Calculate the projects NPV, IRR, and payback period.

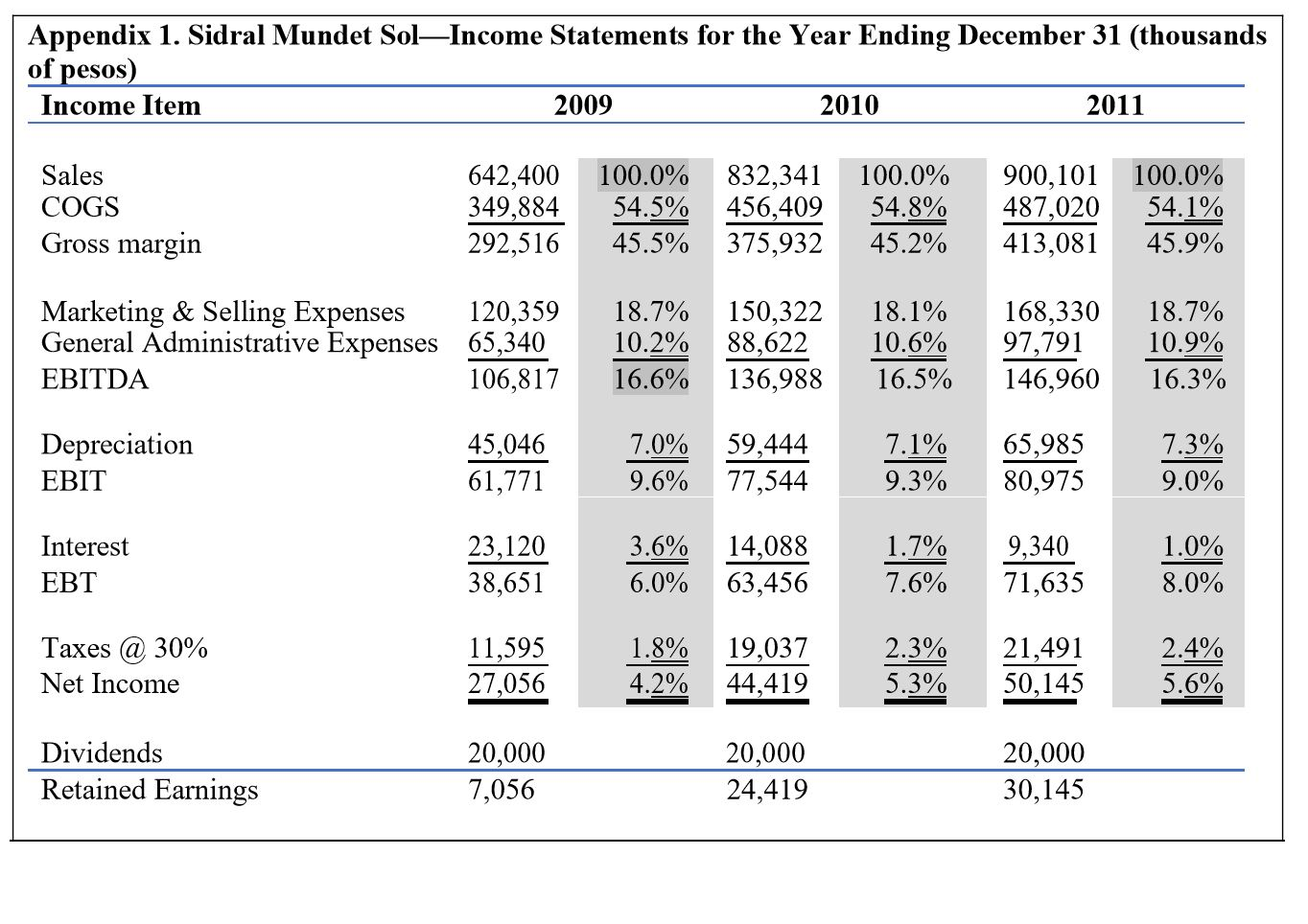

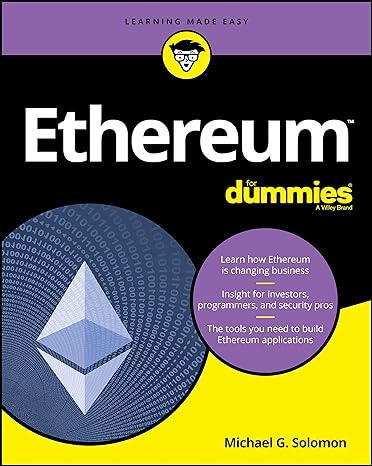

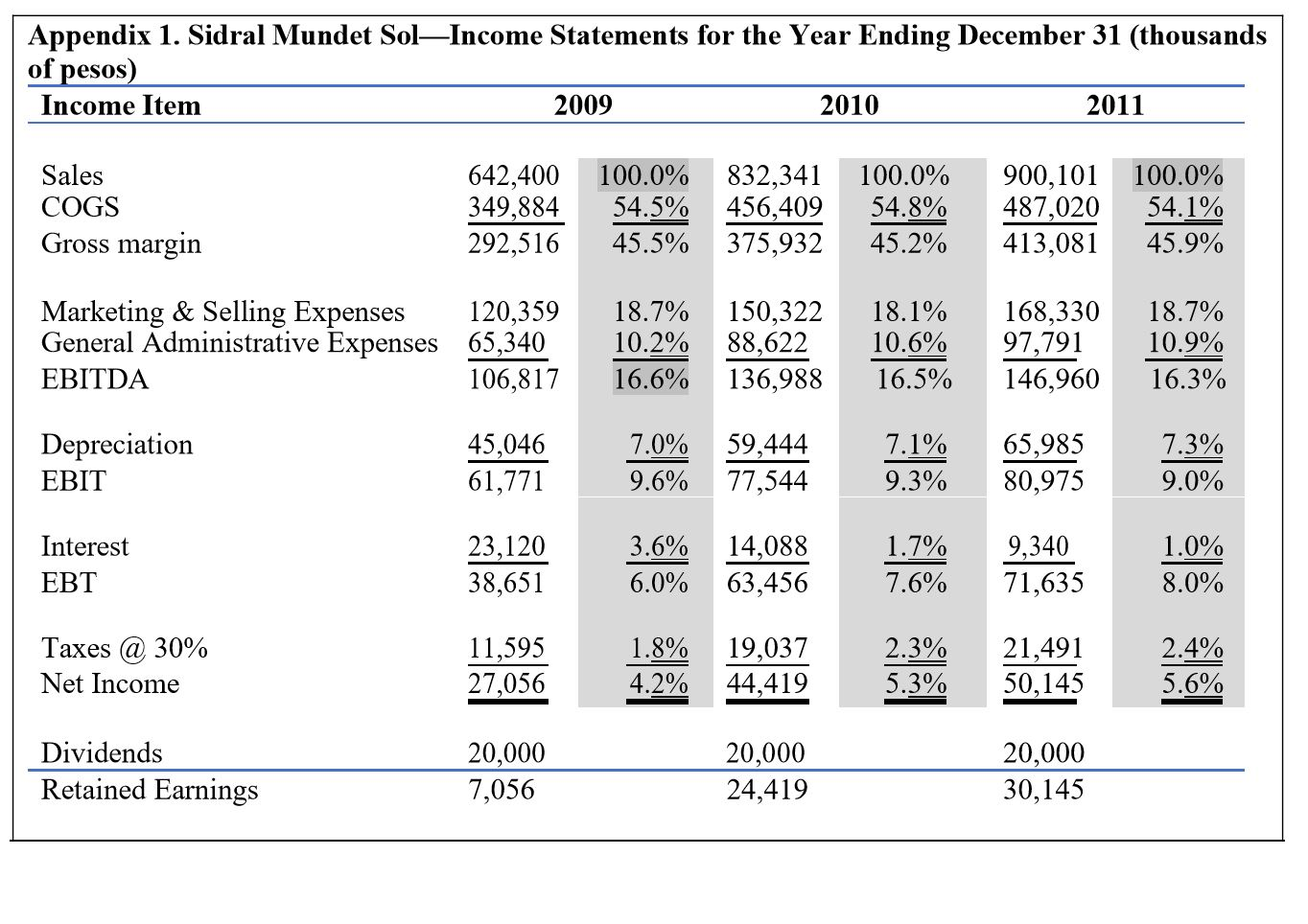

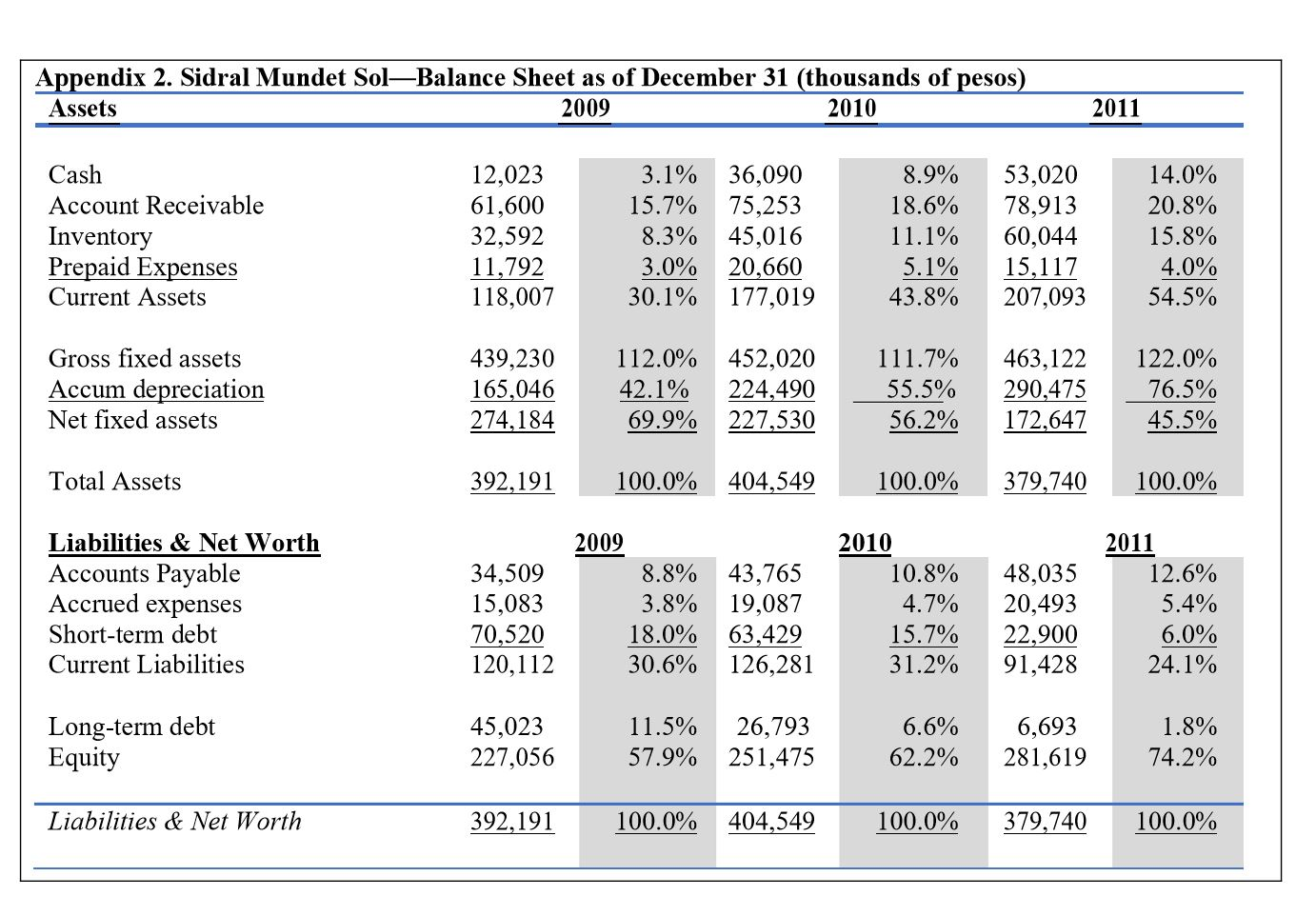

Appendix 1. Sidral Mundet SolIncome Statements for the Year Ending December 31 (thousands of pesos) Income Item 2009 2010 2011 Sales COGS Gross margin 642,400 349,884 292,516 100.0% 54.5% 45.5% 832,341 456,409 375,932 100.0% 54.8% 45.2% 487,020 413,081 100.0% 54.1% 45.9% Marketing & Selling Expenses 120,359 General Administrative Expenses 65,340 EBITDA 106,817 18.7% 10.2% 16.6% 150,322 88,622 136,988 18.1% 10.6% 16.5% 168,330 97,791 146,960 18.7% 10.9% 16.3% 7.0% Depreciation EBIT 45,046 61,771 59,444 77,544 7.1% 9.3% 9.6% 65,985 80,975 7.3% 9.0% 14,088 1.0% Interest 23,120 38,651 6.0% 3.6% 6.0% 63,456 1.7% 7.6% 9,340 71,635 1.8% Taxes @ 30% Net Income 11,595 27,056 19,037 44,419 4.2% 5.3% 5.6 % Dividends Retained Earnings 20,000 