Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, LMT Inc. acquired a piece of land to construct a new office building. You have the following information about this

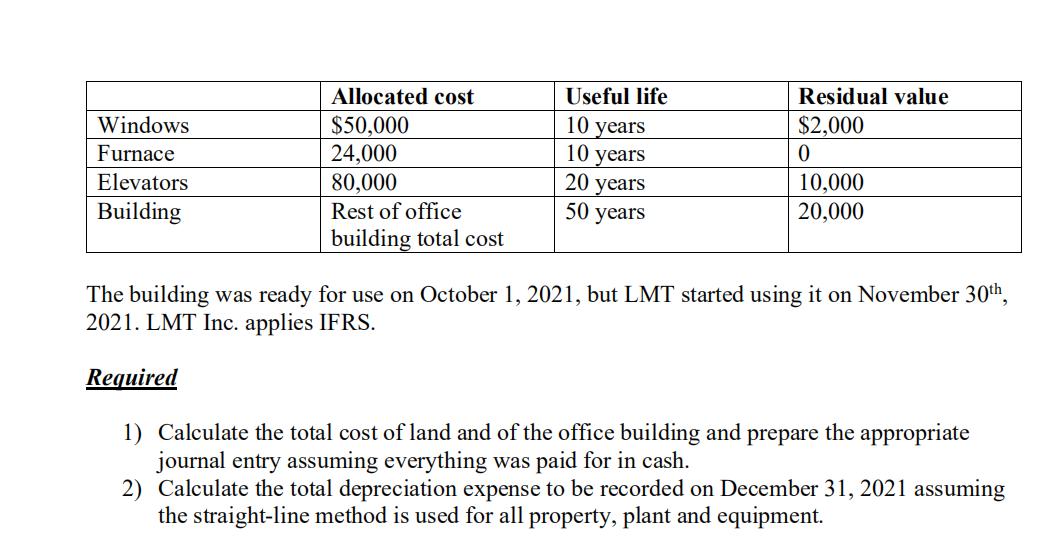

On January 1, 2021, LMT Inc. acquired a piece of land to construct a new office building. You have the following information about this transaction: Price of land Tax on purchase of land Legal fees to transfer property of land to LMT Cost of demolishing old building on land Income from sale of windows of old building demolished Cost of new office building foundation Cost of office building construction Cost of insurance during construction Cost to repair a piece of equipment used in the office building's construction Cost of annual insurance on office building after the construction is finished $180,000 5% of price $4,500 5,600 500 23,400 460,000 2,000 1,000 6,000 LMT management decided to allocate the following amounts to the parts of the office building, and estimated the corresponding useful lives and residual values as follows: Windows Furnace Elevators Building Allocated cost $50,000 24,000 80,000 Rest of office building total cost Useful life 10 years 10 years 20 years 50 years Residual value $2,000 0 10,000 20,000 The building was ready for use on October 1, 2021, but LMT started using it on November 30th, 2021. LMT Inc. applies IFRS. Required 1) Calculate the total cost of land and of the office building and prepare the appropriate journal entry ming everything was paid for in cash. 2) Calculate the total depreciation expense to be recorded on December 31, 2021 assuming the straight-line method is used for all property, plant and equipment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1The total cost of land and of the office building is 150000 This i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started