Answered step by step

Verified Expert Solution

Question

1 Approved Answer

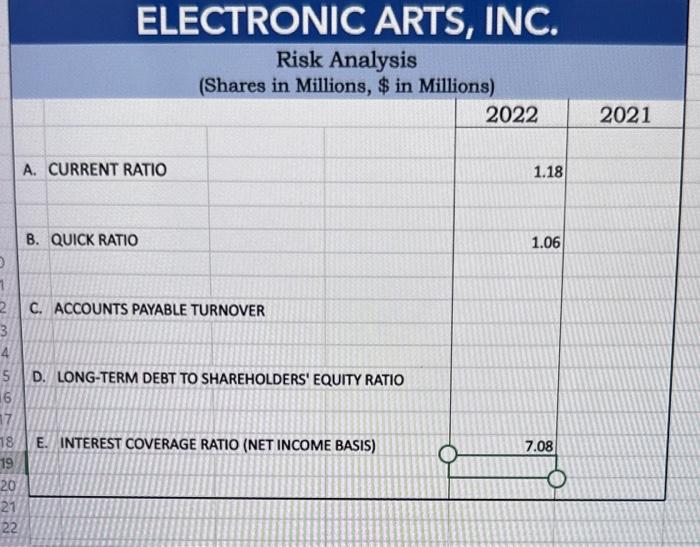

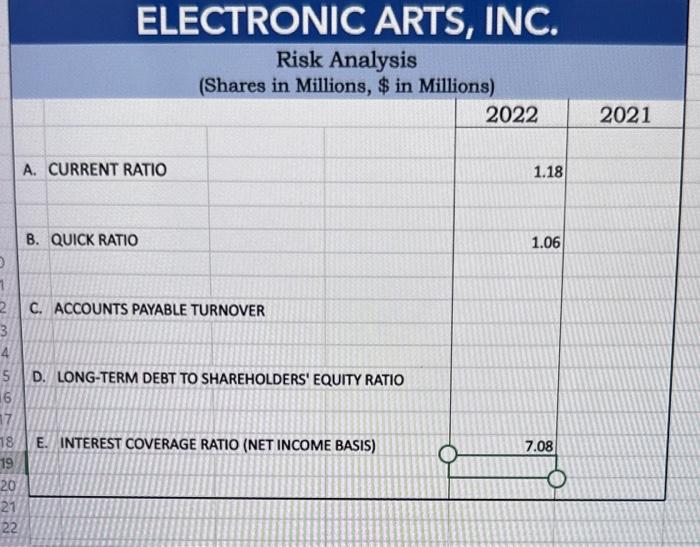

Calculate the return on assets and Calculate the fixed asset turnover Calculate the Risk Analysis ELECTRONIC ARTS, INC. Risk Analysis (Shares in Millions, $ in

