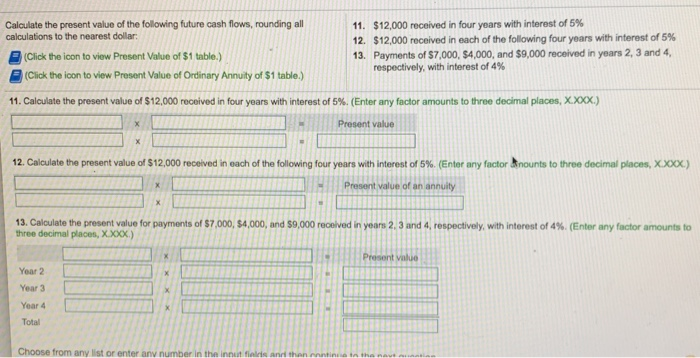

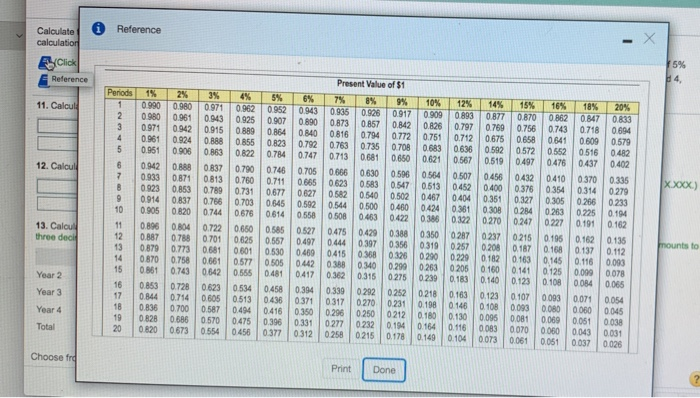

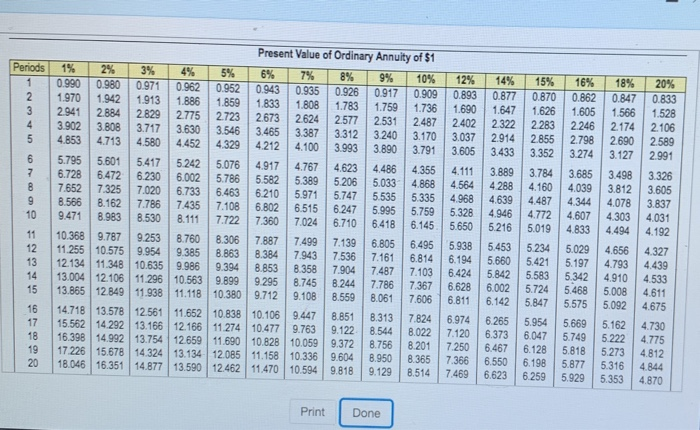

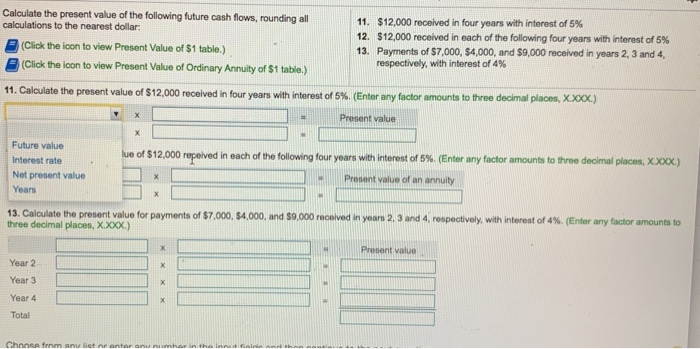

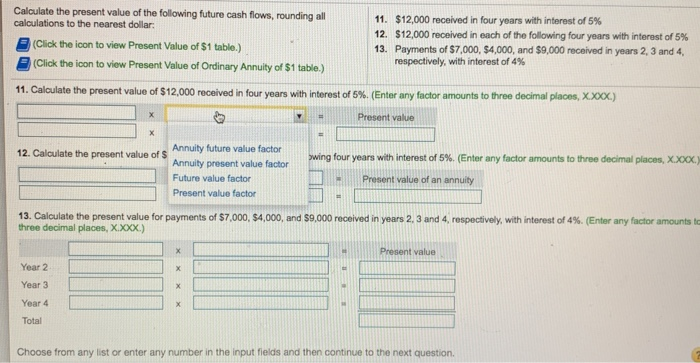

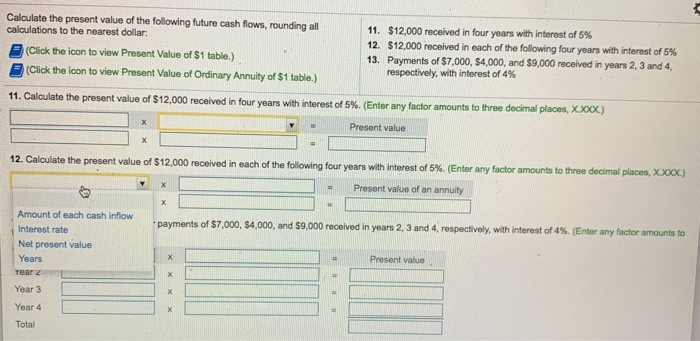

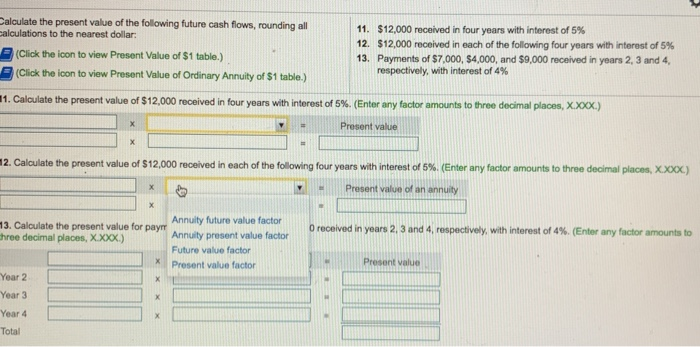

Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: 11. $12,000 received in four years with interest of 5% 12. $12,000 received in each of the following four years with interest of 5% 13. Payments of $7,000, $4,000, and $9,000 received in years 2, 3 and 4 respectively, with interest of 4% (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) 11. Calculate the present value of $12,000 received in four years with interest of 5%. (Enter any factor amounts to three decimal places, X.XXX.) Present value 12. Calculate the present value of $12,000 received in each of the following four years with interest of 5% (Enter any factor Mounts to three decimal places, X.XXX.) resent value of an annuity 13. Calculate the present value for payments of $7,000, $4,000, and $9,000 recolved in years 2, 3 and 4, respectively, with interest of 4%. (Enter any factor amounts to three decimal places, X.XXX.) D Year 2 Year 3 Year 4 Total Choose from any list or enter any number in the in 0 Reference Calculate calculation Click Reference Present Value of $1 11. Calcul 0.943 16% 0862 0.935 0.926 12% 0893 0.797 0.917 14% 0.877 0.769 0.675 15% 0.870 0.756 0.658 0.980 0.971 0.961 0.952 0.907 0.864 0.823 0.961 0.942 0.924 0943 0925 0.915 0.889 0.888 0.855 0.909 0.826 0.751 0.683 0833 0.694 0.579 0.840 0.792 0.712 0.636 12. Calcul 13. Calcul three dec Year 2 Year 3 0.078 0.066 0.054 0045 0038 0.031 0026 Baada Year 4 0277 0.194 Total 6258 0176 0.061 Choose fre Print Done Periods 20% 18% 0.847 1.566 2.174 2.690 3.127 4.767 Present Value of Ordinary Annuity of $1 5% 6% 7% 8% 9% 10% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 1.970 1.942 1.913 1.886 1.859 1.833 | 1.808 1.783 1.759 1.736 1.690 2941 2.884 2829 2775 2723 2673 2624 2.577 2531 2.487 2402 3.902 3.808 3.717 3.630 3.546 | 3.465 3.387 3.312 3.240 3.170 3.037 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.486 4.355 4.111 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7325 7.020 6.733 6.463 6.210 5.971 5.535 5.335 4.968 8.566 8.1627.