Answered step by step

Verified Expert Solution

Question

1 Approved Answer

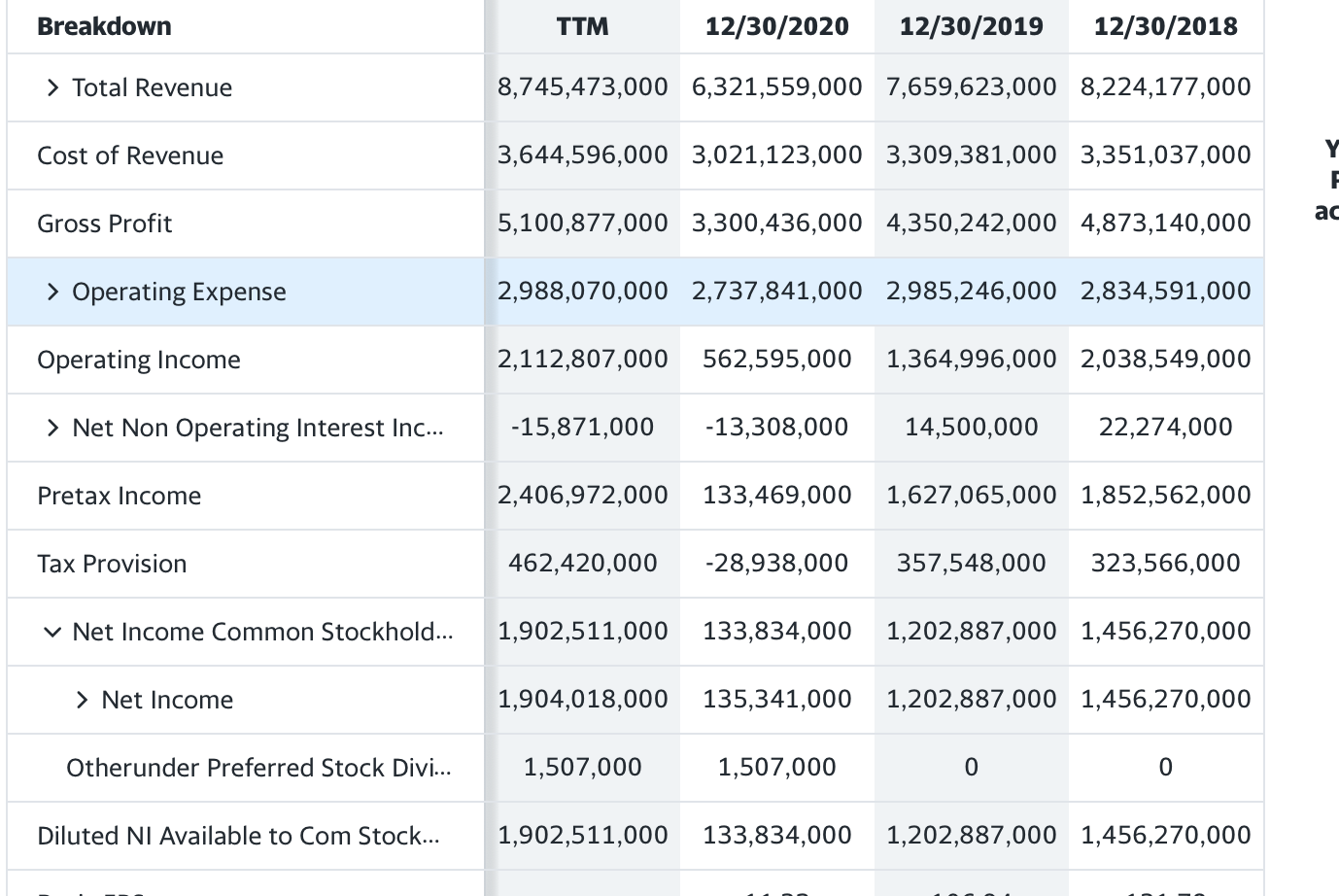

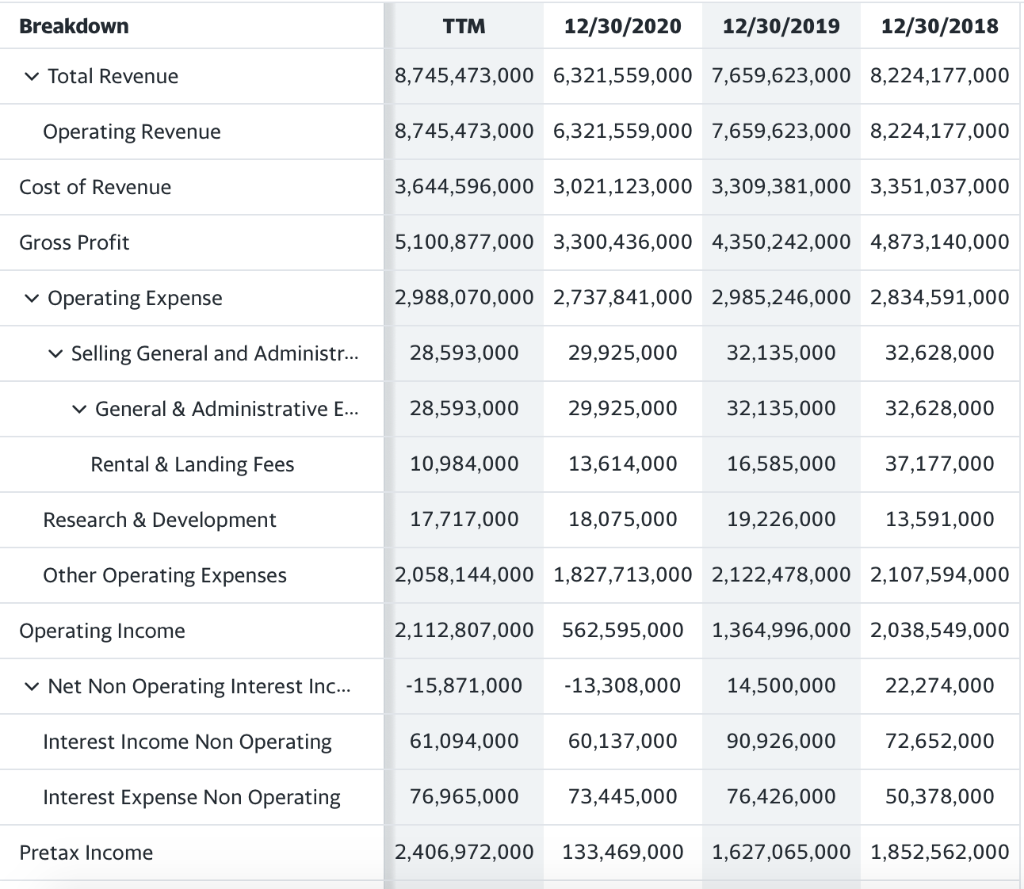

Calculate the profit margin for the current and previous years and comment on the profitability of this company in 1-2 paragraphs Breakdown TTM 12/30/2020 12/30/2019

Calculate the profit margin for the current and previous years and comment on the profitability of this company in 1-2 paragraphs

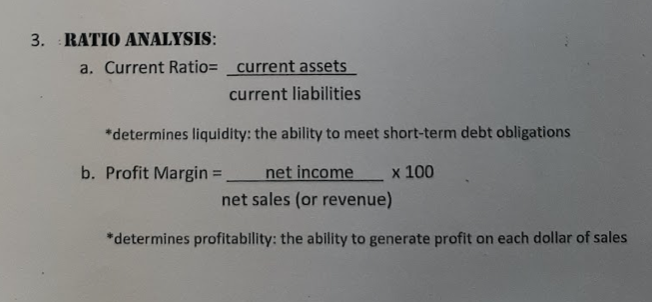

Breakdown TTM 12/30/2020 12/30/2019 12/30/2018 > Total Revenue 8,745,473,000 6,321,559,000 7,659,623,000 8,224,177,000 Cost of Revenue 3,644,596,000 3,021,123,000 3,309,381,000 3,351,037,000 Y Gross Profit 5,100,877,000 3,300,436,000 4,350,242,000 4,873,140,000 > Operating Expense 2,988,070,000 2,737,841,000 2,985,246,000 2,834,591,000 Operating Income 2,112,807,000 562,595,000 1,364,996,000 2,038,549,000 > Net Non Operating Interest Inc... -15,871,000 -13,308,000 14,500,000 22,274,000 Pretax Income 2,406,972,000 133,469,000 1,627,065,000 1,852,562,000 Tax Provision 462,420,000 -28,938,000 357,548,000 323,566,000 v Net Income Common Stockhold... 1,902,511,000 133,834,000 1,202,887,000 1,456,270,000 > Net Income 1,904,018,000 135,341,000 1,202,887,000 1,456,270,000 Otherunder Preferred Stock Divi... 1,507,000 1,507,000 0 0 Diluted NI Available to Com Stock... 