Answered step by step

Verified Expert Solution

Question

1 Approved Answer

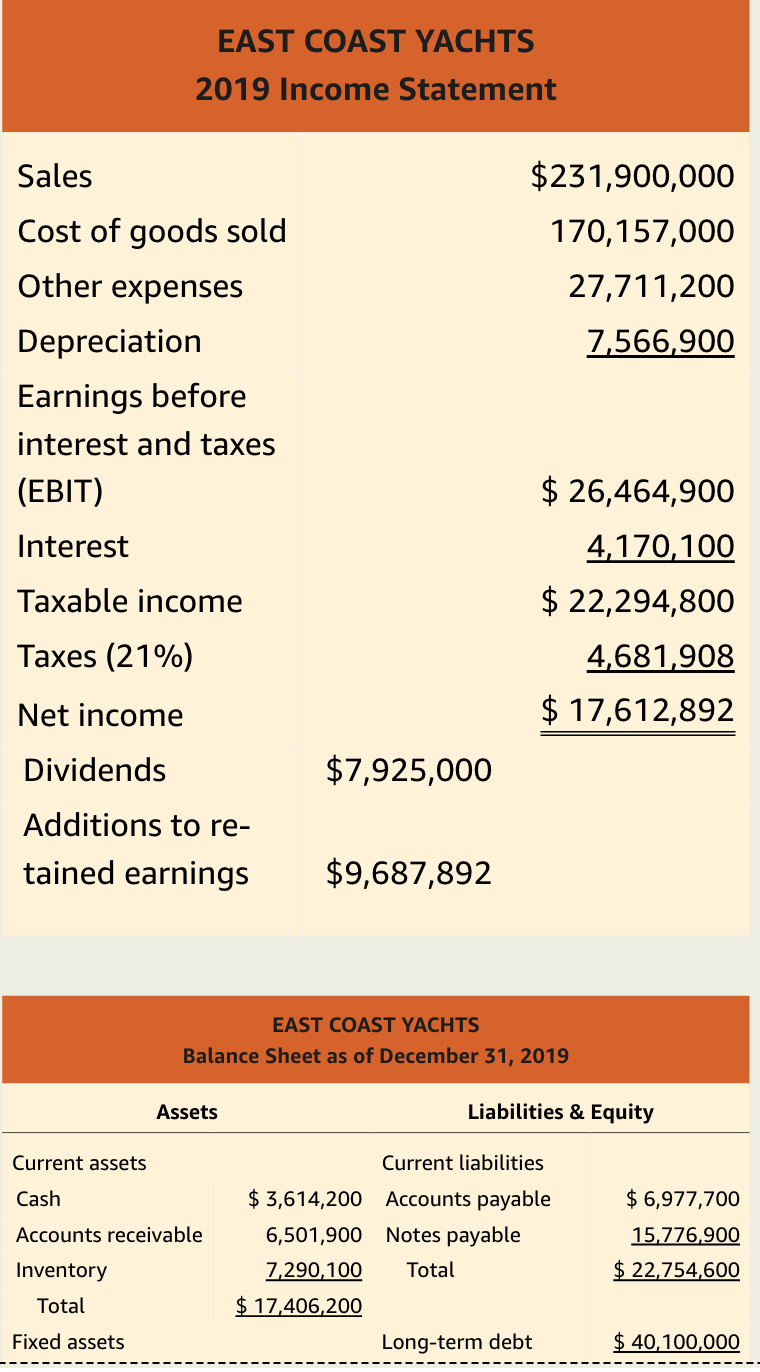

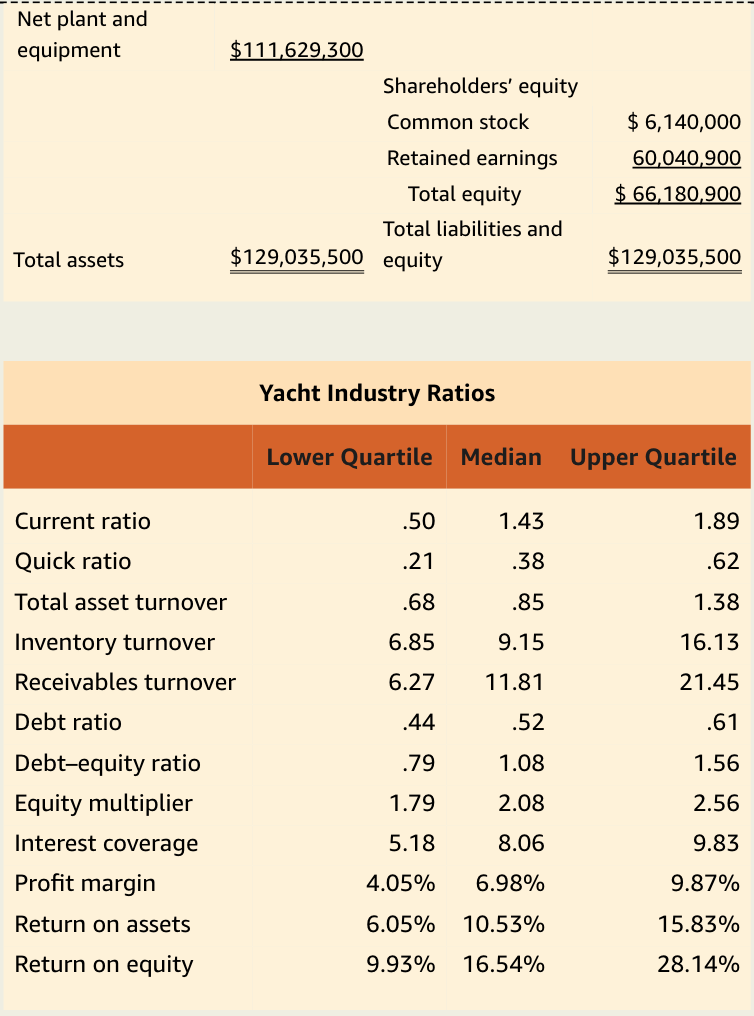

Calculate the sustainable growth rate of East Coast Yachts. Calculate EFN and prepare pro forma income statements and balance sheets assuming growth at precisely this

Calculate the sustainable growth rate of East Coast Yachts. Calculate EFN and prepare pro forma income statements and balance sheets assuming growth at precisely this rate.

i

i

EAST COAST YACHTS 2019 Income Statement Sales $231,900,000 170,157,000 27,711,200 7,566,900 Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest Taxable income $ 26,464,900 4,170,100 $ 22,294,800 4,681,908 $ 17,612,892 Taxes (21%) Net income Dividends $7,925,000 Additions to re- tained earnings $9,687,892 EAST COAST YACHTS Balance Sheet as of December 31, 2019 Assets Liabilities & Equity Current assets Current liabilities Cash Accounts receivable $ 3,614,200 Accounts payable 6,501,900 Notes payable 7,290,100 Total $ 17,406,200 Long-term debt $ 6,977,700 15,776,900 $ 22,754,600 Inventory Total Fixed assets $ 40,100,000 Net plant and equipment $ 6,140,000 $111,629,300 Shareholders' equity Common stock Retained earnings Total equity Total liabilities and $129,035,500 equity 60,040,900 $ 66,180,900 Total assets $129,035,500 Yacht Industry Ratios Lower Quartile Median Upper Quartile Current ratio .50 1.43 1.89 Quick ratio .21 .38 .62 Total asset turnover .68 .85 1.38 6.85 9.15 16.13 Inventory turnover Receivables turnover 6.27 11.81 21.45 