7,056 20,000 24,419 20,000 30,145 Appendix 2. Sidral Mundet SolBalance Sheet as of December 31 (thousands of pesos) Assets 2009 2010 2011 Cash Account Receivable Inventory Prepaid Expenses Current Assets 12,023 61,600 32,592 11,792 118,007 3.1% 15.7% 8.3% 3.0% 30.1% 36,090 75,253 45,016 20,660 177,019 8.9% 18.69 11.1% 5.1% 43.8% 53,020 78,913 60,044 15,117 207,093 14.0% 20.8% 15.8% 4.0% 54.5% Gross fixed assets Accum depreciation Net fixed assets 439,230 165,046 274,184 112.0% 42.1% 69.9% 452,020 224,490 227,530 111.7% 55.5% 56.2% 463,122 290,475 172,647 122.0% 76.5% 45.5% Total Assets 392,191 100.0% 404,549 100.0% 379,740 100.0% Liabilities & Net Worth Accounts Payable Accrued expenses Short-term debt Current Liabilities 34,509 15,083 70,520 120,112 2009 8.8% 3.8% 18.0% 30.6% 43,765 19,087 63,429 126,281 2010 10.8% 4.7% 15.7% 31.2% 48,035 20,493 22,900 91,428 2011 12.6% 5.4% 6.0% 24.1% Long-term debt Equity 45,023 227,056 11.5% 57.9% 26,793 