Answered step by step

Verified Expert Solution

Question

1 Approved Answer

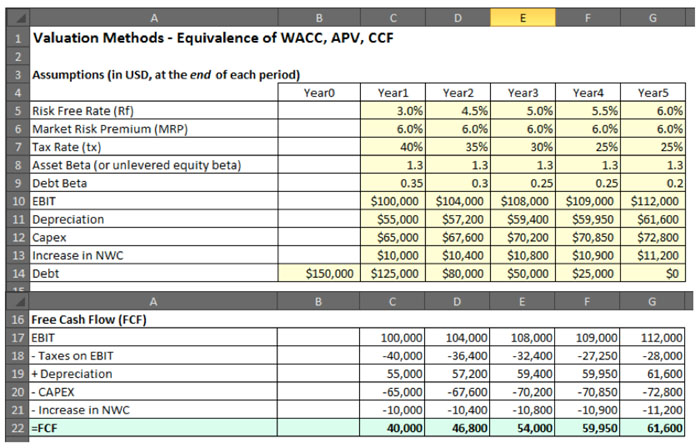

Calculate the WACC and the firm value based on the WACC method. It will be necessary to calculate the firm value (and hence the debt

- Calculate the WACC and the firm value based on the WACC method. It will be necessary to calculate the firm value (and hence the debt ratio) and the WACC for each year.

- Calculate the firm value based on the APV method, assuming ITS has the same risk as the debt.

- Calculate the CCF and the firm value based on the CCF method.

All three amounts should be identical.

Valuation Methods -Equivalence of WACC, APV, CCF Assumptions (in USD, at the end of each period) YearoYearlYear2 Year3Year4Years Risk Free Rate (Rf) Market Risk Premium (MRP) Tax Rate (tx) Asset Beta (or unlevered equity beta) Debt Beta EBIT Depreciation 3.0% 6.0% 40%) 1.3 0.35 45% 6.0% 35%| 1.3 0.3 5.0% 6.0% 30%| 1.3 0.25 5.5% 6.0% 25%| 6.0% 6.0% 25% 1.3 0.2 1.3 100,000 $104,000 $108,000 $109,000 $112,000 55,000! S57,200! S59,400| S59,950| S61,600 $65,000$67,600 $70,200 $70,850 $72,800 $10,000$10,400 $10,800 $10,900 $11,200 $0 12 3 Increase in NWC $150,000 $125,000 $80,000 $50,000$25,000 Free Cash Flow (FCF) 17 16 100,000104,000 108,000 109,000112,000 -40,000 55,00057,200 59,40059,95061,600 -65,00067,60070,20070,85072,800 Taxes on EBIT 36,400 32,40027,250 28,000 19 + Depreciation CAPEX Increase in NWC 2FCF 40,00046,80054,000 59,950 61,600 Valuation Methods -Equivalence of WACC, APV, CCF Assumptions (in USD, at the end of each period) YearoYearlYear2 Year3Year4Years Risk Free Rate (Rf) Market Risk Premium (MRP) Tax Rate (tx) Asset Beta (or unlevered equity beta) Debt Beta EBIT Depreciation 3.0% 6.0% 40%) 1.3 0.35 45% 6.0% 35%| 1.3 0.3 5.0% 6.0% 30%| 1.3 0.25 5.5% 6.0% 25%| 6.0% 6.0% 25% 1.3 0.2 1.3 100,000 $104,000 $108,000 $109,000 $112,000 55,000! S57,200! S59,400| S59,950| S61,600 $65,000$67,600 $70,200 $70,850 $72,800 $10,000$10,400 $10,800 $10,900 $11,200 $0 12 3 Increase in NWC $150,000 $125,000 $80,000 $50,000$25,000 Free Cash Flow (FCF) 17 16 100,000104,000 108,000 109,000112,000 -40,000 55,00057,200 59,40059,95061,600 -65,00067,60070,20070,85072,800 Taxes on EBIT 36,400 32,40027,250 28,000 19 + Depreciation CAPEX Increase in NWC 2FCF 40,00046,80054,000 59,950 61,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started