Answered step by step

Verified Expert Solution

Question

1 Approved Answer

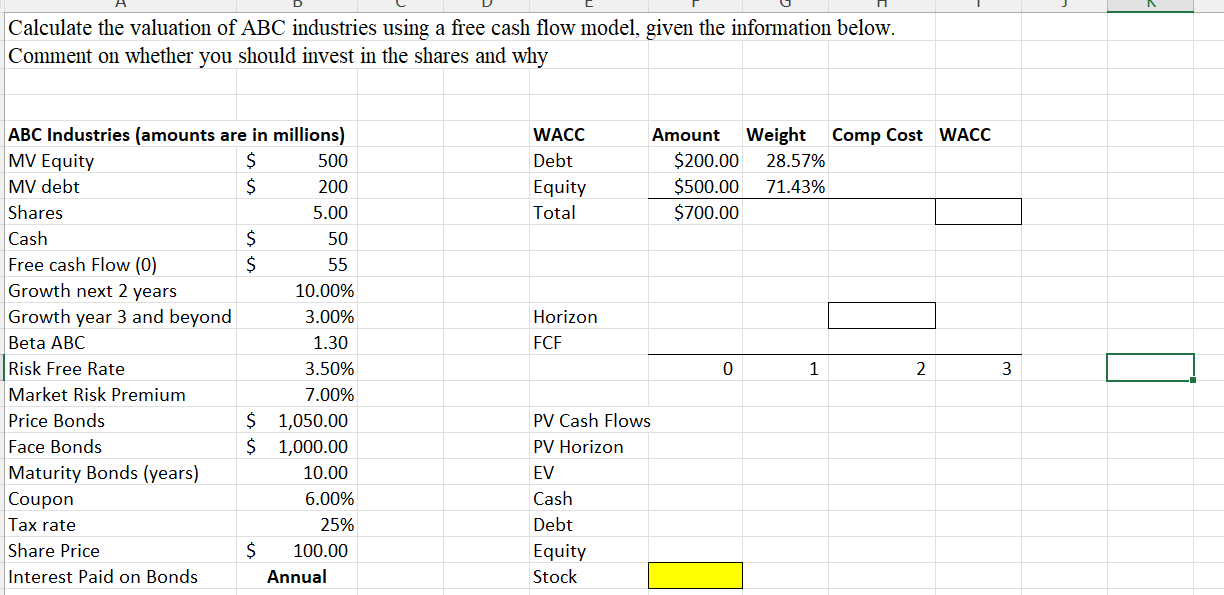

Calculate the valuation of ABC industries using a free cash flow model, given the information below. Calculate the valuation of ABC industries using a free

Calculate the valuation of ABC industries using a free cash flow model, given the information below. Calculate the valuation of ABC industries using a free cash flow model, given the information below.

Comment on whether you should invest in the shares and why

ABC Industries amounts are in millions

Shares

Growth next years

Growth year and beyond

Beta ABC

Risk Free Rate

Market Risk Premium

Price Bonds

Face Bonds

Maturity Bonds years

Coupon

Tax rate

Share Price

Interest Paid on Bonds

Comment on whether you should invest in the shares and why

ABC Industries amounts are in millions WACC Amount Weight Comp Cost WACC

MV Equity $ Debt $

MV debt $ Equity $

Shares Total $

Cash $

Free cash Flow $

Growth next years

Growth year and beyond Horizon

Beta ABC FCF

Risk Free Rate

Market Risk Premium

Price Bonds $ PV Cash Flows

Face Bonds $ PV Horizon

Maturity Bonds years EV

Coupon Cash

Tax rate Debt

Share Price $ Equity

Interest Paid on Bonds Annual Stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started