Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the profits tax payable by Poor Corporation for the year ended 31 March 2020. Ignore overseas taxes. Show all your workings and write

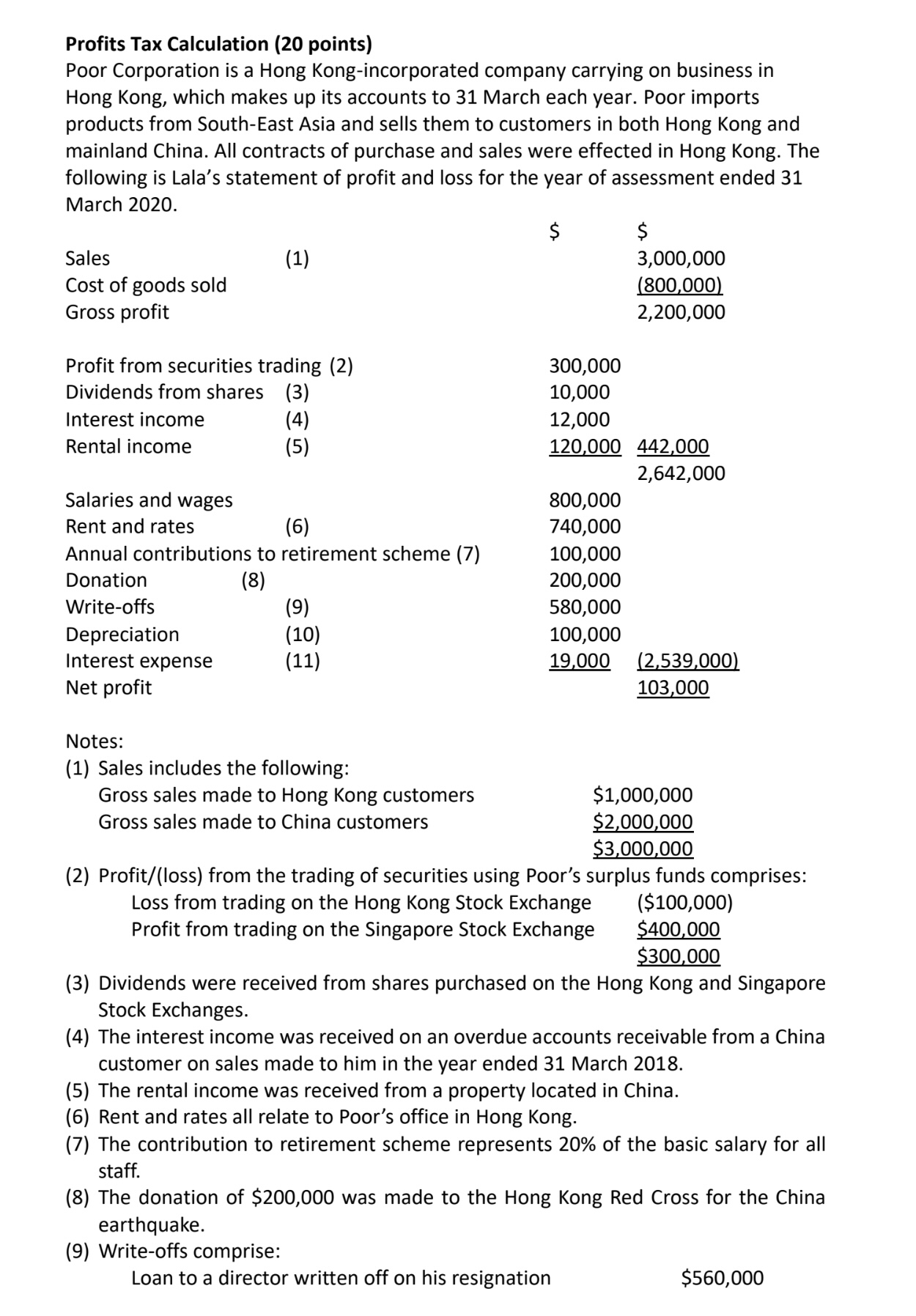

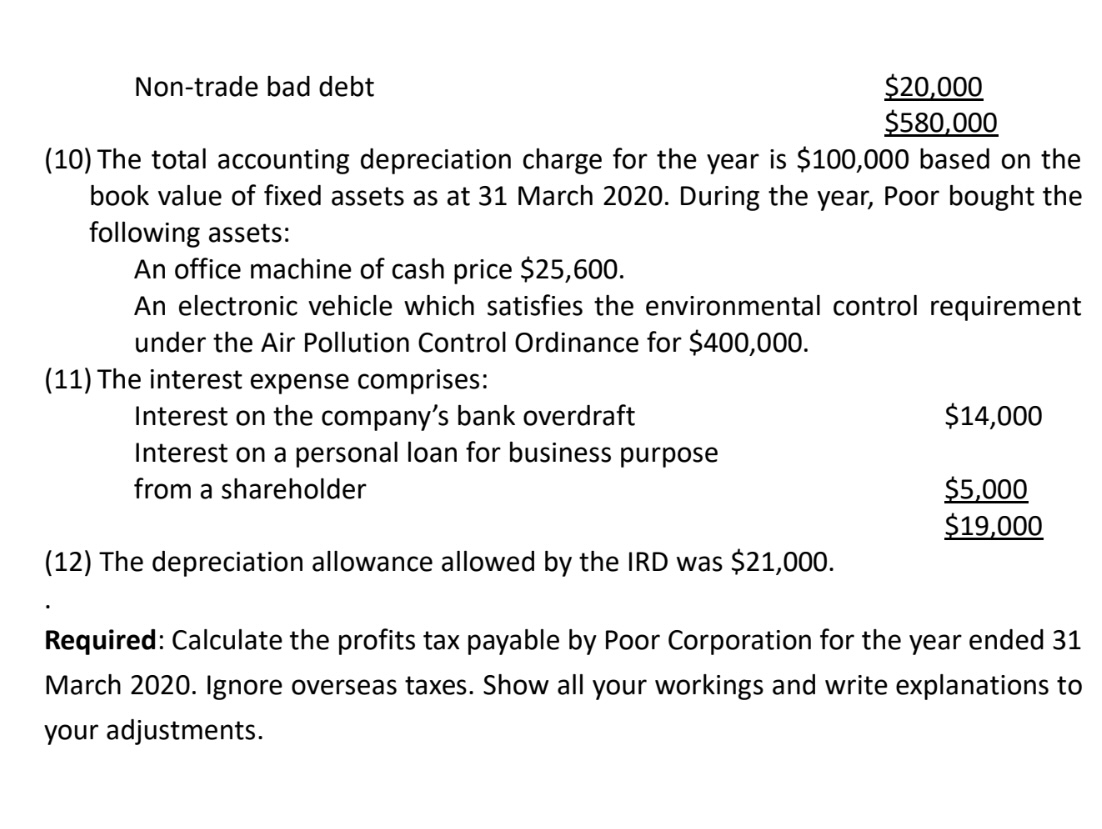

Calculate the profits tax payable by Poor Corporation for the year ended 31 March 2020. Ignore overseas taxes. Show all your workings and write explanations to your adjustments. Profits Tax Calculation (20 points) Poor Corporation is a Hong Kong-incorporated company carrying on business in Hong Kong, which makes up its accounts to 31 March each year. Poor imports products from South-East Asia and sells them to customers in both Hong Kong and mainland China. All contracts of purchase and sales were effected in Hong Kong. The following is Lala's statement of profit and loss for the year of assessment ended 31 March 2020. $ Sales Cost of goods sold Gross profit (1) Profit from securities trading (2) Dividends from shares (3) Interest income (4) Rental income (5) Salaries and wages Rent and rates (6) Annual contributions to retirement scheme (7) Donation (8) Write-offs Depreciation Interest expense Net profit (9) (10) (11) Notes: (1) Sales includes the following: Gross sales made to Hong Kong customers Gross sales made to China customers 300,000 10,000 12,000 120,000 442,000 800,000 740,000 $ 3,000,000 (800,000) 2,200,000 2,642,000 100,000 200,000 580,000 100,000 19,000 (2,539,000) 103,000 Loan to a director written off on his resignation $1,000,000 $2,000,000 $3,000,000 (2) Profit/(loss) from the trading of securities using Poor's surplus funds comprises: Loss from trading on the Hong Kong Stock