1,902,511,000 133,834,000 1,202,887,000 1,456,270,000 Breakdown TTM 12/30/2020 12/30/2019 12/30/2018 Total Revenue 8,745,473,000 6,321,559,000 7,659,623,000 8,224,177,000 Operating Revenue 8,745,473,000 6,321,559,000 7,659,623,000 8,224,177,000 Cost of Revenue 3,644,596,000 3,021,123,000 3,309,381,000 3,351,037,000 Gross Profit 5,100,877,000 3,300,436,000 4,350,242,000 4,873,140,000 Operating Expense 2,988,070,000 2,737,841,000 2,985,246,000 2,834,591,000 Selling General and Administr... 28,593,000 29,925,000 32,135,000 32,628,000 v General & Administrative E... 28,593,000 29,925,000 32,135,000 32,628,000 Rental & Landing Fees 10,984,000 13,614,000 16,585,000 37,177,000 Research & Development 17,717,000 18,075,000 19,226,000 13,591,000 Other Operating Expenses 2,058,144,000 1,827,713,000 2,122,478,000 2,107,594,000 Operating Income 2,112,807,000 562,595,000 1,364,996,000 2,038,549,000 Net Non Operating Interest Inc... -15,871,000 -13,308,000 14,500,000 22,274,000 Interest Income Non Operating 61,094,000 60,137,000 90,926,000 72,652,000 Interest Expense Non Operating 76,965,000 73,445,000 76,426,000 50,378,000 Pretax Income 2,406,972,000 133,469,000 1,627,065,000 1,852,562,000 3. RATIO ANALYSIS: a. Current Ratio= current assets current liabilities *determines liquidity: the ability to meet short-term debt obligations b. Profit Margin net income x 100 net sales (or revenue) *determines profitability: the ability to generate profit on each dollar of sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started