Question

Calculate the total value of assets, liabilities and equity capital of Global Bank. b) Calculate the equity capital ratio of Global Bank. What does the

Calculate the total value of assets, liabilities and equity capital of Global Bank.

b) Calculate the equity capital ratio of Global Bank. What does the ratio tell you?

c) How much from net loans and leases would Global Bank have to lose to completely deplete its equity capital? Please provide your answer as a total value and as a ratio to net loans and leases.

d) Global Bank decides to fund an extra $250 million worth of real estate loans by accepting $250 million worth of deposits.

What is the new equity capital ratio?

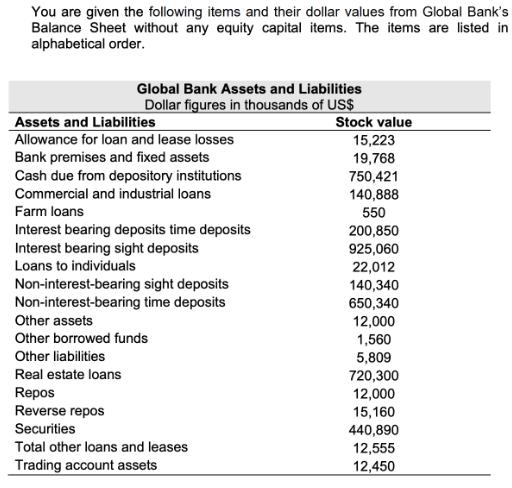

You are given the following items and their dollar values from Global Bank's Balance Sheet without any equity capital items. The items are listed in alphabetical order. Global Bank Assets and Liabilities Dollar figures in thousands of US$ Assets and Liabilities Allowance for loan and lease losses Bank premises and fixed assets Cash due from depository institutions Commercial and industrial loans Farm loans Interest bearing deposits time deposits Interest bearing sight deposits Loans to individuals Non-interest-bearing Non-interest-bearing Other assets Other borrowed funds Other liabilities Real estate loans Repos Reverse repos Securities sight deposits time deposits Total other loans and leases Trading account assets Stock value 15,223 19,768 750,421 140,888 550 200,850 925,060 22,012 140,340 650,340 12,000 1,560 5,809 720,300 12,000 15,160 440,890 12,555 12,450

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The total value of assets liabilities and equity capital of Global Bank are as follows Total Asset...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started