251,475 6.6% 62.29 6,693 281,619 1.8% 74.2% Liabilities & Net Worth 392,191 100.0% 404,549 100.0% 379,740 100.0% Appendix 1. Sidral Mundet SolIncome Statements for the Year Ending December 31 (thousands of pesos) Income Item 2009 2010 2011 Sales COGS Gross margin 642,400 349,884 292,516 100.0% 54.5% 45.5% 832,341 456,409 375,932 100.0% 54.8% 45.2% 487,020 413,081 100.0% 54.1% 45.9% Marketing & Selling Expenses 120,359 General Administrative Expenses 65,340 EBITDA 106,817 18.7% 10.2% 16.6% 150,322 88,622 136,988 18.1% 10.6% 16.5% 168,330 97,791 146,960 18.7% 10.9% 16.3% 7.0% Depreciation EBIT 45,046 61,771 59,444 77,544 7.1% 9.3% 9.6% 65,985 80,975 7.3% 9.0% 14,088 1.0% Interest 23,120 38,651 6.0% 3.6% 6.0% 63,456 1.7% 7.6% 9,340 71,635 1.8% Taxes @ 30% Net Income 11,595 27,056 19,037 44,419 4.2% 5.3% 5.6 % Dividends Retained Earnings 20,000 7,056 20,000 24,419 20,000 30,145 Appendix 2. Sidral Mundet SolBalance Sheet as of December 31 (thousands of