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.1616.814 6.194 12.134 11.348 10.635 9.986 9.3948.853 8.358 7.904 7.487 7.103 6.424 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.2447.786 7.367 6.628 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.5598.061 7.6066.811 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 15.562 14.292 13.166 12.166 11.274 10.4779.763 9.122 8.544 8.022 7.120 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.3728.756 8.201 7.250 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 5.328 14% 15% 0.877 0.870 1.647 1.626 2322 2283 2.914 2.855 3.433 3.352 3.889 3.784 4288 4.160 4.639 4.487 4.946 5216 5.019 5.234 5.660 5.421 5.842 5.583 6.002 5.724 6.142 5.847 6.2655954 6.373 6.047 6.467 6.128 6.198 6.623 6259 3.498 3.812 4.078 4.303 4494 4.772 16% 0.862 1.605 2246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.669 5.749 5.818 5.877 5.929 0.833 1.528 2106 2.589 2991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 5.453 4.656 4.793 4910 5.008 5.092 5.162 5222 5.273 5.316 5.353 Print Done Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) 11. $12,000 received in four years with interest of 5% 12. $12,000 received in each of the following four years with interest of 5% 13. Payments of $7,000, $4,000, and $9,000 received in years 2, 3 and 4 respectively, with interest of 4% 11. Calculate the present value of $12,000 received in four years with interest of 5% (Enter any factor amounts to three decimal places, XXOOX.) Present value lue of $12,000 repeived in each of the following four years with interest of 5% (Enter any factor amounts to three decimal places, Xxx.) Future value Interest rate Not present value Years 13. Calculate the present value for payments of $7,000 $4,000, and $9,000 received in yours 2, 3 and 4, respectively, with interest of 4%. (Enter any factor amounts to three decimal places, X.XXX.) Year 2 Year 3 Year 4 Total Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) 11. $12,000 received in four years with interest of 5% 12. $12,000 received in each of the following four years with interest of 5% 13. Payments of $7,000, $4,000, and $9,000 received in years 2, 3 and 4 respectively, with interest of 4% 11. Calculate the present value of $12,000 received in four years with interest of 5% (Enter any factor amounts to three decimal places, Xxx.) Present value 12. Calculate the present value of $ . Annuity future value factor Annuity present value factor Future value factor Present value factor wing four years with