Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the total average Cost. Calculate the Marginal Cost. Calculate the total Income Tax of Andrews company. Mr. Andrews is the CEO of Victoria Ltd.

Calculate the total average Cost.

Calculate the total average Cost.Calculate the Marginal Cost.

Calculate the total Income Tax of Andrews company.

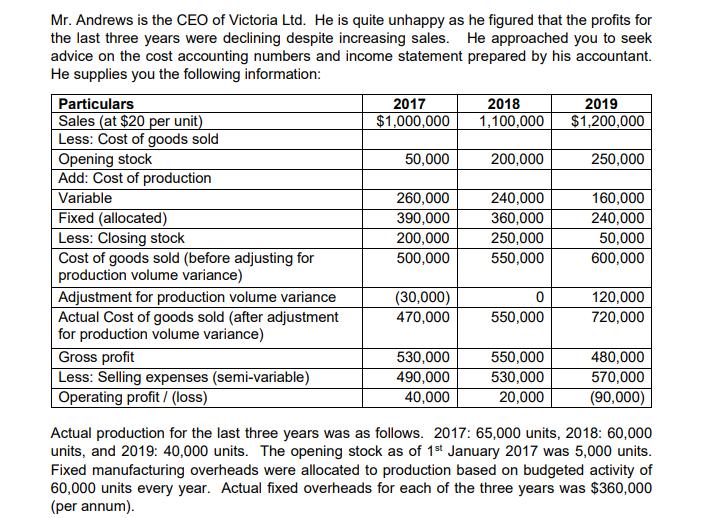

Mr. Andrews is the CEO of Victoria Ltd. He is quite unhappy as he figured that the profits for the last three years were declining despite increasing sales. He approached you to seek advice on the cost accounting numbers and income statement prepared by his accountant. He supplies you the following information: Particulars Sales (at $20 per unit) Less: Cost of goods sold Opening stock Add: Cost of production Variable 2017 $1,000,000 2018 1,100,000 2019 $1,200,000 50,000 200,000 250,000 260,000 240,000 160,000 Fixed (allocated) 390,000 360,000 240,000 Less: Closing stock 200,000 250,000 50,000 Cost of goods sold (before adjusting for 500,000 550,000 600,000 production volume variance) Adjustment for production volume variance (30,000) 0 120,000 Actual Cost of goods sold (after adjustment 470,000 550,000 720,000 for production volume variance) Gross profit 530,000 550,000 480,000 Less: Selling expenses (semi-variable) 490,000 530,000 570,000 Operating profit/(loss) 40,000 20,000 (90,000) Actual production for the last three years was as follows. 2017: 65,000 units, 2018: 60,000 units, and 2019: 40,000 units. The opening stock as of 1st January 2017 was 5,000 units. Fixed manufacturing overheads were allocated to production based on budgeted activity of 60,000 units every year. Actual fixed overheads for each of the three years was $360,000 (per annum).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total average cost and the marginal cost we will need to perform the following step...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started