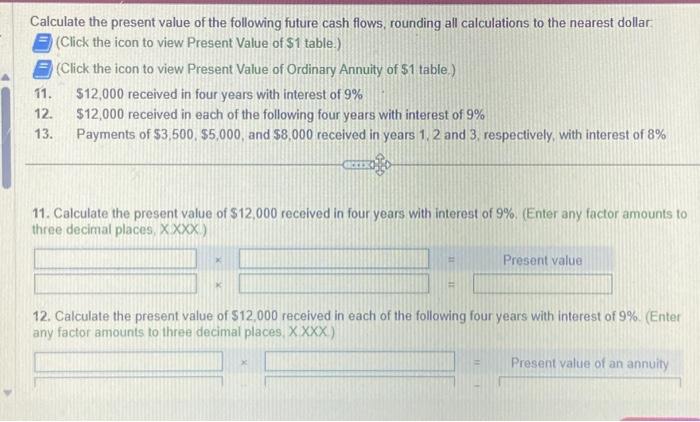

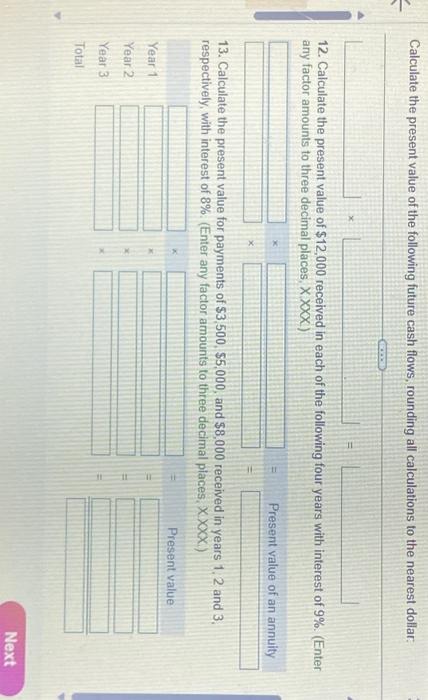

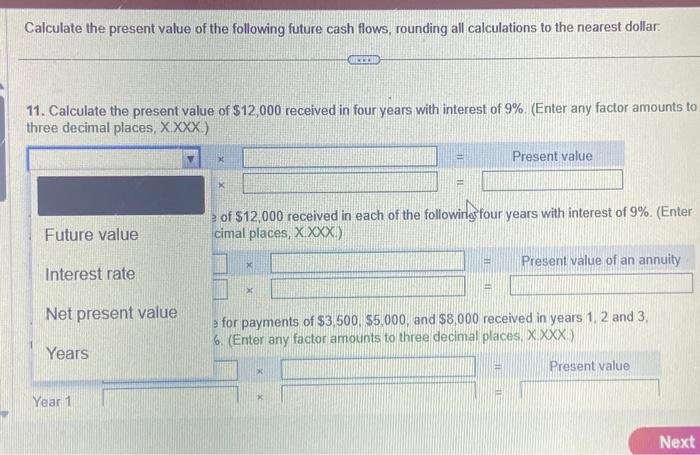

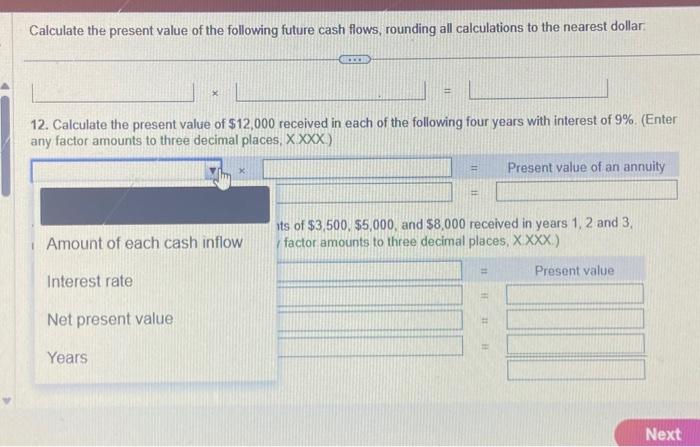

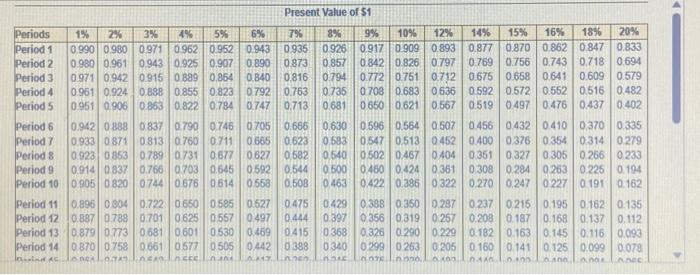

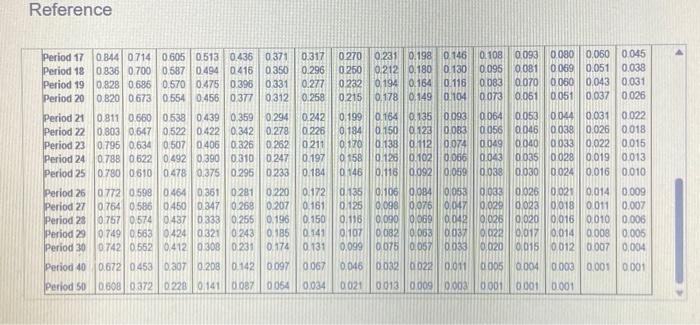

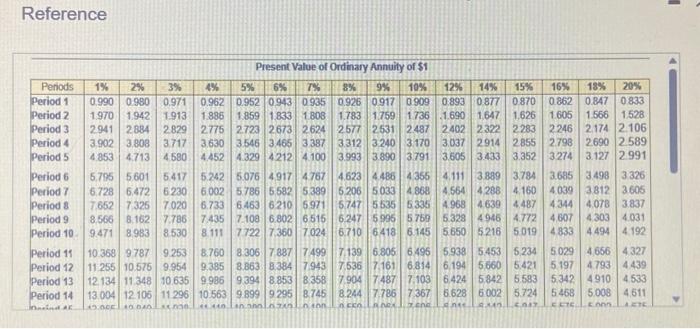

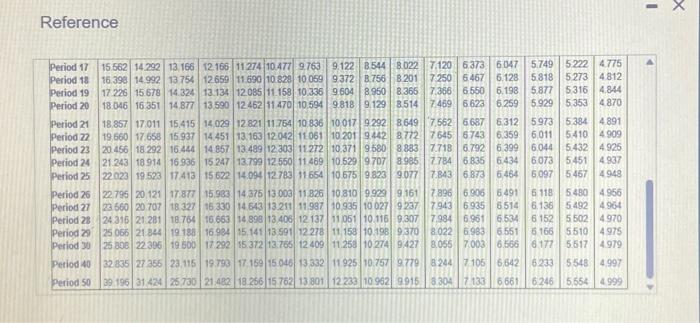

Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of \$1 table) 11. $12,000 received in four years with interest of 9% 12. $12,000 received in each of the following four years with interest of 9% 13. Payments of $3,500,$5,000, and $8,000 received in years 1,2 and 3 , respectively, with interest of 8% 11. Calculate the present value of $12,000 received in four years with interest of 9%. (Enter any factor amounts to three decimal places, XX ) 12. Calculate the present value of $12,000 received in each of the following four years with interest of 9%. Enter any factor amounts to three decimal places, XXX) Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: 12. Calculate the present value of $12,000 received in each of the following four years with interest of 9%. (Enter any factor amounts to three decimal places, XXX ) inuity 13. Calculate the present value for payments of $3,500,$5,000, and $8,000 received in years 1,2 and 3 . respectively, with interest of 8%. (Enter any factor amounts to three decimal places, XXXX ) Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: 11. Calculate the present value of $12,000 received in four years with interest of 9%. (Enter any factor amounts to three decimal places, XXXX ) Interest rate Net present value 3 for payments of $3,500,$5,000, and $8,000 received in years 1, 2 and 3 . 6. (Enter any factor amounts to three decimal places, XXXX) Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: 12. Calculate the present value of $12,000 received in each of the following four years with interest of 9%. (Ente any factor amounts to three decimal places, XXXX ) its of $3,500,$5,000, and $8,000 received in years 1,2 and 3 . (factor amounts to three decimal places, XXXX ) Present Value of \$1 Reference Reference Reference