interest of 5%. (Enter any factor amounts to three decimal places, X.X value of an annuity 13. Calculate the present value for payments of $7,000, $4,000, and $9.000 received in years 2, 3 and 4, respectively, with interest of 4%. (Enter any factor amounts te three decimal places, XXOOX.) Year 2 Year 3 Year 4 Total Choose from any list or enter any number in the input fields and then continue to the next question. Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) 11. $12,000 received in four years with interest of 5% 12. $12,000 received in each of the following four years with interest of 5% 13. Payments of $7,000, $4,000, and $9,000 received in years 2, 3 and 4 respectively, with interest of 4% 11. Calculate the present value of $12,000 received in four years with interest of 5%. (Enter any factor amounts to three decimal places, X200C.) - Present value 12. Calculate the present value of $12,000 received in each of the following four years with interest of 5%. (Enter any factor amounts to three decimal places, X.XXX.) - Present value of an annuity *payments of $7,000 $4,000, and $9,000 received in years 2, 3 and 4, respectively, with interest of 4%. (Enter any factor amounts to Amount of each cash inflow Interest rate Net present value Years Present value Year 3 Year 4 Total Calculate the present value of the following future cash flows, rounding all 11. $12,000 received in four years with interest of 5% alculations to the nearest dollar 12. $12,000 received in each of the following four years with interest of 5% (Click the icon to view Present Value of $1 table.) 13. Payments of $7,000, $4,000, and $9,000 received in years 2, 3 and 4 respectively, with interest of 4% (Click the icon to view Present Value of Ordinary Annuity of $1 tablo.) 11. Calculate the present value of $12,000 received in four years with interest of 5%. (Enter any factor amounts to three decimal places, X.XX.) Present value 2. Calculate the present value of $12,000 received in each of the following four years with interest of 5%. (Enter any factor amounts to three decimal places, X.XXX.) Present value of an annuity 13. Calculate the present value for payer hree decimal places, X.XX.) received in years 2, 3 and 4, respectively, with interest of 4%. (Enter any factor amounts to Annuity future value factor Annuity present value factor Future value factor Present value factor Year 2 Year 3 Year 4 Total