Answered step by step

Verified Expert Solution

Question

1 Approved Answer

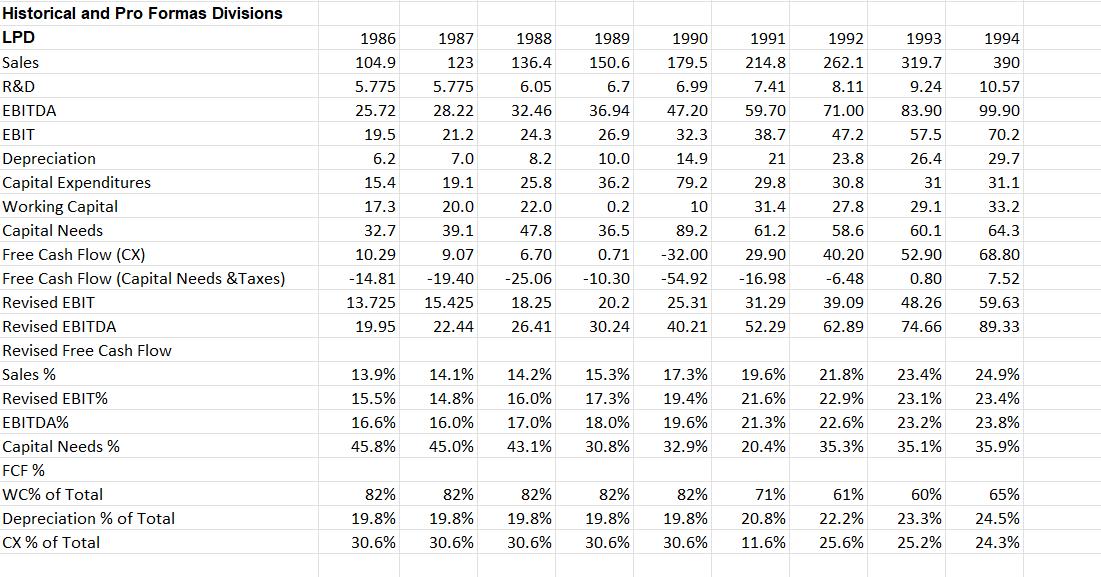

Calculate the projected values of the following from the table below for 1990 to 1994 Cash Working Capital Net Fixed Assets Other Assets Total Assets

Calculate the projected values of the following from the table below for 1990 to 1994

Cash

Working Capital

Net Fixed Assets

Other Assets

Total Assets

Historical and Pro Formas Divisions LPD Sales R&D EBITDA EBIT Depreciation Capital Expenditures Working Capital Capital Needs Free Cash Flow (CX) Free Cash Flow (Capital Needs & Taxes) Revised EBIT Revised EBITDA Revised Free Cash Flow Sales % Revised EBIT% EBITDA% Capital Needs % FCF% WC% of Total Depreciation % of Total CX % of Total 1986 1987 104.9 123 5.775 5.775 25.72 28.22 19.5 21.2 6.2 7.0 15.4 19.1 17.3 20.0 22.0 32.7 39.1 47.8 10.29 9.07 6.70 -14.81 -19.40 -25.06 13.725 15.425 18.25 19.95 22.44 26.41 1988 136.4 6.05 32.46 24.3 8.2 25.8 82% 82% 19.8% 19.8% 30.6% 30.6% 13.9% 14.1% 14.2% 15.3% 15.5% 14.8% 16.0% 17.3% 16.6% 16.0% 17.0% 18.0% 43.1% 30.8% 45.8% 45.0% 1989 1990 150.6 179.5 6.7 6.99 36.94 47.20 26.9 32.3 10.0 14.9 36.2 79.2 0.2 10 36.5 89.2 0.71 -32.00 -10.30 -54.92 20.2 25.31 30.24 40.21 82% 19.8% 30.6% 1991 214.8 7.41 59.70 38.7 21 29.8 31.4 61.2 29.90 -16.98 31.29 52.29 17.3% 19.4% 19.6% 32.9% 20.4% 1992 1993 262.1 319.7 8.11 9.24 71.00 83.90 47.2 57.5 23.8 26.4 30.8 31 27.8 29.1 58.6 60.1 40.20 52.90 -6.48 0.80 39.09 48.26 62.89 1994 390 10.57 99.90 70.2 29.7 31.1 33.2 64.3 68.80 7.52 59.63 74.66 89.33 19.6% 21.8% 23.4% 22.9% 23.1% 21.6% 21.3% 22.6% 23.2% 35.3% 35.1% 82% 82% 71% 61% 20.8% 22.2% 19.8% 19.8% 30.6% 30.6% 11.6% 25.6% 25.2% 60% 23.3% 24.9% 23.4% 23.8% 35.9% 65% 24.5% 24.3%

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the projected values for the given ratios from 1990 to 1994 we will use the provided hi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started