Calculate the return on assets and Calculate the fixed asset turnover

Calculate the Risk Analysis

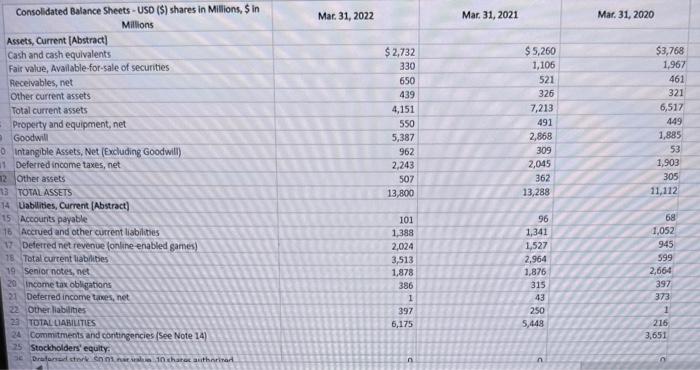

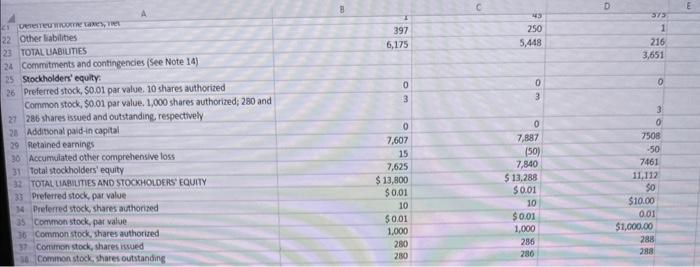

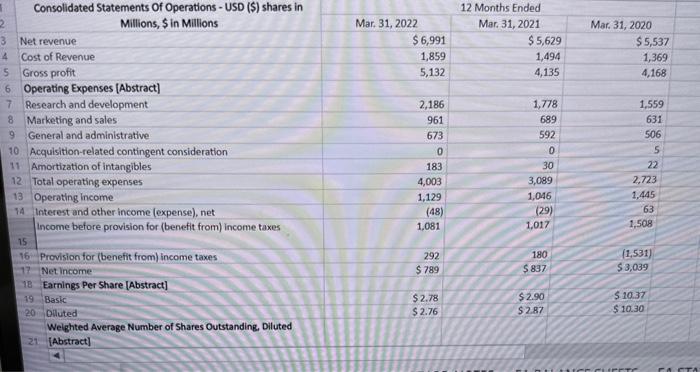

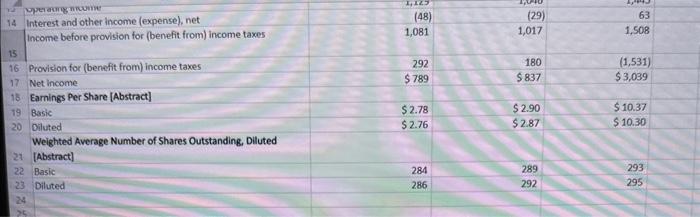

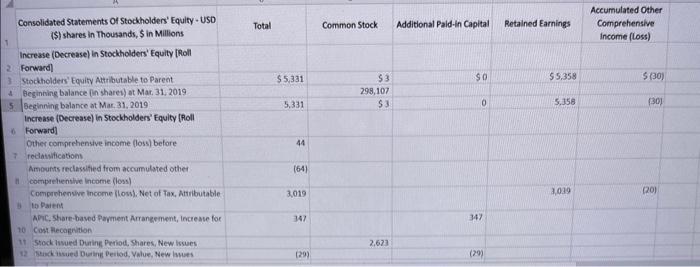

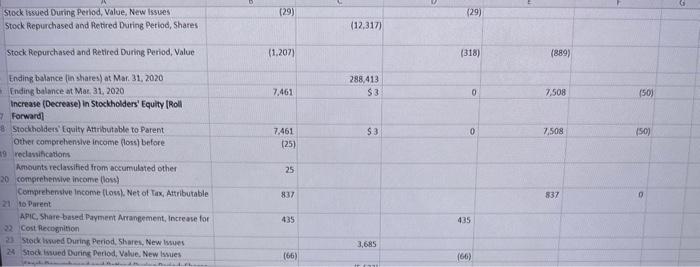

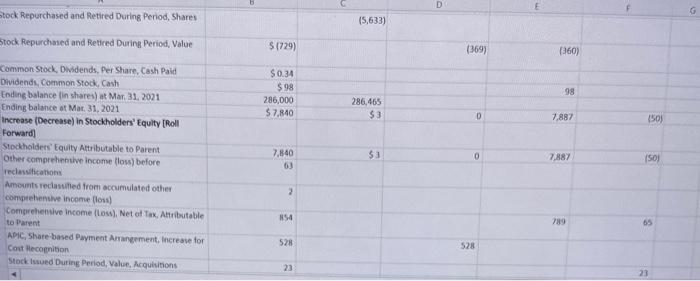

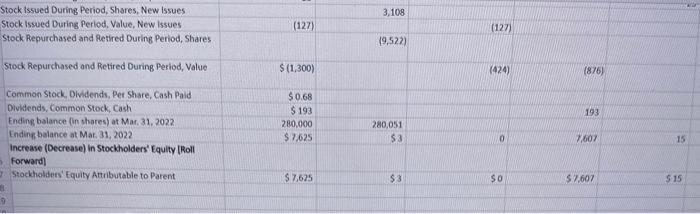

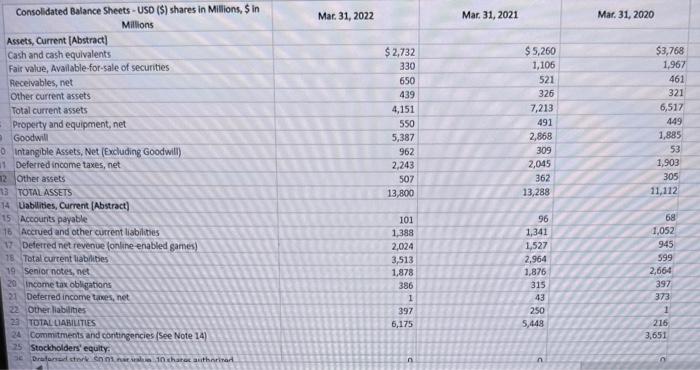

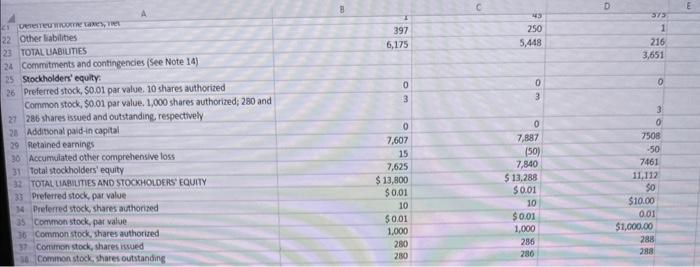

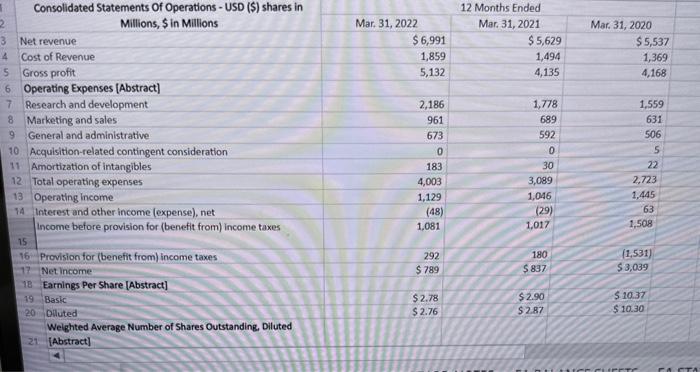

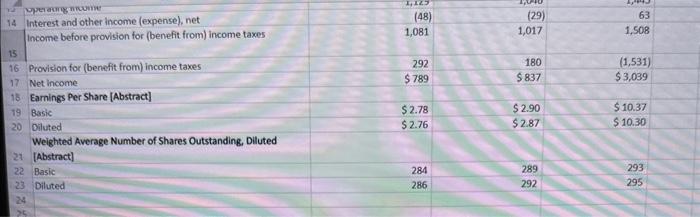

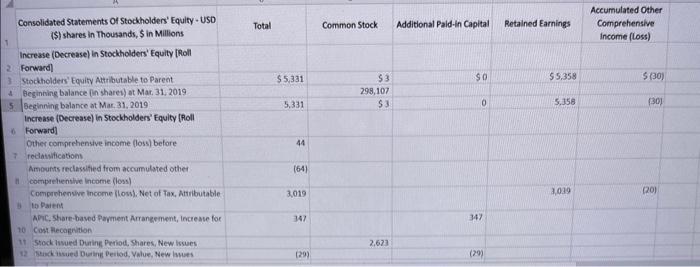

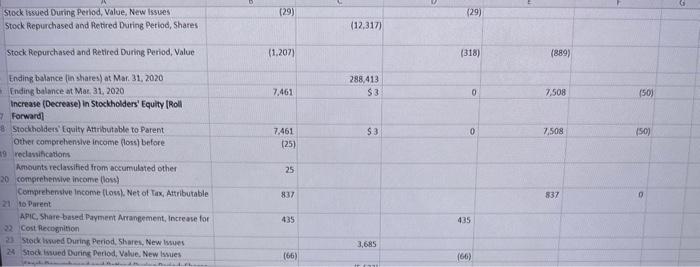

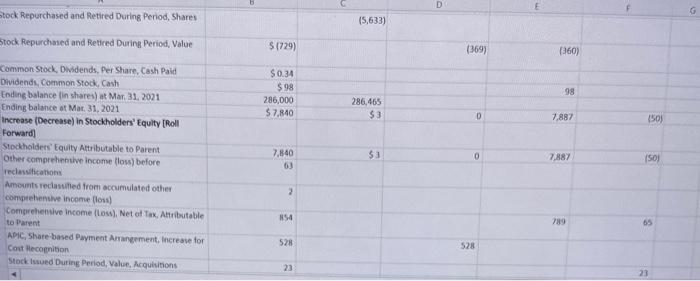

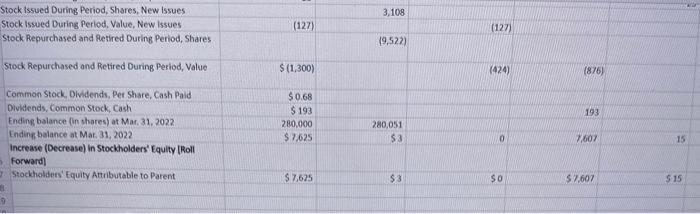

ELECTRONIC ARTS, INC. Risk Analysis (Shares in Millions, $ in Millions) \begin{tabular}{|l|l|} \hline 2022 & 2021 \\ \hline \end{tabular} A. CURRENT RATIO B. QUICK RATIO C. ACCOUNTS PAYABLE TURNOVER D. LONG-TERM DEBT TO SHAREHOLDERS' EQUITY RATIO E. INTEREST COVERAGE RATIO (NET INCOME BASIS) 22 Consolidated Statements Of Operations - USD (\$) shares in 12 Months Ended Welghted Average Number of Shares Outstanding, Diluted 21. [Abstract] 14 Interest and other income (expense), net income before provision for (benefit from) income taxes \begin{tabular}{rrr} (48) & (29) & 63 \\ \hline 1,081 & 1,017 & 1,508 \end{tabular} 15 16 Provision for (benefit from) income taxes 17 Net income 16. Earnings Per Share [Abstract] 19 Basic 20 