Debt ratio .44 .52 .61 .79 1.08 1.56 1.79 2.08 2.56 Debt-equity ratio Equity multiplier Interest coverage Profit margin 5.18 8.06 9.83 4.05% 6.98% 9.87% Return on assets 6.05% 10.53% 15.83% Return on equity 9.93% 16.54% 28.14% EAST COAST YACHTS 2019 Income Statement Sales $231,900,000 170,157,000 27,711,200 7,566,900 Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest Taxable income $ 26,464,900 4,170,100 $ 22,294,800 4,681,908 $ 17,612,892 Taxes (21%) Net income Dividends $7,925,000 Additions to re- tained earnings $9,687,892 EAST COAST YACHTS Balance Sheet as of December 31, 2019 Assets Liabilities & Equity Current assets Current liabilities Cash Accounts receivable $ 3,614,200 Accounts payable 6,501,900 Notes payable 7,290,100 Total $ 17,406,200 Long-term debt $ 6,977,700 15,776,900 $ 22,754,600 Inventory Total Fixed assets $ 40,100,000 Net plant and equipment $ 6,140,000 $111,629,300 Shareholders' equity Common stock Retained earnings Total equity Total liabilities and $129,035,500 equity 60,040,900 $ 66,180,900 Total assets $129,035,500 Yacht Industry Ratios Lower Quartile Median Upper Quartile Current ratio .50 1.43 1.89 Quick ratio .21 .38 .62 Total asset turnover .68 .85 1.38 6.85 9.15 16.13 Inventory turnover Receivables turnover 6.27 11.81 21.45 Debt ratio .44 .52 .61 .79 1.08 1.56 1.79 2.08 2.56 Debt-equity ratio Equity multiplier Interest coverage Profit margin 5.18 8.06 9.83 4.05% 6.98% 9.87% Return on assets 6.05% 10.53% 15.83% Return on equity 9.93% 16.54% 28.14%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started