673 3.465 4% 6% 7% 8% 12% 14% 16% 4 3.630 3.546 3.170 3.037 2.914 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.962 0.925 0.889 0.952 0.907 0.864 0.943 0.890 0.840 0.926 0.857 0.794 0.735 0.877 0.769 0.675 1 0.935 0.909 0.826 0.751 0.893 5 4.452 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 4.212 4.100 3.791 3.605 3.433 0.873 0.816 0.763 0.797 0.712 0.636 0.567 0.507 0452 0404 0.361 2 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 4.917 5.582 6 4.767 4.623 5.206 5.747 6.247 6.710 4.355 4.111 3.889 3.685 3 5.389 5.971 6.515 7.024 7.499 4.564 4.968 5.328 5.650 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 4.288 4.639 4,946 5.216 5.453 5.660 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.792 0.747 0.705 0.665 0.627 0.592 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.683 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 12.085 11.158 12.462 11.470 10.594 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.713 0.666 0.623 0.582 0.544 0.508 0.681 0.630 0.583 0.540 0.500 0.463 5 6 10 11 12 7.139 5.938 6.194 7.943 7.536 0.263 7.904 8.244 8.559 8,851 13 8.358 6.424 5.842 10 0.558 0.322 0.227 6.002 6.142 14 8.745 6.628 11 0.527 0.429 0.397 0.650 0.585 0.475 0.287 0.195 15 10.380 9.108 7.606 6.811 0.557 0.530 0.505 0.481 0.257 0.229 0.205 0.168 0.145 0.125 0.108 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 10.838 11.274 11.690 12 13 14 15 16 17 18 19 0.625 0.497 0.444 16 9.447 5.668 5.749 7.824 8.022 8.201 6.974 6.265 0.415 0.388 0.469 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.368 0.290 17 9.763 10.059 10.336 9.122 9.372 9.604 9.818 7.120 6.373 6.467 6.550 6.623 0.340 0.315 0.263 0.442 7.250 5.818 5.877 5.929 18 0.183 0.417 0.362 0.239 7.366 7.469 19 13.134 8.365 0.394 0.371 0.350 0.331 0.312 0.339 0.317 0.296 0.277 0.258 0.218 0.198 0.180 0.458 0.436 0.416 0.396 0.377 0.292 0.163 0.093 0.080 0.069 0.060 0.051 20 13.590 8.514 0.146 0.130 0.116 0.104 0.270 0.250 0.232 0.215 0.164 Print Done 0.149 20 Print Done