Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Imagine an island a short distance off the east coast of a country. This island is called Onus, and it has a population

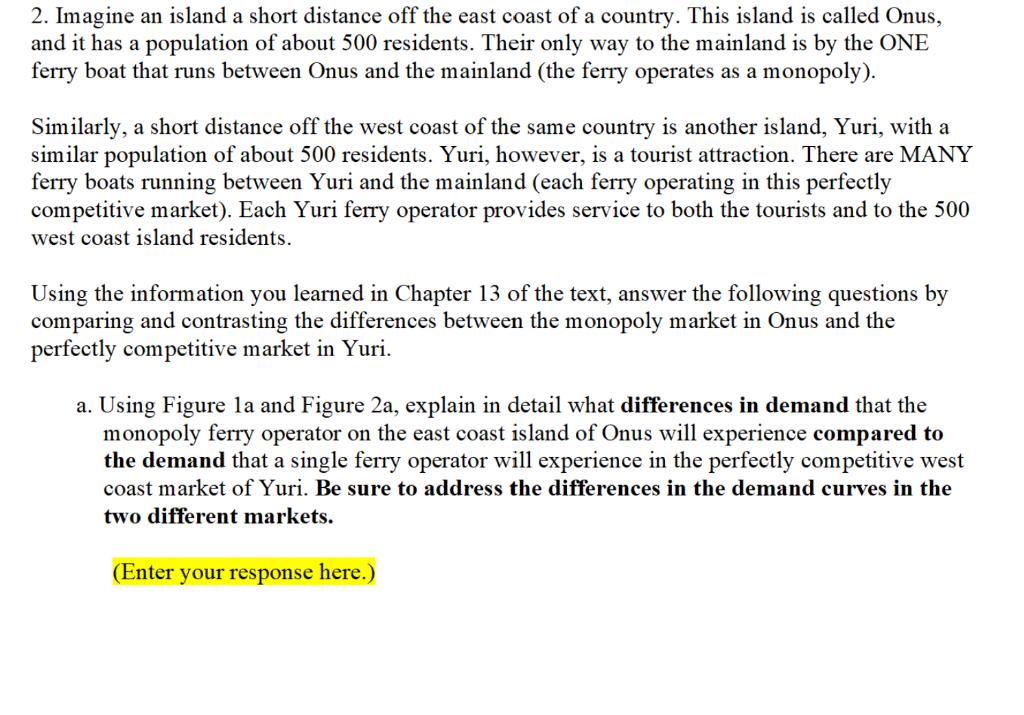

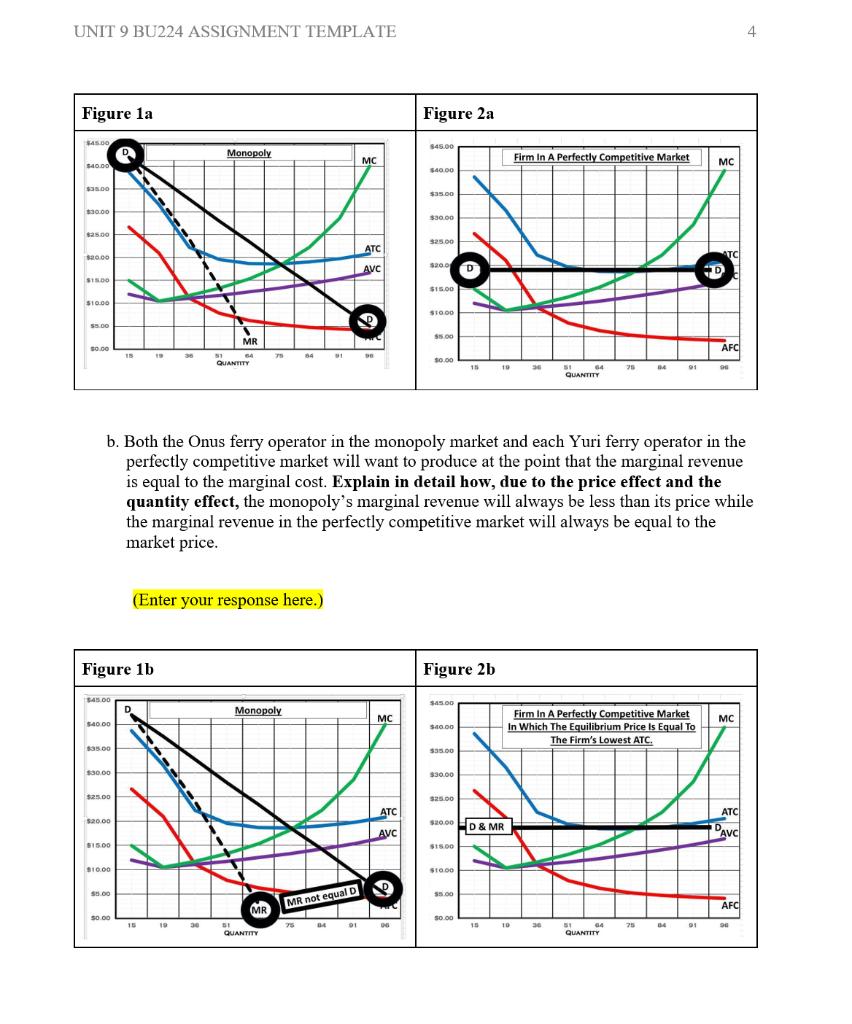

2. Imagine an island a short distance off the east coast of a country. This island is called Onus, and it has a population of about 500 residents. Their only way to the mainland is by the ONE ferry boat that runs between Onus and the mainland (the ferry operates as a monopoly). Similarly, a short distance off the west coast of the same country is another island, Yuri, with a similar population of about 500 residents. Yuri, however, is a tourist attraction. There are MANY ferry boats running between Yuri and the mainland (each ferry operating in this perfectly competitive market). Each Yuri ferry operator provides service to both the tourists and to the 500 west coast island residents. Using the information you learned in Chapter 13 of the text, answer the following questions by comparing and contrasting the differences between the monopoly market in Onus and the perfectly competitive market in Yuri. a. Using Figure la and Figure 2a, explain in detail what differences in demand that the monopoly ferry operator on the east coast island of Onus will experience compared to the demand that a single ferry operator will experience in the perfectly competitive west coast market of Yuri. Be sure to address the differences in the demand curves in the two different markets. (Enter your response here.)

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a There are several key differences in demand that the monopoly ferry operator on the east coast island of Onus will experience compared to the demand ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started