Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the total income and self-employment social security tax due on the 2021 joint income tax return for Bob and Jane if there income

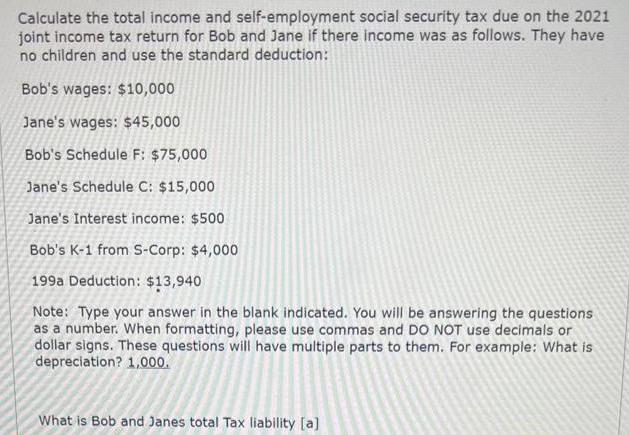

Calculate the total income and self-employment social security tax due on the 2021 joint income tax return for Bob and Jane if there income was as follows. They have no children and use the standard deduction: Bob's wages: $10,000 Jane's wages: $45,000 Bob's Schedule F: $75,000 Jane's Schedule C: $15,000 Jane's Interest income: $500 Bob's K-1 from S-Corp: $4,000 199a Deduction: $13,940 Note: Type your answer in the blank indicated. You will be answering the questions as a number. When formatting, please use commas and DO NOT use decimals or dollar signs. These questions will have multiple parts to them. For example: What is depreciation? 1,000. What is Bob and Janes total Tax liability [a]

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Bob and Janes total tax liability we need to consider their income from various sources ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started