Question

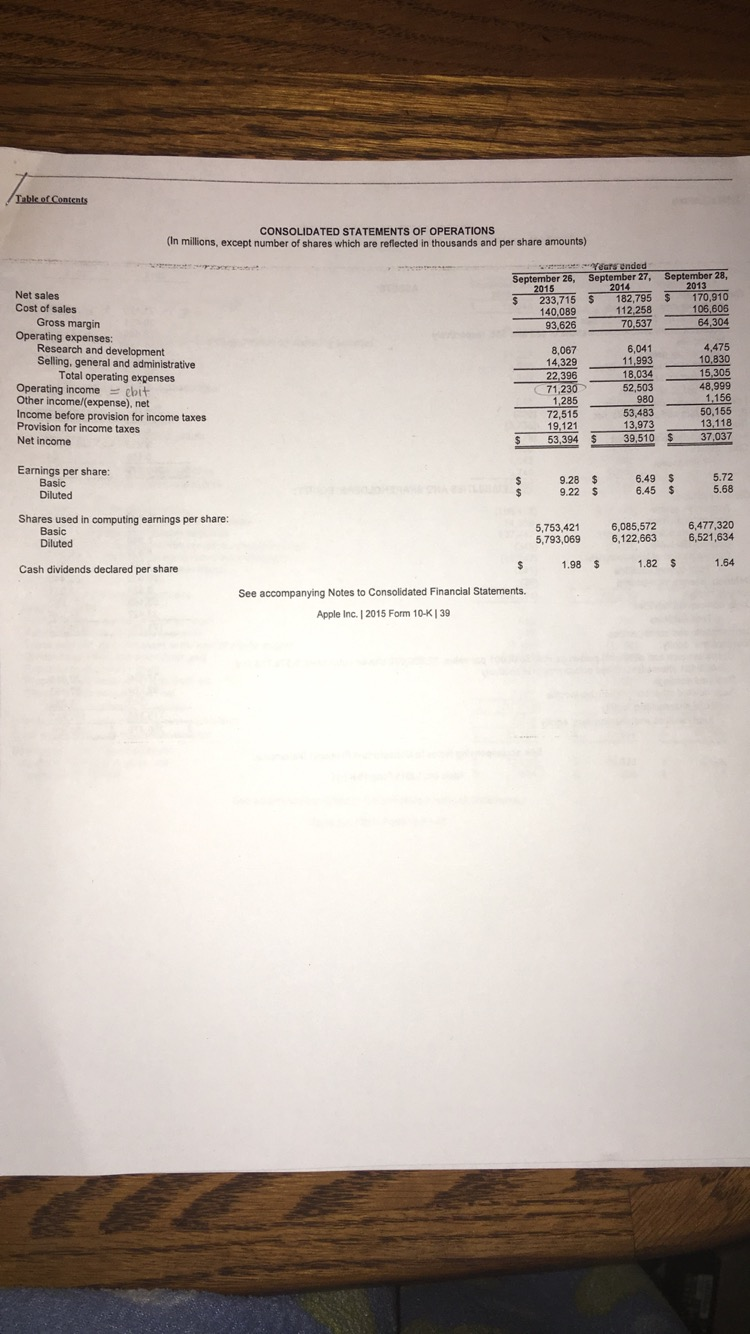

Calculate the WACC for Apple. The beta for Apple is 1.44, the YTM of its bonds 3.29%, the stock price 105.8 $/share. Consider the return

Calculate the WACC for Apple. The beta for Apple is 1.44, the YTM of its bonds 3.29%, the stock price 105.8 $/share. Consider the return on the SP500 to be 9.58%, the risk free rate 0.19%, and the tax rate 35%.

rd = 3.29%

re = 13.71%

D = 53,463 million

E = 608,667.4 million

WACC = 12.77%

Calculate the value of the shares for Apple by using the dividend discount model. Also calculate the value of the company by using the free cash flow model. Use the results from question 1. Express the value of the company in a per share basis.

Dividend growth (g) = 0.087

P = 42.95 $/share (dividend discount model)

Free cash flow (FCF) = 70,533 MM$

Company value = 552,333.6 MM$

Company value per share = 96 $/share (just as an indicator, this is NOT price per share)

| YEAR | 1 | 2 | 3 | 4 |

| SALES (millons) | 400 | 420 | 440 | 460 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started