Answered step by step

Verified Expert Solution

Question

1 Approved Answer

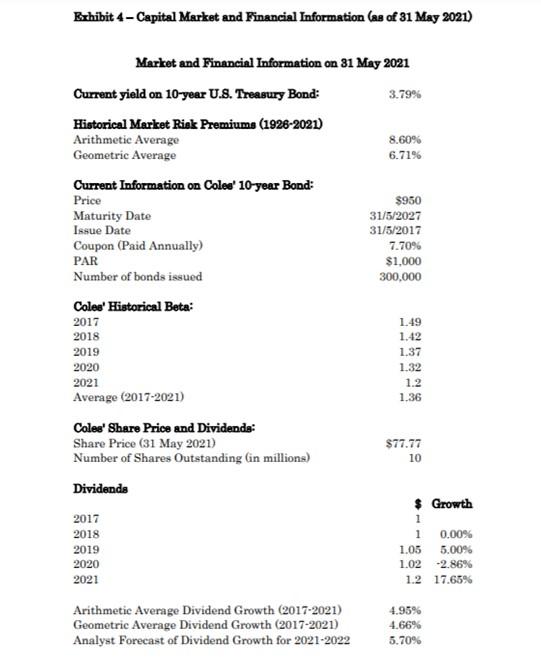

Calculate the WACC and justify your assumptions and calculations. Bxhibit 4 - Capital Market and Financial Information (as of 31 May 2021) Market and Financial

Calculate the WACC and justify your assumptions and calculations.

Bxhibit 4 - Capital Market and Financial Information (as of 31 May 2021) Market and Financial Information on 31 May 2021 Current yield on 10-year U.S. Treasury Bond: 3.79% Historical Market Risk Premiums (1926-2021) Arithmetic Average 8.60% Geometric Average 6.71% Current Information on Coles' 10-year Bond: Price $950 Maturity Date 31/5/2027 Issue Date 31/5/2017 Coupon (Paid Annually) 7.70% PAR $1,000 Number of bonds issued 300,000 Coles' Historical Beta: 2017 1.49 2018 1.42 2019 1.37 2020 1.32 2021 Average (2017-2021) 1.36 Coles' Share Price and Dividends: Share Price (31 May 2021) $77.77 Number of Shares Outstanding in millions) 1.2 10 Dividends 2017 2018 2019 2020 2021 $ Growth 1 1 0.00% 1.05 5.00% 1.02 2.86% 1.2 17.65% Arithmetic Average Dividend Growth (2017-2021) Geometric Average Dividend Growth (2017-2021) Analyst Forecast of Dividend Growth for 2021-2022 4.95% 4.66% 5.70%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started