pesos) Assets 2009 2010 2011 Cash Account Receivable Inventory Prepaid Expenses Current Assets 12,023 61,600 32,592 11,792 118,007 3.1% 15.7% 8.3% 3.0% 30.1% 36,090 75,253 45,016 20,660 177,019 8.9% 18.69 11.1% 5.1% 43.8% 53,020 78,913 60,044 15,117 207,093 14.0% 20.8% 15.8% 4.0% 54.5% Gross fixed assets Accum depreciation Net fixed assets 439,230 165,046 274,184 112.0% 42.1% 69.9% 452,020 224,490 227,530 111.7% 55.5% 56.2% 463,122 290,475 172,647 122.0% 76.5% 45.5% Total Assets 392,191 100.0% 404,549 100.0% 379,740 100.0% Liabilities & Net Worth Accounts Payable Accrued expenses Short-term debt Current Liabilities 34,509 15,083 70,520 120,112 2009 8.8% 3.8% 18.0% 30.6% 43,765 19,087 63,429 126,281 2010 10.8% 4.7% 15.7% 31.2% 48,035 20,493 22,900 91,428 2011 12.6% 5.4% 6.0% 24.1% Long-term debt Equity 45,023 227,056 11.5% 57.9% 26,793 251,475 6.6% 62.29 6,693 281,619 1.8% 74.2% Liabilities & Net Worth 392,191 100.0% 404,549 100.0% 379,740 100.0%