Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DHA Pharmaceutical Company produces three drugs: Diomycin, Homycin, and Addolin. Since its inception four years ago, DHA has used direct labor hours (DLHS) to

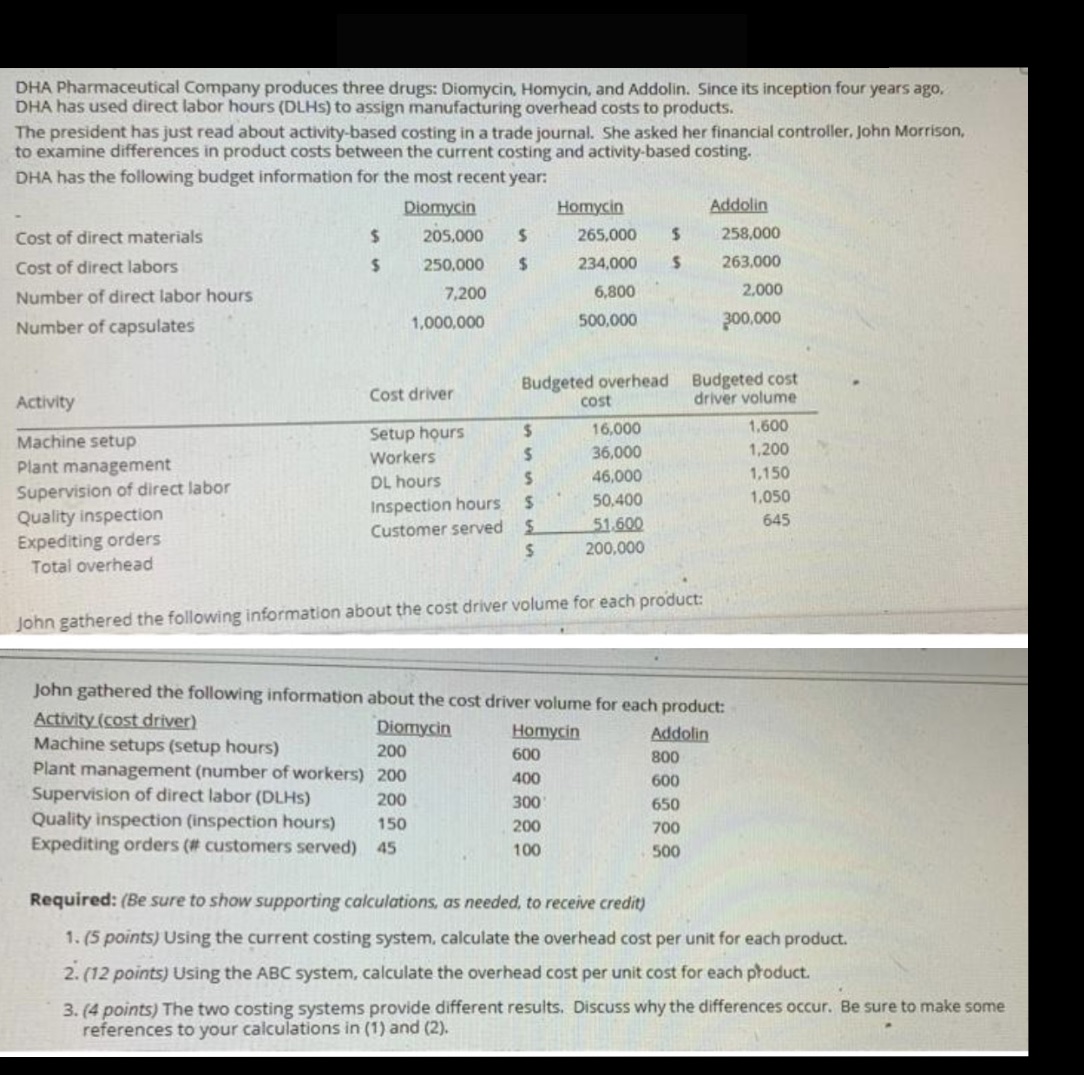

DHA Pharmaceutical Company produces three drugs: Diomycin, Homycin, and Addolin. Since its inception four years ago, DHA has used direct labor hours (DLHS) to assign manufacturing overhead costs to products. The president has just read about activity-based costing in a trade journal. She asked her financial controller, John Morrison, to examine differences in product costs between the current costing and activity-based costing. DHA has the following budget information for the most recent year: Diomycin Homycin Addolin Cost of direct materials $ 205,000 $ Cost of direct labors $ 250,000 $ Number of direct labor hours 7,200 265,000 $ 234,000 6,800 258,000 $ 263,000 2,000 Number of capsulates 1,000,000 500,000 300,000 Activity Machine setup Cost driver Budgeted overhead Budgeted cost cost driver volume Setup hours $ 16,000 1,600 Plant management Workers S 36,000 1,200 Supervision of direct labor Quality inspection DL hours S 46,000 1,150 Inspection hours $ 50,400 1,050 Expediting orders Total overhead Customer served S 51,600 645 $ 200,000 John gathered the following information about the cost driver volume for each product: John gathered the following information about the cost driver volume for each product: Activity (cost driver) Machine setups (setup hours) Diomycin 200 Homycin Addolin 600 800 Plant management (number of workers) 200 400 600 Supervision of direct labor (DLHS) 200 300 650 Quality inspection (inspection hours) 150 200 700 Expediting orders (# customers served) 45 100 500 Required: (Be sure to show supporting calculations, as needed, to receive credit) 1. (5 points) Using the current costing system, calculate the overhead cost per unit for each product. 2. (12 points) Using the ABC system, calculate the overhead cost per unit cost for each product. 3. (4 points) The two costing systems provide different results. Discuss why the differences occur. Be sure to make some references to your calculations in (1) and (2).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Using the current costing system calculate the overhead cost per unit for each product Total overhead cost 36000 46000 50400 51600 645 184645 Overhead rate per direct labor hour 184645 7200 6800 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started