Exchange Profit from trading on the Singapore Stock Exchange ($100,000) $400,000 $300,000 (3) Dividends were received from shares purchased on the Hong Kong and Singapore Stock Exchanges. (4) The interest income was received on an overdue accounts receivable from a China customer on sales made to him in the year ended 31 March 2018. (5) The rental income was received from a property located in China. (6) Rent and rates all relate to Poor's office in Hong Kong. (7) The contribution to retirement scheme represents 20% of the basic salary for all staff. (8) The donation of $200,000 was made to the Hong Kong Red Cross for the China earthquake. (9) Write-offs comprise: $560,000 $20,000 $580,000 (10) The total accounting depreciation charge for the year is $100,000 based on the book value of fixed assets as at 31 March 2020. During the year, Poor bought the following assets: An office machine of cash price $25,600. Non-trade bad debt An electronic vehicle which satisfies the environmental control requirement under the Air Pollution Control Ordinance for $400,000. (11) The interest expense comprises: Interest on the company's bank overdraft Interest on a personal loan for business purpose from a shareholder (12) The depreciation allowance allowed by the IRD was $21,000. Required: Calculate the profits tax payable by Poor Corporation for the year ended 31 March 2020. Ignore overseas taxes. Show all your workings and write explanations to your adjustments. $14,000 $5,000 $19,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the profits tax payable by Poor Corporation for the year ended 31 March 2020 we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started