Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the sustainable growth rate for East Coast Yacht Clubs. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming

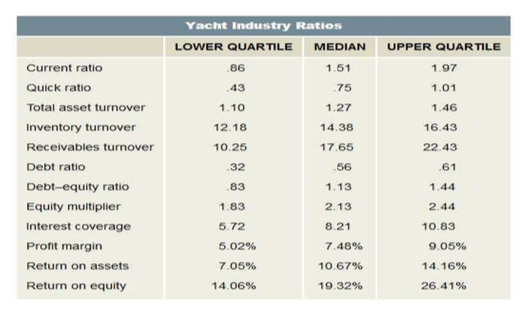

Calculate the sustainable growth rate for East Coast Yacht Clubs. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe?

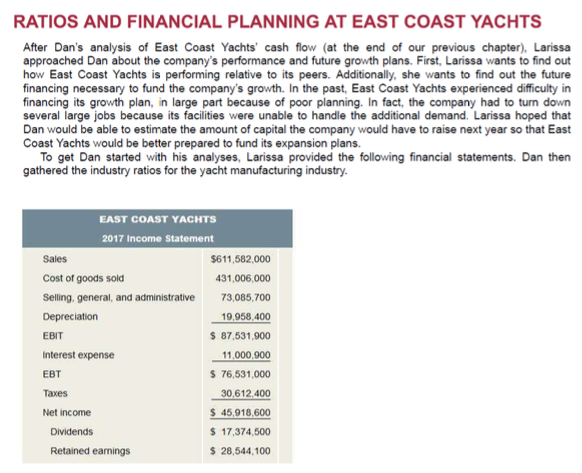

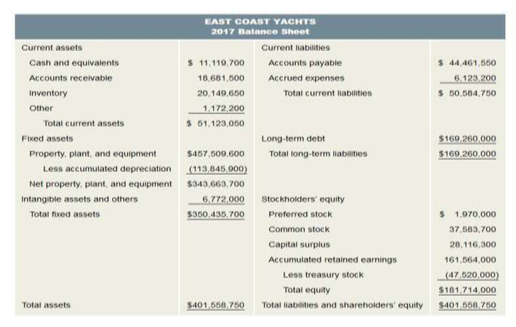

RATIOS AND FINANCIAL PLANNING AT EAST COAST YACHTS After Dan's analysis of East Coast Yachts' cash flow (at the end of our previous chapter), Larissa approached Dan about the company's performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers. Additionally, she wants to find out the future financing necessary to fund the company's growth. In the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning. In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand. Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans. To get Dan started with his analyses, Larissa provided the following financial statements. Dan then gathered the industry ratios for the yacht manufacturing industry. EAST COAST YACHTS 2017 Income Statement Sales $611,582,000 431,006,000 Cost of goods sold Selling, general, and administrative 73,085,700 Depreciation 19,958,400 87,531,900 EBIT Interest expense 11,000,900 EBT 76,531,000 Taxes 30,612,400 45,918,600 Net income 17,374,500 Dividends Retained earnings 28,544,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started