Diluted $2.78 $2.76 $2.90 $2.87 $10.37 Weighted Average Number of Shares Outstanding, Diluted 21. [Abstract] 22 Basic 23 Diluted 284 286 289292293295 Accumulated Other Consolidated Statements of Stockholders' Equity- USO Comprehensive (\$) shares in Thousands, 5 in Millions incorne (loss) Increase (Decrease) in Stockholders' Equity [Roll 2. Forward) 3. Stockholders' Eowity Atributable to Parent. 4. Beginining balance (in share1) at Mar, 31, 2019 5. Geginning balance at Mar, 31, 2019 increase (Decrease) in Stockholders' Equity (fholl 6. Fonward] Other comprehensive income (loss) belore 44 7. redatwitications Amounts reclassified from accumulated other (64) II Comparelientive income (loss) Compechenvive income (los). Net of Tax, Atributable 3.019 3,039 (20) 13. 10 Paient APic, Share-based fayment Aranesment, Increase for 347 347 10 Cost thecaenition it Stock isued During Period, Shares, New lswes 12. Dasckinsued Dunion Period, Ynlue, New lapues [29) (20) Stock tisued During Petlod, Value, New Issues (29) (29) Stock Repurchased and Retbred During Period, Shares (12,317) Stock Repurchased and Retired During Period, Value (1.207) (318) (289) Ending balance (in shares) at Mar. 31, 2020 Ending balance at Mar. 31, 2020 Increase (Decrease) in Stockholders' Equity [Roll Forward] Stockholders' ' tquity Attributbble to Parent other comprehensive income floss) before reclavificedion Amounts reclassified from accumulyted other comprebensive income (loss) Comprehensive income (lon), Net of Tax, Attributable