Calculate the total budgeted manufacturing overheads for the next financial year. Mars (Pty) Ltd manufactures two products, Acas and Bebs at their factory in Salt

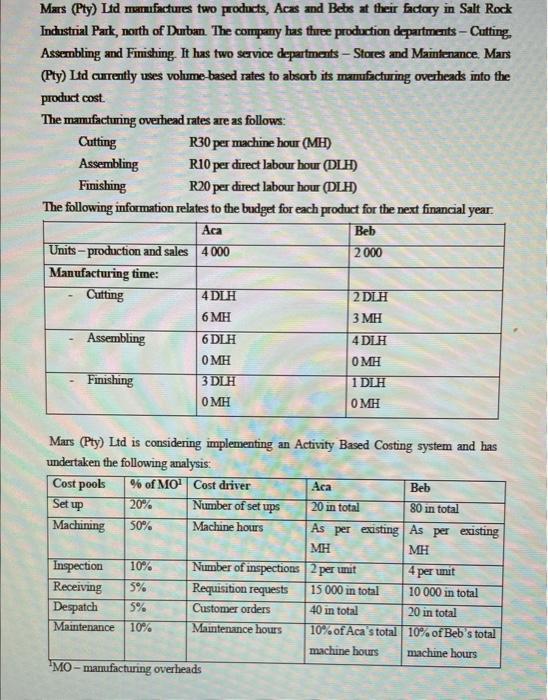

Mars (Pty) Ltd manufactures two products, Acas and Bebs at their factory in Salt Rock Industrial Park, north of Durban. The company has three production departments - Cutting, Assembling and Finishing. It has two service departments - Stores and Maintenance. Mars (Pty) Ltd currently uses volume-based rates to absorb its manufacturing overheads into the product cost. The manufacturing overhead rates are as follows: Cutting R30 per machine hour (MH) R10 per direct labour hour (DLH) Assembling Finishing R20 per direct labour hour (DLH) The following information relates to the budget for each product for the next financial year. Aca Beb Units-production and sales 4 000 2000 Manufacturing time: Cutting 4 DLH 2 DLH 6 MH 3 MH Assembling 6 DLH 4 DLH 0MH 0MH Finishing 3 DLH 1 DLH 0MH 0MH Mars (Pty) Ltd is considering implementing an Activity Based Costing system and has undertaken the following analysis: Cost pools % of MO Cost driver Aca Beb Set up 20% 20 in total 80 in total Number of set ups Machine hours Machining 50% As per existing As per existing MH MH Inspection 10% Number of inspections 4 per unit Receiving 5% Despatch Requisition requests Customer orders 2 per unit 15 000 in total 40 in total 10% of Aca's total machine hours 10 000 in total 20 in total 5% Maintenance 10% Maintenance hours 10% of Beb's total machine hours MO-manufacturing overheads

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the total budgeted manufacturing overheads for the next financial year Cu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started