Calculate the rate of growth in revenue for the company. Please show how you found the answer using Excel.

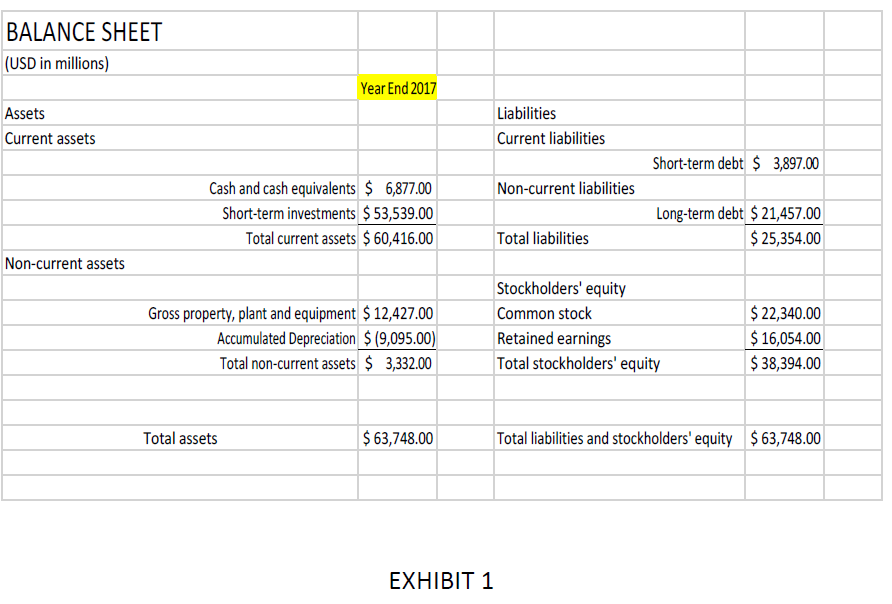

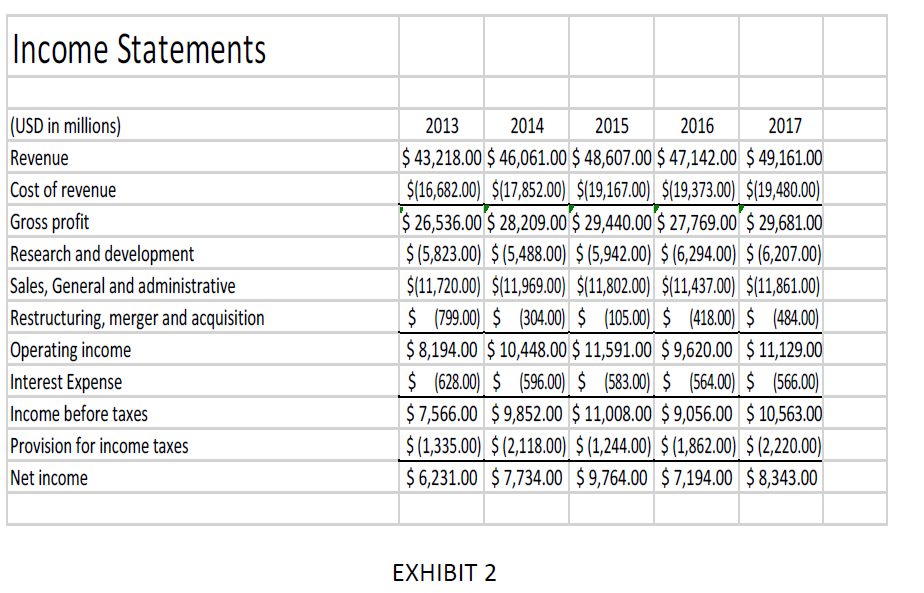

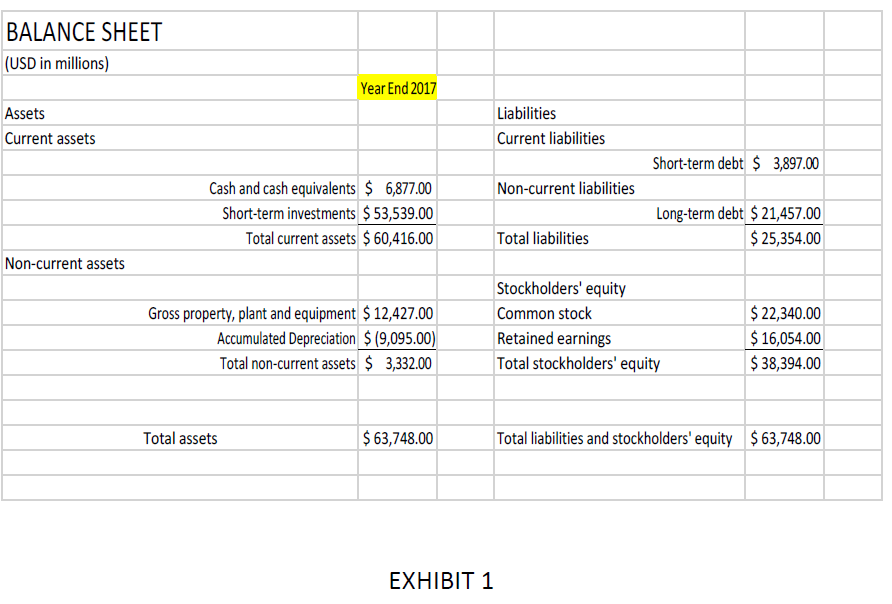

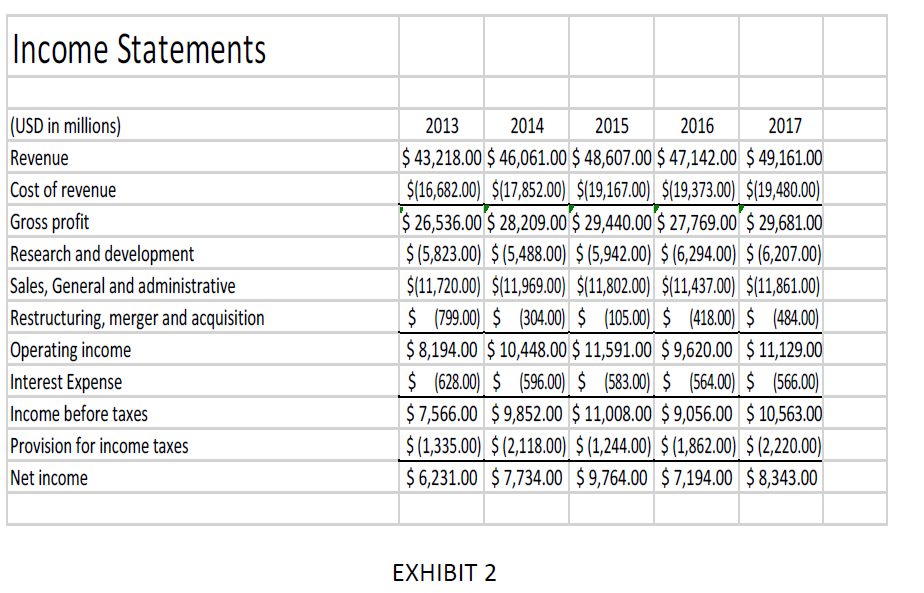

BALANCE SHEET (USD in millions) Year End 2017 Liabilities Current liabilities Assets Current assets Short-term debt 3,897.00 Cash and cash equivalents $6,877.00 Short-term investments 53,539.00 Total current assets $ 60,416.00 Non-current liabilities Long-term debt $21,457.00 $25,354.00 Total liabilities Non-current assets Stockholders' equity Common stock Retained earnings Total stockholders' equity Gross property, plant and equipment $ 12,427.00 Accumulated Depreciation (9,095.00) Total non-current assets 3,332.00 22,340.00 $16,054.00 38,394.00 $63,748.00 $63,748.00 Total liabilities and stockholders' equity Total assets EXHIBIT 1 Income Statements (USD in millions) Revenue Cost of revenue Gross profit Research and development Sales, General and administrative Restructuring, merger and acquisition Operating income Interest Expense Income before taxes Provision for income taxes Net income 2013201420152016 43,218.00 $ 46,061.00 $48,607.00 $47,142.00 $49,161.00 $(16,682.00 $(17,852.00) $(19,167.00) $19,373.00) $19,480.00) $26,536.00 $ 28,209.00$29,440.00$27,769.00 $29,681.00 $(5,823.00) $(5,488.00) $(5,942.00) $(6,294.00) (6,207.00) $(11,720.00) $(11969.00) $(11,802.00) $(11437.00 $(11,861.00 $799.00$ 304.00 $ (105.00) $ (418.00) $ 484.00) 8,194.00 $10,448.00 $11,591.00 $9,620.00 $11,129.00 $ (628.00 $ (596.00) $ (583.00) $ (564.00)$ (566.00) $7,566.00 $9,852.00 $11,008.00 $9,056.00 $10,563.00 $(1,335.00) $(2,118.00) $(1,244.00) $(1,862.00) $(2,220.00) 6,231.00 $7,734.00 $9,764.00 $7,194.00 $8,343.00 2017 EXHIBIT 2 BALANCE SHEET (USD in millions) Year End 2017 Liabilities Current liabilities Assets Current assets Short-term debt 3,897.00 Cash and cash equivalents $6,877.00 Short-term investments 53,539.00 Total current assets $ 60,416.00 Non-current liabilities Long-term debt $21,457.00 $25,354.00 Total liabilities Non-current assets Stockholders' equity Common stock Retained earnings Total stockholders' equity Gross property, plant and equipment $ 12,427.00 Accumulated Depreciation (9,095.00) Total non-current assets 3,332.00 22,340.00 $16,054.00 38,394.00 $63,748.00 $63,748.00 Total liabilities and stockholders' equity Total assets EXHIBIT 1 Income Statements (USD in millions) Revenue Cost of revenue Gross profit Research and development Sales, General and administrative Restructuring, merger and acquisition Operating income Interest Expense Income before taxes Provision for income taxes Net income 2013201420152016 43,218.00 $ 46,061.00 $48,607.00 $47,142.00 $49,161.00 $(16,682.00 $(17,852.00) $(19,167.00) $19,373.00) $19,480.00) $26,536.00 $ 28,209.00$29,440.00$27,769.00 $29,681.00 $(5,823.00) $(5,488.00) $(5,942.00) $(6,294.00) (6,207.00) $(11,720.00) $(11969.00) $(11,802.00) $(11437.00 $(11,861.00 $799.00$ 304.00 $ (105.00) $ (418.00) $ 484.00) 8,194.00 $10,448.00 $11,591.00 $9,620.00 $11,129.00 $ (628.00 $ (596.00) $ (583.00) $ (564.00)$ (566.00) $7,566.00 $9,852.00 $11,008.00 $9,056.00 $10,563.00 $(1,335.00) $(2,118.00) $(1,244.00) $(1,862.00) $(2,220.00) 6,231.00 $7,734.00 $9,764.00 $7,194.00 $8,343.00 2017 EXHIBIT 2