to Pareat Apic, Share-bnsed Payment Arrangement, Increave for 22 Cost Recosnition 2) Stock twoed During Period, Shares, New lsues 24 Stode bused Durine Period, Value. New lsuies (66) (66) tock Repurchased and Retired During Period, Shares (5,633) Stock Repurchased and Reticed During Period, Value $(729) (369) (360) Common Stock, Dwidends, Per Share, Cash Paid $0.31 bevidends, Common Stock, Cash Ending balance (in sharei) at Mar, 31, 2021 Ending balance ot Mat, 31, 2021 Increase (Decrease) in Stockholders' Equity [Roll (50) Forward Stodkholders' Equity Attributable to Parent other comprehentwe income (loss) before 7.840 63 $3 7,887 (50) recluwiticatons Amounts reclasulied from accumulated other convprehenshe income (lows) Comgrehenive income (loss), Net of Tax, Atributable to Parent HS4 APIC, 5hate based Payment Arrangement, increase for Cout Hecognibon 528 528 Stock lssued Durien Period, Value, Arquivitions 23 Stock issued During Period, Shares, New Issues 3,108 Stockissued During Perlod, Value, New issues (127) (127) stock Repurchased and Retired During Period, Shares (9,527) Stock Repurchased and Retired During Peslod, Value $(1,300) (424) (876) Common Stock, Dividends, Per Share, Cash Pald Dividends, Common Stock, Cash Ending balance (in shares) at Mar, 31, 2022 Ending balance at Mat, 31, 2022 increase (Decrease) in Stockholders" Equity IRoll forward] Stockhalders' Equity Antibutable to Parent $7,625 $3 50 $7,607515 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started